Thrifty Car Rental 2007 Annual Report Download - page 64

Download and view the complete annual report

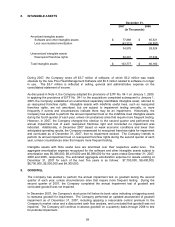

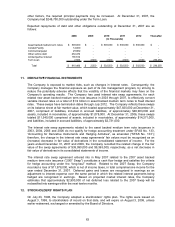

Please find page 64 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4. ACQUISITIONS

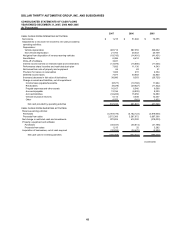

In 2007, the Company added seven locations by acquiring its former franchisee in Seattle,

Washington and Portland, Oregon. The Company also acquired certain assets and assumed

certain liabilities relating to 29 locations from former franchisees in Pittsburgh,

Middletown/Harrisburg, Allentown and Erie, Pennsylvania; McAllen, Texas; Burlington, Vermont;

Knoxville, Tennessee; Louisville, Kentucky; Providence, Rhode Island; Kansas City and Springfield,

Missouri; Wichita, Kansas; Omaha and Lincoln, Nebraska; and Des Moines, Iowa for the Thrifty

brand and in Allentown, Pennsylvania and Wichita, Kansas for the Dollar brand. During 2006, the

Company acquired certain assets and assumed certain liabilities relating to 35 locations from former

franchisees in Little Rock, Arkansas; Providence, Rhode Island; Cincinnati, Columbus and Dayton,

Ohio; Milwaukee and Madison, Wisconsin; Pensacola, Florida; Phoenix, Arizona; Reno, Nevada; El

Paso and San Antonio, Texas for the Thrifty brand and in Nashville, Tennessee; Oklahoma City and

Tulsa, Oklahoma; Minneapolis, Minnesota; Madison, Wisconsin; and El Paso, Texas for the Dollar

brand. During 2005, the Company acquired certain assets and assumed certain liabilities relating to

12 locations from former franchisees in Jacksonville, Melbourne and Cape Canaveral, Florida; San

Jose, California; Baton Rouge and New Orleans, Louisiana and Albuquerque and Santa Fe, New

Mexico for the Thrifty brand. Total cash paid, net of cash acquired, for these acquisitions was

$30,292,000, $34,475,000 and $5,224,000 in 2007, 2006 and 2005, respectively.

Beginning January 1, 2005, the Company adopted the provisions of EITF No. 04-1. EITF No. 04-1

affirms that a business combination between two parties that have a preexisting relationship should

be accounted for as a multiple element transaction. This includes determining how the cost of the

combination should be allocated after considering the assets and liabilities that existed between the

parties prior to the combination. Adoption of EITF No. 04-1 impacted the way in which the Company

accounts for certain business combination transactions through establishing identifiable intangibles,

other than goodwill, such as reacquired franchise rights through the Company’s acquisitions of

franchisee operations. At December 31, 2007, the Company had recognized an unamortized

intangible asset for reacquired franchise rights totaling $69,201,000 (Note 8).

The Company recognized $147,000 in goodwill related to acquisition transactions during 2007 and

did not recognize any goodwill related to acquisition transactions during 2006 or 2005. Reacquired

franchise rights and a portion of goodwill are both deductible for tax purposes. The Company may

have an adjustment or subsequent settlement to the purchase price of an acquisition affecting the

recorded amount of goodwill or reacquired franchise rights and the allocation of the purchase price.

Historically, these purchase price adjustments have not been material. Each of the acquisitions has

been accounted for using the purchase method of accounting and operating results of the acquirees

from the dates of acquisition are included in the consolidated statements of income of the Company.

Acquisitions made in each year are not material individually or collectively to amounts presented for

each of the years ended December 31, 2007, 2006 and 2005.

56