Tiscali 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 Tiscali annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual financial report as at 31 December 2012

Date File Name Status Page

-

Annual Report as at 31

December 2012 20

deriving from the implementation of the Solidarity pact, signed with the organisations representing the

employees in 2011 which came into force as from 7 November 2011. Other indirect costs include

lease instalments and general operating expenses.

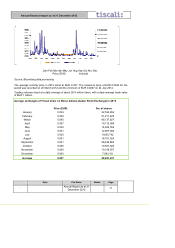

The effect of the above led to an Adjusted Gross Operating Result (EBITDA), before provisions for

risks, write-downs and amortisation/depreciation, totalling EUR 70.5 million (30.2% of revenues). This

balance was down slightly with respect to the same figure as at 31 December 2011, amounting to

EUR 71.7 million.

The Gross operating result (EBITDA), net of write-downs of receivables and other provisions came to

EUR 44.2 million in 2012 (18.9% of revenues), an increase of 23% on the figure for 2011 (EUR 35.9

million, 13.4% of revenues).

The write-down of receivables and other provisions in 2012 totalled EUR 26.3 million (EUR 35.8

million in the same period of 2011).

Amortisation/depreciation came to EUR 42.7 million (EUR 55.1 million in the same period of 2011). As

indicated above, the reduction in amortisation and depreciation is attributable to the extension of the

amortisation/depreciation period for certain categories of fixed assets (in this connection see the

matters fully described in the section “Format and content of the accounting statements”).

The operating result (EBIT) for 2012, net of provisions, write-downs and restructuring costs, was a loss

of EUR 0.2 million (0.1% of revenues), with respect to the balance in 2011, a loss of EUR 21.3 million

(7.9% of revenues).

The result from operating activities (on-going), a loss of EUR 15.9 million at 31 December 2012,

improved with respect to the same balance in the previous year, disclosing a loss of EUR 38.2 million.

The Group’s net result was a loss of EUR 15.9 million, compared with a loss in 2011 of EUR 38.1

million.