Telus 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

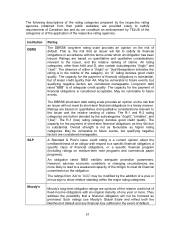

Institution Rating

Obligations rated Baa are judged to be medium-grade and subject to

moderate credit risk and as such may possess certain speculative

characteristics.

Moody's appends numerical modifiers 1, 2, and 3 to each generic rating

classification from ‘Aa’ through ‘Caa’. The modifier 1 indicates that the

obligation ranks in the higher end of its generic rating category; the modifier

2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in

the lower end of that generic rating category.

Fitch 'BBB' ratings indicate that expectations of default risk are currently low. The

capacity for payment of financial commitments is considered adequate but

adverse business or economic conditions are more likely to impair this

capacity. The modifiers "+" or "-" may be appended to a rating to denote

relative status within major rating categories. Such suffixes are not added to

the 'AAA' Long-Term rating or to Long-Term rating below ‘B’.

As is common practice, during the last two years, each of the above-noted credit rating

agencies charged TELUS for their rating services which include annual surveillance fees

covering our outstanding long-term and short-term debt securities, in addition to one-

time rating fees for certain agencies when debt is initially issued. We reasonably expect

that such payments will continue to be made for rating services in the future.