Toyota 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2012

Toyota Global Vision Changes for Making

Ever-Better Cars President

ʼ

s Message Medium- to Long-Term

Growth Initiatives Special Feature Management and

Corporate Information Investor Information

Business and

Performance Review Financial Section

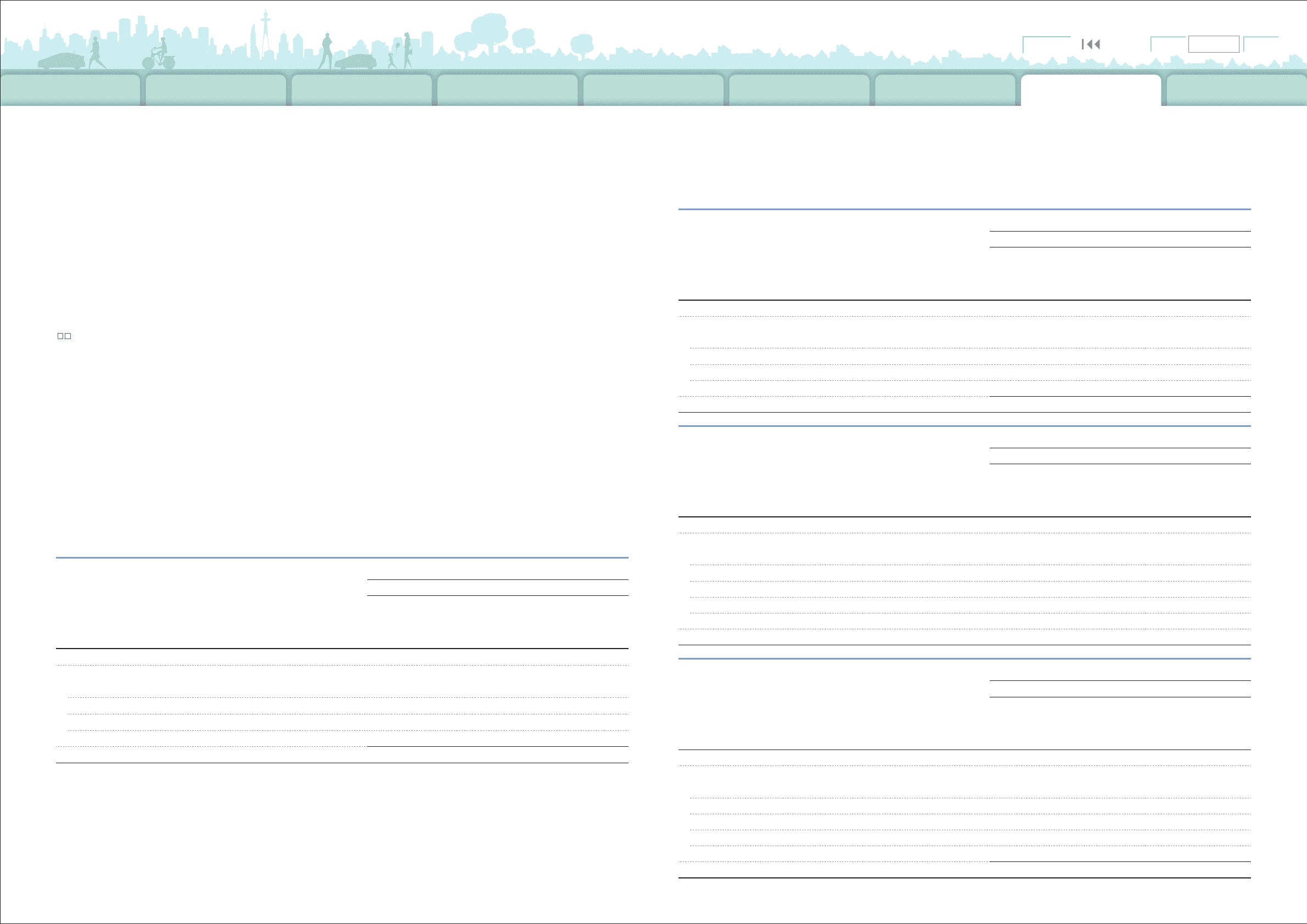

Notes to Consolidated Financial Statements

These assets are classified in Level 2. During the

year ended March 31, 2012, certain government

bonds were transferred from in Level 1 to Level

2 due to the lack of quoted prices for identical

assets traded in an active market.

See note 20 to the consolidated financial

statements about derivative financial instruments.

Toyota estimates the fair value of derivative

financial instruments using industry-standard

valuation models that require observable inputs

including interest rates and foreign exchange

rates, and the contractual terms. The usage

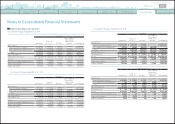

The following table summarizes the changes in Level 3 assets and liabilities measured at fair value

on a recurring basis for the periods ended March 31, 2010, 2011 and 2012:

of these models does not require significant

judgment to be applied. These derivative financial

instruments are classified in Level 2. In other

certain cases when market data is not available,

key inputs to the fair value measurement include

quotes from counterparties, and other market

data. Toyota assesses the reasonableness of

changes of the quotes using observable market

data. These derivative financial instruments are

classified in Level 3. Toyota

ʼ

s derivative fair value

measurements consider assumptions about

counterparty and our own non-performance risk,

using such as credit default probabilities.

■

Derivative financial instruments

Yen in millions

For the year ended March 31, 2010

Marketable

securities and

other securities

investments

Derivative

financial

instruments Total

Balance at beginning of year ¥ 19,581 ¥

(

5,734

)

¥ 13,847

Total gains

(

losses

)

Included in earnings

(

641

)

25,057 24,416

Included in other comprehensive income

(

loss

) (

99

)—

(

99

)

Purchases, issuances and settlements

(

6,376

) (

13,582

) (

19,958

)

Other 669 151 820

Balance at end of year ¥ 13,134 ¥ 5,892 ¥ 19,026

Yen in millions

For the year ended March 31, 2011

Marketable

securities and

other securities

investments

Derivative

financial

instruments Total

Balance at beginning of year ¥ 13,134 ¥ 5,892 ¥ 19,026

Total gains

(

losses

)

Included in earnings 433 31,338 31,771

Included in other comprehensive income 779

—

779

Purchases, issuances and settlements

(

810

) (

8,381

) (

9,191

)

Other

(

13,536

) (

22,055

) (

35,591

)

Balance at end of year ¥

—

¥ 6,794 ¥ 6,794

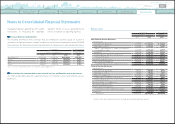

Yen in millions

For the year ended March 31, 2012

Marketable

securities and

other securities

investments

Derivative

financial

instruments Total

Balance at beginning of year ¥

̶

¥ 6,794 ¥ 6,794

Total gains

(

losses

)

Included in earnings

̶

6,476 6,476

Included in other comprehensive income

(

loss

)̶

̶

̶

Purchases and issuances

̶

̶

̶

Settlements

̶

(

3,832

) (

3,832

)

Other 1,684

(

4,699

) (

3,015

)

Balance at end of year ¥1,684 ¥ 4,739 ¥ 6,423

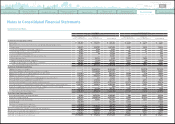

U.S. dollars in millions

For the year ended March 31, 2012

Marketable

securities and

other securities

investments

Derivative

financial

instruments Total

Balance at beginning of year $

̶

$ 83 $ 83

Total gains

(

losses

)

Included in earnings

̶

78 78

Included in other comprehensive income

(

loss

)̶

̶

̶

Purchases and issuances

̶

̶

̶

Settlements

̶

(

47

) (

47

)

Other 21

(

57

) (

36

)

Balance at end of year $ 21 $ 57 $ 78

0820

Search NextPrev page 122

Contents