Thrifty Car Rental 2007 Annual Report Download - page 69

Download and view the complete annual report

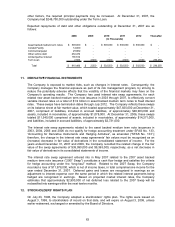

Please find page 69 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The 2005 Series notes are comprised of $110 million 4.59% fixed rate notes and $290 million of

floating rate notes. In conjunction with the issuance of the 2005 Series notes, the Company also

entered into interest rate swap agreements (Note 11) to convert $190 million of the floating rate debt

to fixed rate debt at a 4.58% interest rate. Additionally, in December 2006, the Company entered

into an interest rate swap agreement to convert the remaining $100 million of the floating rate debt

to fixed rate debt at a 5.09% interest rate.

The 2004 Series notes are floating rate notes that were converted to a fixed rate of 4.20% by

entering into interest rate swap agreements (Note 11) in conjunction with the issuance of the notes.

The 2003 Series notes are floating rate notes that were converted to a fixed rate of 3.64% by

entering into an interest rate swap agreement (Note 11) in conjunction with the issuance of the

notes. During 2007, the 2003 Series notes were paid in full.

The assets of RCFC, including revenue-earning vehicles related to the asset backed medium term

notes, restricted cash and investments, and certain receivables related to revenue-earning vehicles

are available to satisfy the claims of its creditors. Dollar and Thrifty lease vehicles from RCFC under

the terms of a master lease and servicing agreement. The asset backed medium term note

indentures also provide for additional credit enhancement through over collateralization of the

vehicle fleet, cash or letters of credit and maintenance of a liquidity reserve. RCFC is in compliance

with the terms of the indentures.

The asset backed medium term note programs are covered by bond insurers (the “Monolines”) and

each contain a minimum net worth covenant and an interest coverage covenant. The Company is in

compliance with these covenants at December 31, 2007. The Company will amend the existing

minimum net worth covenant in the Monoline agreements to exclude the impact of any potential

goodwill write-down; or, if not amended, a violation of this covenant can be avoided by providing

additional credit enhancement.

The asset backed medium term notes mature from 2008 through 2012 and are generally subject to

repurchase by the Company on any payment date subject to a prepayment penalty.

Conduit Facility – On June 25, 2007, the asset backed Variable Funding Note Purchase Facility

(the “Conduit”) was renewed for another 364-day period at a capacity of $300,000,000. Proceeds

are used for financing of vehicle purchases and for periodic refinancing of asset backed notes. The

Conduit generally bears interest at market-based commercial paper rates (5.86% and 5.72% at

December 31, 2007 and 2006, respectively). The Company had $12,000,000 and $425,000,000

outstanding under the Conduit at December 31, 2007 and 2006, respectively.

The Conduit contains a minimum net worth covenant and an interest coverage covenant. The

Company is in compliance with these covenants at December 31, 2007. The Company expects to

modify the existing minimum net worth covenant upon renewal of the Conduit to exclude the impact

of any potential goodwill write-down.

Commercial Paper – On June 25, 2007, the commercial paper program (the “Commercial Paper

Program”), representing $545,000,000 of borrowing capacity as a part of the existing asset backed

note program, was renewed for another 364-day period. Concurrently with the establishment of the

Commercial Paper Program, DTFC also entered into a 364-day, $460,000,000 liquidity facility (the

“Liquidity Facility”) to support the Commercial Paper Program. Proceeds are used for financing of

vehicle purchases and for periodic refinancing of asset backed notes. The Liquidity Facility provides

the Commercial Paper Program with an alternative source of funding if DTFC is unable to refinance

maturing commercial paper by issuing new commercial paper. Commercial paper bears interest at

rates ranging from 4.95% to 5.32% at December 31, 2007 and 5.33% to 5.38% at December 31,

2006 and matured within 30 days of December 31, 2007.

The Commercial Paper Program contains a minimum net worth covenant and an interest coverage

covenant. The Company is in compliance with these covenants at December 31, 2007. The

Company expects to modify the existing minimum net worth covenant upon renewal of the

Commercial Paper Program to exclude the impact of any potential goodwill write-down.

61