Thrifty Car Rental 2007 Annual Report Download - page 59

Download and view the complete annual report

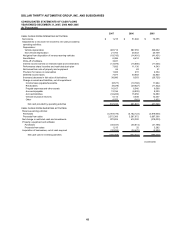

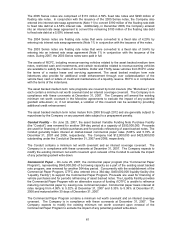

Please find page 59 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.tax program for deferred tax gains on eligible vehicle remarketing. These funds are primarily held in

a highly rated money market fund with investments primarily in government and corporate

obligations with a dollar-weighted average maturity not to exceed 60 days, as permitted by the

indenture. Restricted cash and investments are excluded from cash and cash equivalents. Interest

earned on restricted cash and investments was $13,975,000, $16,896,000 and $11,045,000, for

2007, 2006 and 2005, respectively, and remains in restricted cash and investments.

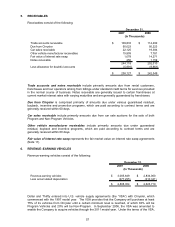

Allowance for Doubtful Accounts – An allowance for doubtful accounts is generally established

during the period in which receivables are recorded. The allowance is maintained at a level deemed

appropriate based on loss experience and other factors affecting collectibility.

Financing Issue Costs – Financing issue costs related to vehicle debt and the Senior Secured

Credit Facilities are deferred and amortized to interest expense over the term of the related debt

using the effective interest method.

Revenue-Earning Vehicles – Revenue-earning vehicles are stated at cost, net of related discounts.

The Company generally purchases 50% to 60% of its vehicles for which residual values are

determined by depreciation rates that are established and guaranteed by the manufacturers

(“Program Vehicles”). The remaining 40% to 50% of the Company’s vehicles are purchased without

the benefit of a manufacturer residual value guaranty program (“Non-Program Vehicles”). Also, the

Company may convert vehicles originally acquired as Program Vehicles to Non-Program Vehicles

on an opportunistic basis to lower vehicle depreciation costs. For these Non-Program Vehicles, the

Company must estimate what the residual values of these vehicles will be at the expected time of

disposal to determine monthly depreciation rates. The Company continually evaluates estimated

residual values. Differences between actual residual values and those estimated by the Company

result in a gain or loss on disposal and are recorded as an adjustment to depreciation expense. The

average holding term for vehicles is seven to nine months.

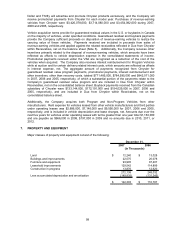

Property and Equipment – Property and equipment are recorded at cost and are depreciated or

amortized using principally the straight-line method over the estimated useful lives of the related

assets. Estimated useful lives range from ten to thirty years for buildings and improvements and

three to seven years for furniture and equipment. Leasehold improvements are amortized over the

estimated useful lives of the related assets or leases, whichever is shorter.

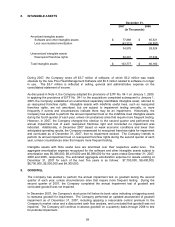

Intangible Assets – Software and other intangible assets are recorded at cost and amortized using

the straight-line method primarily over five years. The remaining useful life of all intangible assets is

evaluated annually to assess whether events and circumstances warrant a revision to the remaining

amortization period.

Reacquired franchise rights, established upon reacquiring a previously franchised location, are not

amortized as they have an indefinite life, rather they are tested annually for impairment in

accordance with Emerging Issues Task Force ("EITF") No. 04-1, "Accounting for Preexisting

Relationships between the Parties to a Business Combination" ("EITF No. 04-1") (Note 8).

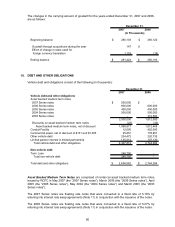

Goodwill – The excess of acquisition costs over the fair value of net assets acquired is recorded as

goodwill. In accordance with Statement of Financial Accounting Standards (“SFAS”) No. 142,

“Goodwill and Other Intangible Assets,” goodwill is no longer amortized but instead is tested for

impairment at least annually (Note 9).

Long–Lived Assets – The Company reviews the value of long-lived assets, including software and

other intangible assets, for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable based upon estimated future cash flows.

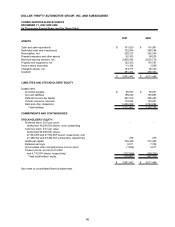

Accounts Payable – Book overdrafts of $16,333,000 and $21,491,000 are included in accounts

payable at December 31, 2007 and 2006, respectively.

51