Toyota 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TOYOTA ANNUAL REPORT 2012

Toyota Global Vision Changes for Making

Ever-Better Cars President

ʼ

s Message Medium- to Long-Term

Growth Initiatives Special Feature Management and

Corporate Information Investor Information

Business and

Performance Review Financial Section

Management's Discussion and Analysis of Financial Condition and Results of Operations

All financial information discussed in this section is derived from Toyota

s consolidated financial

statements that appear elsewhere in this annual report. The financial statements have been

prepared in conformity with accounting principles generally accepted in the United States of

America.

The business segments of Toyota include

automotive operations, financial services

operations and all other operations. Automotive

operations are Toyota

ʼ

s most significant business

segment, accounting for 89% of Toyota

ʼ

s total

revenues before the elimination of intersegment

revenues for fiscal 2012. Toyota

ʼ

s primary markets

based on vehicle unit sales for fiscal 2012 were:

Japan

(

28%

)

, North America

(

25%

)

, Europe

(

11%

)

and Asia

(

18%

)

. Japan

ʼ

s economy suffered from

the effects of the Great East Japan Earthquake and

its aftermath

(

collectively, the

“

Great East Japan

Earthquake

”)

. As a result, in Japan and other

regions, Toyota experienced negative impacts on

its production in the first half of fiscal year 2012.

See

“

Information on the Company

—

Business

Overview

—”

for more detailed information of the

Great East Japan Earthquake in Toyota

ʼ

s annual

report on Form 20-F.

The worldwide automotive market is highly

competitive and volatile. The demand for

automobiles is affected by a number of factors

including social, political and general economic

conditions; introduction of new vehicles and

technologies; and costs incurred by customers to

purchase or operate vehicles. These factors can

cause consumer demand to vary substantially in

different geographic markets and for different

types of automobiles.

During fiscal 2012, automotive markets

developed steadily in the U.S. and emerging

countries such as Asia. However, many Japanese

manufacturers, including Toyota, were forced

to adjust or stop productions due to shortages

of parts supplies caused by the Great East

Japan Earthquake and by the flood in Thailand

that occurred in October 2011. Toyota and its

group companies together exerted every effort

to normalize production, and Toyota was able

to achieve full normalization of production and

begin its recovery from the disaster sooner than

initially anticipated.

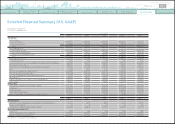

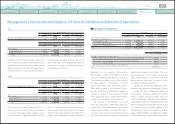

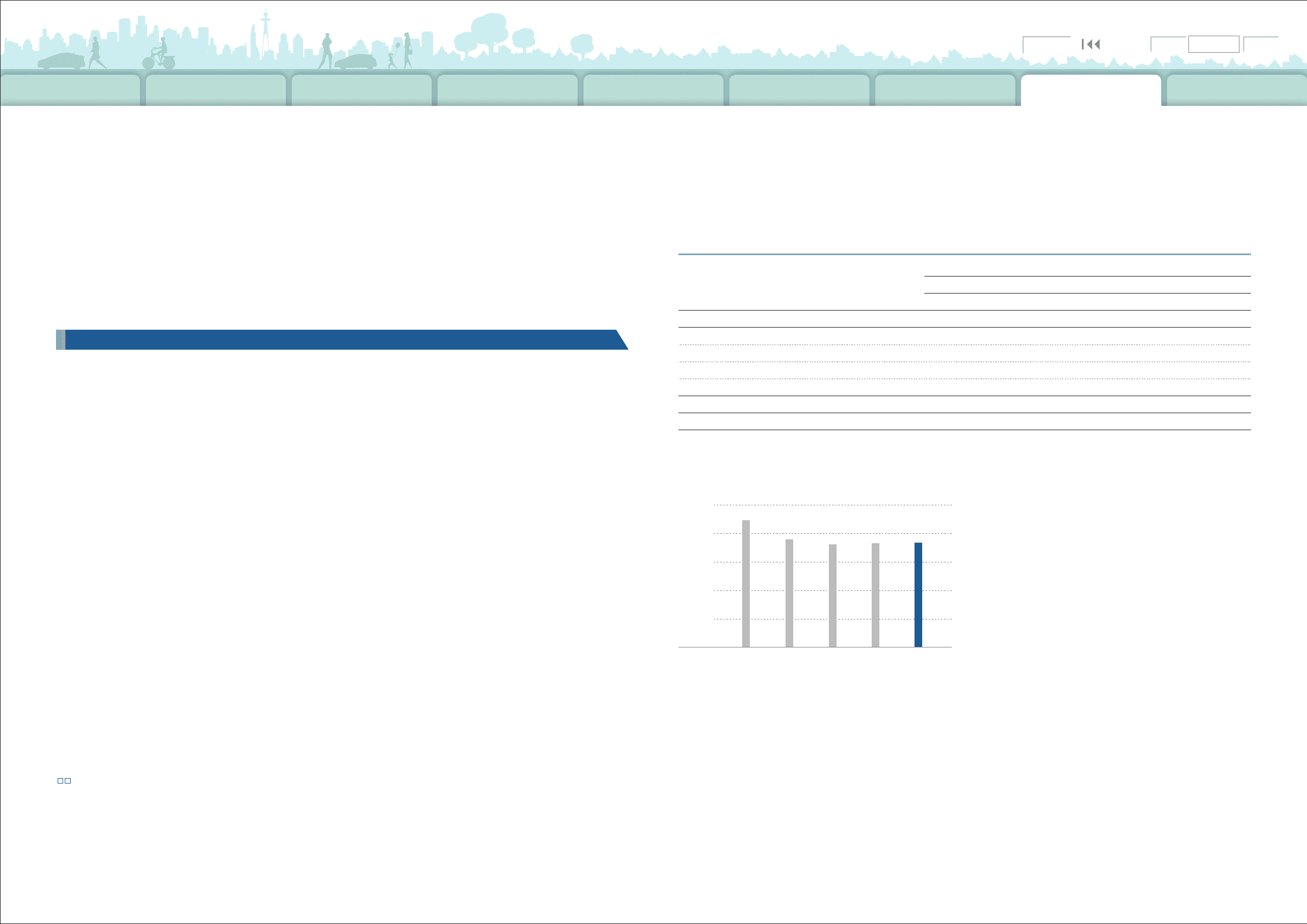

The following table sets forth Toyota

ʼ

s consolidated vehicle unit sales by geographic market based

on location of customers for the past three fiscal years.

During fiscal 2011, Toyota

ʼ

s consolidated

vehicle unit sales in Japan decreased as

compared with the prior fiscal year because

market conditions in Japan deteriorated as

compared with the prior fiscal year. During fiscal

2012, Toyota

ʼ

s consolidated vehicle unit sales

in Japan increased as compared with the prior

fiscal year reflecting frequent introduction of new

products and sales efforts of domestic dealers.

Toyota and Lexus brands

ʼ

market share in Japan

excluding mini-vehicles was 45.5%, and Toyota

ʼ

s

market share

(

including Daihatsu and Hino

brands

)

in Japan including mini-vehicles was

43.2%, both maintaining the high level of market

share in Japan from the prior fiscal year. Overseas

consolidated vehicle unit sales increased during

fiscal 2011, whereas they decreased during fiscal

2012. During fiscal 2011, total overseas vehicle

unit sales increased in Asia and Other. During

fiscal 2012, total overseas vehicle unit sales

decreased, particularly in North America due to

impact of the Great East Japan Earthquake and

the flood in Thailand, although an increase in

Asia resulted from steady demand in spite of the

flood in Thailand.

Toyota

ʼ

s share of total vehicle unit sales in

each market is influenced by the quality, safety,

reliability, price, design, performance, economy

and utility of Toyota

ʼ

s vehicles compared with

■

Automotive Market Environment

Overview

Thousands of units

Year Ended March 31,

2010 2011 2012

Japan 2,163 1,913 2,071

North America 2,098 2,031 1,872

Europe 858 796 798

Asia 979 1,255 1,327

Other* 1,139 1,313 1,284

Overseas total 5,074 5,395 5,281

Total 7,237 7,308 7,352

*

“

Other

”

consists of Central and South America, Oceania, Africa and the Middle East, etc.

‘12‘09 ‘10‘08 ‘11

0

2,000

4,000

6,000

8,0 00

10,000

(Thousands of units)

Consolidated Vehicle Sales

0820

Search NextPrev page 49

Contents