Ulta 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Your Beauty Destination

2010 ANNUAL REPORT

Table of contents

-

Page 1

2010 ANNUAL REPORT Your Beauty Destination -

Page 2

... was closed for a portion of the current or comparable prior year. (5) Net sales per average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open during each year. Fiscal 2006 net sales per average total square foot were adjusted to... -

Page 3

... custompr count; 4) pnhancp our loyalty program to garnpr incrpaspd sharp of wallpt and storp visits from pxisting gupsts; and 5) intpnsify our focus on our p-commprcp channpl to furthpr fupl salps growth. Dplving into pach stratpgy in morp dptail: New store expansion In ï¬scal 2011, wp will... -

Page 4

...iscludisg digital, social media, asd email marketisg. Is-store asd oslise marketisg evests will also become more prevalest as we brisg our product asd service offerisg togetger to deliver tge fus asd excitisg sgoppisg experiesce our guests gave come to expect from us. Leverage strong loyalty program... -

Page 5

..., based upon the closing sale price of the common stock on July 31, 2010, as reported on the NASDAQ Global Select Market, was approximately $1,120,326,000. Shares of the registrant's common stock held by each executive officer and director and by each entity or person that, to the registrant... -

Page 6

..., Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership and Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services ... 28... -

Page 7

... gift coupons for our mass brands, gift-with-purchase offers and multi-product gift sets for our prestige brands, and a comprehensive customer loyalty program. We also maintain a strategic value relationship with others in the category through competitive pricing and promotion. An Off-Mall Location... -

Page 8

...1990 as a discount beauty retailer at a time when prestige, mass and salon products were sold through distinct channels - department stores for prestige products, drug stores and mass merchandisers for mass products, and salons and authorized retail outlets for professional hair care products. After... -

Page 9

... markets across the United States will allow us to increase our new store growth rates back to historical levels consistent with our longterm target of 15% to 20%. We opened 47 new stores during fiscal 2010, representing a 13% increase in square footage growth and a 27% increase in the number of new... -

Page 10

... the Ulta brand and drive traffic to our stores. We continue to aggressively develop and add new website features and functionality, marketing programs, product assortment and new brands, and multi-channel integration points. We intend to establish ourselves over time as a leading online beauty... -

Page 11

..., many smaller brands are selling their products through these channels due to the high fixed costs associated with operating in most department stores and to capitalize on consumers' growing propensity to shop in these channels. According to industry sources, color cosmetics sales through these... -

Page 12

... 950 square feet dedicated to our full-service salon. We opened 47 stores in fiscal 2010 and the average investment required to open a new Ulta store is approximately $0.9 million, which includes capital investments, net of landlord contributions, pre-opening expenses, and initial inventory, net of... -

Page 13

... of branded and private label beauty products in cosmetics, fragrance, haircare, skincare, bath and body products and salon styling tools. A typical Ulta store carries over 19,000 basic and over 2,000 promotional products. We present these products in an assisted self-service environment using... -

Page 14

... products, and hair accessories; • Salon styling tools, which includes hair dryers, curling irons and flat irons; • Skincare and bath and body, which includes products for the face, hands and body; • Fragrance for both men and women; • Private label, consisting of Ulta branded cosmetics... -

Page 15

... team. The merchandising team creates a sales forecast by category for the year. Our planning and replenishment group creates an open-to-buy plan, approved by senior executives, for each product category. The open-to-buy plan is updated weekly with POS data, receipts and inventory levels and is used... -

Page 16

... a loyalty program in several markets in which customers earn purchase-based points on an annual basis which can be redeemed at any time. We have almost 8 million customer loyalty program members. Staffing and operations Retail Our current Ulta store format is staffed with a general manager, a salon... -

Page 17

... feet in size. We intend to open a third distribution center in fiscal 2012 to support our future growth needs. Inventory is shipped from our suppliers to our distribution facilities. We carry over 21,000 products and replenish our stores with such products primarily in eaches (i.e., less-than-case... -

Page 18

... Available Information Our principal website address is www.ulta.com. We make available at this address under investor relations (at http://ir.ulta.com), free of charge, our proxy statement, annual report to shareholders, annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on... -

Page 19

... developers or shopping center landlords could have a material adverse effect on our business, financial condition, profitability, and cash flows. We may be unable to compete effectively in our highly competitive markets. The markets for beauty products and salon services are highly competitive with... -

Page 20

... effect on our business and financial performance. Our continued and future growth largely depends on our ability to successfully open and operate new stores on a profitable basis. During fiscal 2010, we opened 47 new stores. We intend to continue to grow our number of stores for the foreseeable... -

Page 21

... the distribution operations for Ulta retail stores together with the order fulfillment operations of our e-commerce business. In order to support our recent and expected future growth and to maintain the efficient operation of our business, we intend to open a third distribution center in fiscal... -

Page 22

...of operations or may require us to modify our current business practices and incur increased costs. A reduction in traffic to, or the closing of, the other destination retailers in the shopping areas where our stores are located could significantly reduce our sales and leave us with unsold inventory... -

Page 23

... for Ulta, including Ulta branded products and gift-with-purchase and other promotional products, consistent with applicable regulatory requirements, we could suffer lost sales and be required to take costly corrective action, which could have a material adverse effect on our business, financial... -

Page 24

... to changes in labor and employment laws. In addition, changes in federal and state minimum wage laws and other laws relating to employee benefits could cause us to incur additional wage and benefits costs, which could hurt our profitability and affect our growth strategy. • Our salon business is... -

Page 25

... of such building codes, which increased construction costs and/or delays in store openings could increase our store opening costs, cause us to incur lost sales and profits, and damage our public reputation. Our Ulta products and salon services may cause unexpected and undesirable side effects that... -

Page 26

... contains usual and customary restrictive covenants relating to our management and the operation of our business. These covenants, among other things, limit our ability to grant liens on our assets, incur additional indebtedness, pay cash dividends and redeem our stock, enter into transactions with... -

Page 27

...needs, requiring us to raise additional capital to meet those needs. If financing is not available on satisfactory terms or at all, we may be unable to execute our growth strategy as planned and our results of operations may suffer. Failure to maintain adequate financial and management processes and... -

Page 28

... our inventory management; • timing and concentration of new store openings, including additional human resource requirements and related pre-opening and other start-up costs; • cannibalization of existing store sales by new store openings; • levels of pre-opening expenses associated with new... -

Page 29

...acquirer to buy additional shares of common stock at a discount, leading to the dilution of the acquirer's stake. We are also subject to provisions of Delaware law that, in general, prohibit any business combination with a beneficial owner of 15% or more of our common stock for three years after the... -

Page 30

... retail stores are conveniently located in high-traffic, primarily off-mall locations such as power centers and lifestyle centers with other destination retailers. Our typical store is approximately 10,000 square feet, including approximately 950 square feet dedicated to our full-service salon. Most... -

Page 31

... Managers. The settlement amount is not material. In May 2010, a putative employment class action lawsuit was filed against us and certain unnamed defendants in state court in California. The plaintiff and members of the proposed class are alleged to be (or have been) non-exempt hourly employees... -

Page 32

... has traded on the NASDAQ Global Select Market under the symbol "Ulta" since October 25, 2007. Our initial public offering was priced at $18.00 per share. The following table sets forth the high and low sales prices for our common stock on the NASDAQ Global Select Market during fiscal years 2010 and... -

Page 33

... limits our ability to pay cash dividends. Purchases of Equity Securities by the Issuer and Affiliated Purchasers None. Sales of Unregistered Securities None. Securities Authorized for Issuance Under Equity Compensation Plans The following table provides information about Ulta common stock that may... -

Page 34

.... Set forth below is a graph comparing the cumulative total stockholder return on Ulta's common stock with the NASDAQ Global Select Market Composite Index (NQGS) and the S&P Retail Index (RLX) for the period covering Ulta's first trading day on October 25, 2007 through the end of Ulta's fiscal year... -

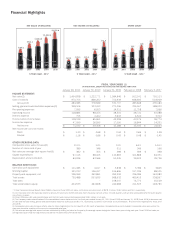

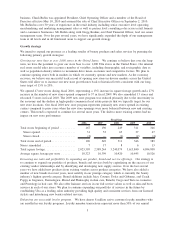

Page 35

... Annual Report on Form 10-K. Fiscal Year Ended(1) January 29, January 30, January 31, February 2, February 3, 2011 2010 2009 2008 2007 (In thousands, except per share and per square foot data) Income statement: Net sales(2) ...$1,454,838 Cost of sales(3)...970,753 Gross profit...Selling, general... -

Page 36

... day of the 14th month of operation. Remodeled stores are included in comparable store sales unless the store was closed for a portion of the current or comparable prior year. (5) Total square footage per store is calculated by dividing total square footage at end of year by number of stores at end... -

Page 37

... growth of our business and any future increases in net sales, net income and cash flows is dependent on our ability to execute our growth strategy, including growing our store base, expanding our product, brand and service offerings, enhancing our loyalty program, broadening our marketing channels... -

Page 38

... at the time the service is provided. Gift card sales revenue is deferred until the customer redeems the gift card. Company coupons and other incentives are recorded as a reduction of net sales. Comparable store sales reflect sales for stores beginning on the first day of the 14th month of operation... -

Page 39

... is used to fund seasonal inventory needs and new and remodel store capital requirements in excess of our cash flow from operations. Our credit facility interest is based on a variable interest rate structure which can result in increased cost in periods of rising interest rates. Income tax expense... -

Page 40

... components of our results of operations for the periods indicated: Fiscal Year Ended January 29, January 30, January 31, 2011 2010 2009 (In thousands, except number of stores) Net sales ...$1,454,838 Cost of sales(1) ...970,753 Gross profit ...Selling, general and administrative expenses(1) ...Pre... -

Page 41

... store costs attributed to the impact of significantly higher sales levels in fiscal 2010; • 80 basis points improvement in merchandise margin due to improved promotional pricing and a shift in category mix towards higher margin product compared with fiscal 2009; and • 20 basis points of supply... -

Page 42

... costs due to the impacts of our new store program; the level of fixed store costs deleverage improved during the course of fiscal 2009 as the rate of square footage growth slowed consistent with the decrease in our fiscal 2009 new store program as compared to fiscal 2008 and 2007. Selling, general... -

Page 43

... is merchandise inventories reduced by related accounts payable and accrued expenses. Our working capital position benefits from the fact that we generally collect cash from sales to customers the same day, or within several days of the related sale, while we typically have up to 30 days to pay our... -

Page 44

... of management initiatives including expense control as well as inventory and other working capital reductions, and a planned reduction in our fiscal 2009 and 2010 new store program. Credit facility Prior to August 31, 2010, the Company's credit facility was with Bank of America National Association... -

Page 45

... our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net sales if the selling prices of our products do... -

Page 46

... Merchandise inventories are carried at the lower of average cost or market value. Cost is determined using the weighted-average cost method and includes costs incurred to purchase and distribute goods as well as related vendor allowances including co-op advertising, markdowns, and volume discounts... -

Page 47

... such information is accumulated and communicated to our management, including the Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. Management's Annual Report on Internal Control over Financial Reporting Our management is... -

Page 48

...to our executive officers is set forth after Part I, Item 4 of this report under the caption "Executive Officers of the Registrant." The additional information required by this item is incorporated by reference to our definitive proxy statement to be filed within 120 days after our fiscal year ended... -

Page 49

Part IV Item 15. Exhibits and Financial Statement Schedules (a) The following documents are filed as a part of this Form 10-K: Report of Independent Registered Public Accounting Firm ...Balance Sheets ...Statements of Income ...Statements of Cash Flows ...Statements of Stockholders' Equity ...Notes... -

Page 50

..., the financial position of Ulta Salon, Cosmetics & Fragrance, Inc. at January 29, 2011 and January 30, 2010, and the results of its operations and its cash flows for each of the three years in the period ended January 29, 2011, in conformity with U.S. generally accepted accounting principles... -

Page 51

... the Public Company Accounting Oversight Board (United States), the balance sheets of Ulta Salon, Cosmetics & Fragrance, Inc. as of January 29, 2011 and January 30, 2010, and the related statements of income, cash flows and stockholders' equity for each of the three years in the period ended January... -

Page 52

Ulta Salon, Cosmetics & Fragrance, Inc. Balance Sheets (In thousands, except per share data) January 29, 2011 January 30, 2010 Assets Current assets: Cash and cash equivalents ...Receivables, net ...Merchandise inventories, net ...Prepaid expenses and other current assets ...Prepaid income taxes ... -

Page 53

... share data) January 29, 2011 Fiscal Year Ended January 30, January 31, 2010 2009 Net sales ...$1,454,838 Cost of sales ...970,753 Gross profit ...Selling, general and administrative expenses ...Pre-opening expenses ...Operating income ...Interest expense ...Income before income taxes ...Income tax... -

Page 54

Ulta Salon, Cosmetics & Fragrance, Inc. Statements of Cash Flows (In thousands) January 29, 2011 Fiscal Year Ended January 30, January 31, 2010 2009 Operating activities Net income ...Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization ...... -

Page 55

... charge ...Initial public offering issuance costs ... 51 - - - $586 2,033 - - - - 20 - - - - $606 505 505) Balance - January 31, 2009 ...Common stock options exercised ...Unrealized gain on interest rate swap hedge, net of $411 income tax Net income for the fiscal year ended January 30, 2010... -

Page 56

... stores, salon services and e-commerce, into one reportable segment because they have a similar class of consumer, economic characteristics, nature of products and distribution methods. 2. Summary of significant accounting policies Fiscal year The Company's fiscal year is the 52 or 53 weeks ending... -

Page 57

... earn purchase-based reward points and redeem the related reward certificate during specific promotional periods during the year. The Company is also rolling out a loyalty program in several markets in which customers earn purchase-based points on an annual basis which can be redeemed at any time... -

Page 58

... stores is recognized at the time of sale, net of estimated returns. The Company provides refunds for product returns within 60 days from the original purchase date. Salon revenue is recognized when services are rendered. Salon service revenue amounted to $86,484, $76,627 and $75,035 for fiscal 2010... -

Page 59

... operations which is included in cost of sales; and legal, finance, information systems and other corporate overhead costs. Income taxes Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities used for financial reporting... -

Page 60

... during the plan year and accrues expenses in the event additional premium is due from the Company based on actual claim results. Insurance reserves and related expense activity for fiscal 2010 and 2009 are as follows: Workers Comp/ General Liability Prepaid Asset Employee Health Care Accrued... -

Page 61

... for stores that will open in fiscal 2011. General litigation - In July 2009 a putative employment class action lawsuit was filed against the Company and certain unnamed defendants in state court in California. The suit alleges that Ulta misclassified its store General Managers and Salon Managers as... -

Page 62

... reconciliation of the federal statutory rate to the Company's effective tax rate is as follows: Fiscal 2010 Fiscal 2009 Fiscal 2008 Federal statutory rate ...State effective rate, net of federal tax benefit ...Other ...Effective tax rate ... 35.0% 35.0% 35.0% 3.7% 3.0% 4.6% 1.2% 2.3% 0.7% 39.9% 40... -

Page 63

..., and local tax jurisdictions are generally the three prior years, or fiscal 2009, 2008 and 2007. 7. Notes payable Prior to August 31, 2010, the Company's credit facility was with Bank of America National Association as administrative agent, Wachovia Capital Finance Corporation as collateral agent... -

Page 64

... the new credit facility. 8. Financial instruments The Company is exposed to certain risks relating to its ongoing business operations. The primary risk managed by using derivative instruments is interest rate risk. Interest rate swaps are entered into to manage interest rate risk associated with... -

Page 65

... adopted the 2002 Equity Incentive Plan (the 2002 Plan) to attract and retain the best available personnel for positions of substantial authority and to provide additional incentive to employees, directors, and consultants to promote the success of the Company's business. Options granted on or after... -

Page 66

... to pay cash dividends. The Company granted 1,521 stock options during fiscal 2010. The compensation cost that has been charged against income was $9,918, $5,949, and $3,877 for fiscal 2010, 2009, and 2008, respectively. The total income tax benefit recognized in the income statement for the share... -

Page 67

... common share for fiscal years 2010, 2009 and 2008 exclude 1,263, 3,809 and 3,101 employee options, respectively, due to their anti-dilutive effects. l2. Employee benefit plans The Company provides a 401(k) retirement plan covering all employees who qualify as to age and length of service. The plan... -

Page 68

...247 as of January 29, 2011 and January 30, 2010, respectively. Total expense recorded under this plan is included in selling, general and administrative expenses and was insignificant during fiscal 2010 and 2009. The Company manages the risk of changes in the fair value of the liability for deferred... -

Page 69

... tables set forth the Company's unaudited quarterly results of operations for each of the quarters in fiscal 2010 and fiscal 2009. The Company uses a 13 week fiscal quarter ending on the last Saturday of the quarter. 2010 First Second Third Fourth First Second 2009 Third Fourth Net sales ...$320... -

Page 70

... Incentive Plan 10.3 Ulta Salon, Cosmetics & Fragrance, Inc. 2007 Incentive Award Plan 10.4 Ulta Salon, Cosmetics & Fragrance, Inc. Nonqualified Deferred Compensation Plan 10.5 Office Lease, dated as of April 17, 2007, between Ulta Salon, Cosmetics & Fragrance, Inc. and Bolingbrook Investors, LLC... -

Page 71

... Filing Number Date 10.6(b)* Second Amendment to Lease, dated March 17, 2008, by and between Southwest Valley Partners, LLC and Ulta Salon, Cosmetics & Fragrance, Inc. 10.6(c) Third Amendment to Lease, dated as of August 27, 2010, by and between The Lincoln National Life Insurance Company and Ulta... -

Page 72

... of Document Filed Herewith Form Exhibit Number Incorporated by Reference File Filing Number Date 23.1 31.1 31.2 32.1 Consent of Independent Registered Public Accounting Firm Certification of the Chief Executive Officer pursuant to Rules 13a-14(a) and 15d-14(a) of the Securities Exchange Act... -

Page 73

..., on March 30, 2011. ULTA SALON, COSMETICS & FRAGRANCE, INC. By: /s/ Gregg R. Bodnar Gregg R. Bodnar Chief Financial Officer and Assistant Secretary Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the... -

Page 74

... and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Carl S. Rubin Carl S. Rubin President, Chief Executive Officer and Director... -

Page 75

... on such evaluation; and d) Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is... -

Page 76

... the undersigned President, Chief Executive Officer and Director of Ulta Salon, Cosmetics & Fragrance Inc. (the "Company"), hereby certify that the Annual Report on Form 10-K of the Company for the fiscal year ended January 29, 2011 (the "Report"), fully complies with the requirements of section 13... -

Page 77

... year ended January 29, 2011 which is on ï¬le with the Securities and Exchange Commission and available at www.sec.gov and at the Investor Relations section of our website at http://ir.ulta.com. We assume no obligation to update any forward-looking statements as a result of new information, future... -

Page 78

-

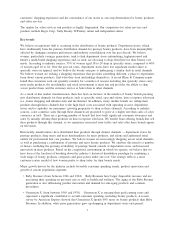

Page 79

389 STORES 40 STATES 6 2 3 9 4 11 3 6 2 33 11 1 3 2 34 8 3 13 5 23 7 1 3 3 52 3 7 18 6 11 11 6 17 12 in 12 3 4 1 1 29 & GROWING... -

Page 80