Tiscali 2003 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2003 Tiscali annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1616

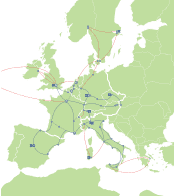

IDC expects the number of broadband users as a percentage of the total online population in western Europe to rise from

44% in 2003 to 53% in 2007.Note that growth in Internet penetration rates in western Europe vary significantly: in France,

which saw the highest growth in broadband in 2003, the percentage of households online is expected to rise from 36% at

end-2003 to 46% in 2007.This compares to projected rises from 47% to 53% in Germany and from 56% to 64% in the UK.

Growth is expected to be higher in countries where Internet penetration rates are relatively low, such as the Czech Republic

and Greece.

The broadband services market has become increasingly competitive, prompting a fall in average consumer prices compared to

the previous year. Operators also introduced the kind of offers previously typical of dial-up services.

In some countries, the emergence of OLOs, including ISPs that were originally alternative carriers, has changed the face of the

market, fuelling growth in the sector and creating an extremely competitive environment, both for basic access services and rela-

ted services/content (voice, video, music, films and games).

OLOs such as Tiscali can access broadband business through:

• the wholesale market, in which OLOs resell broadband access provided by the former incumbents. In this market, operators

are unable to exploit the competitive advantage of owning proprietary networks—which squeezes margins—and they also have

no control over the product offered to the user. Thanks to an improvement in the regulatory situation in Europe, profitability

has increased, but is still unsatisfactory in many European countries;

• bit-stream, whereby interconnection to the network of the national telecoms operators is charged at cost. Bit-stream allows

operators such as Tiscali to use their own networks, which means they only have to pay the national carrier for access to the

local loop and backhauling services (transmission of traffic to the interconnection point). This tariff system is only available in

France and the UK, where better conditions allow interconnection costs to be reflected fairly. The introduction of bit-stream

would be beneficial in other European countries and would be in line with the European regulations approved on 23 February

(“Recommendation on relevant product and service markets within the electronic communications sector susceptible to ex-

ante regulation”);

• unbundled services, through which OLOs can access the local loop by investing in local networks. Unbundled services allow

operators to expand their margins to over 70% and to control the quality of the service provided to final customers.

BT

4%

KPN

4%

TelecomItalia

5%

Tiscali

5%

AOL

5%

Others

30%

T-Online

24%

Telefonica

8%

Wanadoo

15%

European broadband market share as of 31.12.2003

Source: Tiscali chart using CMA Dataxis data