Thrifty Car Rental 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Highly Competitive Nature of the Vehicle Rental Industry

There is intense competition in the vehicle rental industry, especially on price and service. The Internet

has increased brand exposure and gives more details on rental prices to consumers and increases price

competition. The vehicle rental industry primarily consists of eight major brands, all of which compete

strongly for rental customers. A significant increase in industry capacity or a reduction in overall demand

could adversely affect our ability to maintain or increase rental rates or market share.

Seasonality

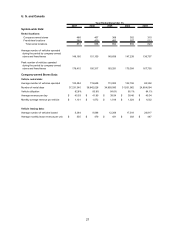

Our business is subject to seasonal variations in customer demand, with the summer vacation period

representing the peak season for vehicle rentals. In 2007, the third quarter accounted for over 29% of our

vehicle rental revenues and over 45% of our operating income, while the second quarter accounted for

over 25% of our vehicle rental revenues and over 27% of our operating income. Any event that disrupts

rental activity, fleet supply, or industry fleet capacity during these quarters could have a disproportionately

material adverse effect on our liquidity, our cash flows and/or our results of operations.

Dependence on Air Travel

We get approximately 90% of our rental revenues from airport locations and airport arriving customers.

The number of airline passengers has a significant impact on our business. Mergers and acquisitions in

the airline industry and airline restructuring through bankruptcy may cause airlines to reduce flight

schedules which could adversely impact the number of airline passengers. A significant reduction in

airline passengers or any event that significantly disrupts air travel could negatively impact our results.

Concentration in Leisure Destinations

We have a significant presence in key leisure destinations and earn a large portion of our revenue from

these markets. Rental revenue from Florida, Hawaii, California and Nevada represented approximately

55% of our total rental revenue in 2007. Reductions in leisure travel to these destinations resulting from

natural disasters, terrorist acts, general economic conditions or other factors would have a material

impact on our results.

Vehicle Supply and Residual Value Programs

Our vehicle supply agreement with Chrysler extends through model year 2011 and we generally purchase

80% to 90% of our vehicles from Chrysler. Under the vehicle supply agreement, we must purchase 75%

of our vehicles from Chrysler up to certain targeted volumes and Chrysler has agreed to provide us

certain minimum volumes of vehicles. The vehicle supply agreement also requires that 80% of the

vehicles at the initial targeted volumes be vehicles covered by a manufacturer program that guarantees

the value of the vehicle at the time of sale and 20% of the vehicles be vehicles not covered by a

manufacturer program. We have historically acquired more than 75% of our vehicles from Chrysler and

annually we evaluate our mix of Program and Non-Program Vehicles. Residual value programs enable

us to determine depreciation expense, which is our largest single cost element, on Program Vehicles in

advance.

Our annual vehicle purchase requirements generally exceed the amounts that Chrysler has agreed to

provide under the vehicle supply agreement. We are actively pursuing other vehicle manufacturers to

further diversify our vehicle supply in the future to reduce our dependence on a single supplier. For the

2007 model year, Chrysler vehicles represented about 88% of the Company’s U.S. fleet purchases. A

material diversification of our supplier base may be difficult in an environment where manufacturers are

reducing overall supply to the rental car industry.

Vehicle manufacturers, including Chrysler, have reduced vehicle supply to the rental car industry and

have significantly increased industry vehicle costs for the past few years by increasing Program Vehicle

depreciation rates and lowering incentives. The failure of any of the major vehicle manufacturers to sell

enough vehicles to the industry could adversely affect our results. Furthermore, if the vehicle

manufacturers change the size or terms of their residual value programs, we could experience increased

residual value risk or increased depreciation rates on Program Vehicles that could be material to our

results of operations and could adversely affect our ability to finance our vehicles.

17