Tiscali 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Tiscali annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual financial report as at 31 December 2012

Date File Name Status Page

-

Annual Report as at 31

December 2012 15

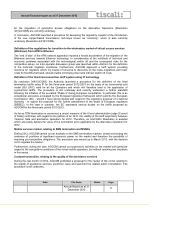

CONSOLIDATED INCOME STATEMENT

31 December

2012

31 December

2011 (*)

Change

Revenues 233.8 267.6

(33.8)

Other income 2.4 3.9 (1.5)

Purchase of materials and outsourced

services 133.3 169.3 (36.0)

Payroll and related costs 34.5 38.0 (3.6)

Other operating costs / (income) (2.1) (7.5) 5.4

Adjusted Gross Operating Result (EBITDA) 70.5 71.7 (1.2)

Write-downs of receivables from customers 26.3 35.8 (9.5)

Gross Operating Result (EBITDA) 44.2 35.9 8.3

Restructuring costs, provisions for risk

reserves and write-downs 1.6 2.1 (0.5)

Amortisation/depreciation 42.8 55.1 (12.4)

Operating result (EBIT) (0.2) (21.3) 21.1

Net financial income (charges) (13.2) (15.1) 1.9

Pre-tax result (13.4) (36.4) 23.0

Income taxes (2.5) (1.8) (0.7)

Net result from operating activities (on-

going) (15.9) (38.2) 22.3

Result from assets disposed of and/or

destined for disposal - 0.1 (0.1)

Net result (15.9) (38.1) 22.2

Minority interests - - -

Group Net Result (15.9) (38.1) 22.2

(*) note that, with respect to the balances published in the Annual Financial Report as at 31 December 2011, reclassifications

were made to the cost items included in the Ebitda, for the purpose of providing a fuller comparative representation with respect

to the previous year

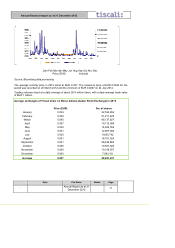

Tiscali Group revenues during 2012 came to EUR 233.8 million, down by 12.6% with respect to the

balance of EUR 267.6 million in 2011. The change, EUR 33.8 million, is essentially attributable to the

following factors:

• a reduction of EUR 21.5 million (-11%) in revenues for the “Access and VOIP” segment

essentially due to the drop in the number of customers;

• a rise of EUR 2.5 million (+11.7%) in revenues for the Media segment thanks to the additional

volumes of traffic registered on the network websites;

• a reduction of EUR 12.1 million (drop of 45.3%) in analogue voice revenues mainly due to the

reduction in the volume of wholesale services for EUR 9.7 million. This decrease was the

result of the Group’s strategic choice, laid down by the low margins on wholesale.

During 2012, internet access and voice services – the Group’s core business – represented around

81% of total turnover.

Costs for purchases of materials and services totalling EUR 133.3 million, decreased EUR 36 million

with respect to last year. This decrease was attributable in part to the reduction in volumes determined

by the decrease in the number of customers (and consequent reduction in Telecom line rental costs),

and in part to the positive effect deriving from the commercial agreements entered into with the main