Toyota 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2012

Toyota Global Vision Changes for Making

Ever-Better Cars President

ʼ

s Message Medium- to Long-Term

Growth Initiatives Special Feature Management and

Corporate Information Investor Information

Business and

Performance Review Financial Section

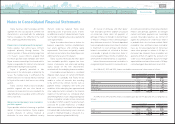

Notes to Consolidated Financial Statements

guidance allows the use of estimated selling

price for determining the selling price of

deliverables, eliminates the residual method of

allocation and expands the disclosures related

to a vendor

ʼ

s multiple-deliverable revenue

arrangements. Toyota adopted this guidance for

revenue arrangements entered into or materially

modified in the fiscal year begun on or after June

15, 2010. The adoption of this guidance did not

have a material impact on Toyota

ʼ

s consolidated

financial statements.

In April 2011, FASB issued updated guidance

to clarify the accounting for and disclosures

about troubled debt restructurings by creditors.

This guidance provides the criteria as to whether

a loan modification constitutes a troubled debt

restructuring and requires additional disclosures

about troubled debt restructurings. Toyota

adopted this guidance from the fiscal year ended

March 31, 2012. The adoption of this guidance

did not have a material impact on Toyota

ʼ

s

consolidated financial statements. For a further

discussion of additional disclosures by adoption

of this guidance, please see note 7 to Toyota

ʼ

s

consolidated financial statements.

In May 2011, FASB issued updated guidance

on fair value measurement and disclosure

requirements. This guidance is the amendment

to achieve common fair value measurement

and disclosure requirements in U.S. GAAP and

International Financial Reporting Standards.

Consequently, this guidance changes some fair

value measurement principles and enhances

after December 15, 2011. Management does not

expect this guidance to have a material impact on

Toyota

ʼ

s consolidated financial statements.

In December 2011, FASB issued updated

guidance of disclosures about offsetting assets

and liabilities. This guidance requires additional

disclosures about gross and net information

for assets and liabilities including financial

instruments eligible for offset in the balance

sheets. This guidance is effective for fiscal year

beginning on or after January 1, 2013, and for

interim period within the fiscal year. Management

does not expect this guidance to have a material

impact on Toyota

ʼ

s consolidated financial

statements.

Certain prior year amounts have been reclassified

to conform to the presentations as of and for the

year ended March 31, 2012.

The calculation of diluted net income attributable

to Toyota Motor Corporation per common share

is similar to the calculation of basic net income

attributable to Toyota Motor Corporation per

share, except that the weighted-average number

of shares outstanding includes the additional

dilution from the assumed exercise of dilutive

stock options.

Toyota measures compensation expense for its

stock-based compensation plan based on the

grant-date fair value of the award, and accounts

for the award.

Other comprehensive income refers to revenues,

expenses, gains and losses that, under U.S.GAAP

are included in comprehensive income, but are

excluded from net income as these amounts are

recorded directly as an adjustment to shareholders

ʼ

equity. Toyota

ʼ

s other comprehensive income is

primarily comprised of unrealized gains/losses

on marketable securities designated as available-

for-sale, foreign currency translation adjustments

and adjustments attributed to pension liabilities

or minimum pension liabilities associated with

Toyota

ʼ

s defined benefit pension plans.

In October 2009, FASB issued updated guidance

of accounting for and disclosure of revenue

recognition with multiple deliverables. This

the disclosure requirements. Toyota adopted this

guidance from the fiscal year ended March 31,

2012. The adoption of this guidance did not have a

material impact on Toyota

ʼ

s consolidated financial

statements. For a further discussion of additional

disclosures by adoption of this guidance, please

see notes 21 and 26 to Toyota

ʼ

s consolidated

financial statements.

In June 2011, FASB issued updated guidance

of presentation of comprehensive income.

This guidance requires to present the total

of comprehensive income, the components

of net income, and the components of other

comprehensive income either in a single

continuous statement of comprehensive income

or in two separate but consecutive statements.

This guidance is effective for fiscal year, and

interim period within the fiscal year, beginning

■

Stock-based compensation

■

Reclassifications

■

Recent pronouncements to be adopted in

future periods

■

Other comprehensive income

■

Accounting changes

U.S. dollar amounts: 3

be converted into, U.S. dollars. For this purpose,

the rate of ¥82.19 = U.S. $1, the approximate

current exchange rate at March 31, 2012, was

used for the translation of the accompanying

consolidated financial amounts of Toyota as of

and for the year ended March 31, 2012.

U.S. dollar amounts presented in the consolidated

financial statements and related notes are

included solely for the convenience of the reader

and are unaudited. These translations should

not be construed as representations that the yen

amounts actually represent, or have been or could

0820

Search NextPrev page 87

Contents