Thrifty Car Rental 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Thrifty Car Rental annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

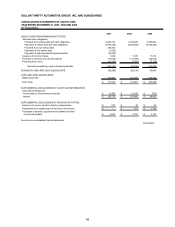

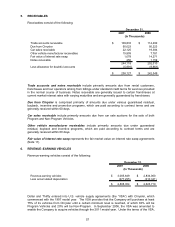

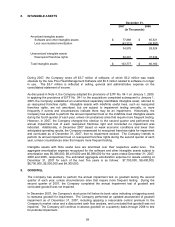

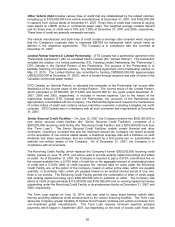

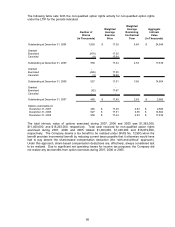

8. INTANGIBLE ASSETS

2007 2006

Amortized intangible assets

Software and other intangible assets 77,888$ 65,521$

Less accumulated amortization (43,312) (36,997)

34,576 28,524

Unamortized intangible assets

Reacquired franchise rights 69,201 37,636

Total intangible assets 103,777$ 66,160$

December 31,

(In Thousands)

During 2007, the Company wrote off $3.7 million of software, of which $3.2 million was made

obsolete by the new Pros Fleet Management Software and $0.5 million related to software no longer

in use. The $3.7 million is reflected in selling, general and administrative expense on the

consolidated statement of income.

As discussed in Note 4, the Company adopted the provisions of EITF No. 04-1 on January 1, 2005.

In applying the provisions of EITF No. 04-1 to the acquisitions completed subsequent to January 1,

2005, the Company established an unamortized separately identifiable intangible asset, referred to

as reacquired franchise rights. Intangible assets with indefinite useful lives, such as reacquired

franchise rights, are not amortized, but are subject to impairment testing annually, or more

frequently if events and circumstances indicate there may be an impairment. Historically, the

Company has elected to perform the annual impairment test on the indefinite lived intangible assets

during the fourth quarter of each year, unless circumstances arise that require more frequent testing.

However, in 2007, the Company changed this election to the second quarter and performed the

annual impairment test of each reacquired franchise right and concluded no impairment was

indicated. Additionally, in December 2007 based on weak economic conditions and lower than

anticipated operating results, the Company reassessed its reacquired franchise rights for impairment

and concluded as of December 31, 2007, that no impairment existed. The Company intends to

perform its annual impairment test on reacquired franchise rights during the second quarter of each

year, unless circumstances arise that require more frequent testing.

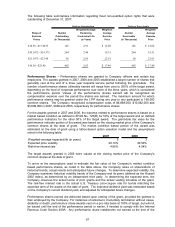

Intangible assets with finite useful lives are amortized over their respective useful lives. The

aggregate amortization expense recognized for the software and other intangible assets subject to

amortization was $6,386,000, $6,410,000 and $6,088,000 for the years ended December 31, 2007,

2006 and 2005, respectively. The estimated aggregate amortization expense for assets existing at

December 31, 2007 for each of the next five years is as follows: $7,700,000, $8,400,000,

$6,700,000, $5,500,000 and $4,300,000.

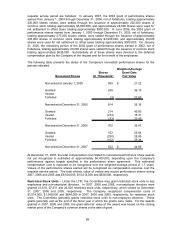

9. GOODWILL

The Company has elected to perform the annual impairment test on goodwill during the second

quarter of each year, unless circumstances arise that require more frequent testing. During the

second quarter of 2007, the Company completed the annual impairment test of goodwill and

concluded goodwill was not impaired.

In December 2007, the Company’s stock price fell below its book value indicating a triggering event

to reassess goodwill for impairment. The Company performed an updated assessment of goodwill

impairment as of December 31, 2007, including applying a reasonable control premium to the

Company’s market value and a discounted cash flow analysis, and concluded that goodwill was not

impaired. The Company will continue to assess goodwill on a quarterly basis through 2008 to test

for potential impairment.

59