Tiscali 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 Tiscali annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

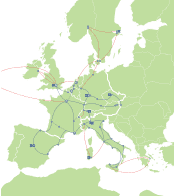

There was no significant change in the market shares of the main players in 2003: T-Online, Wanadoo and Tiscali remain Europe’s

leading Internet access operators.

The plans announced by France Telecom and Telefónica to buy out minority shareholders in subsidiaries Wanadoo and Terra Lycos

signal a significant new trend and reveal the strategic importance telecoms operators attach to the Internet access business.

Broadband market

At the end of 2002 the broadband market still bore some of the hallmarks of a monopoly, although this changed somewhat last

year, as the effects of EU regulations approved in February 2003 for implementation by July began to trickle through.

These regulations formalise the basic principle that national authorities (NRAs) must ensure other licensed operators (OLOs) can

operate under fair and non-discriminatory conditions on the broadband market, and should not be at a disadvantage to former

incumbents, which have a natural monopoly of the network.

This has eased the de facto monopoly in place when broadband was first available, and new operators such as Tiscali could not

compete with the former incumbents on a level playing field.

According to statistics provided by ECTA (the European Competitive Telecommunications Association), the former incumbents pro-

vided 92% of DSL connections at end-2003. Although competition increased in Europe’s main markets in 2003 (particularly in

France, where several OLOs have emerged to challenge the dominant position of the former incumbent and its ISP), in Italy

Telecom Italia’s share of the broadband market was 68% at the end of the year.

Tiscali

11%

AOL

5%

Wanadoo

13%

T-Online

17%

Others

54%

Internet market shares as of 31.12.2003

Source: Tiscali