Telus 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 29

the shareholders of TELUS. The Second Preferred shares rank, subject to the prior

rights of the holders of the First Preferred shares, prior to the Common Shares with

respect to priority in payment of dividends and in the distribution of assets in the event of

liquidation, dissolution or winding up of TELUS.

Shareholder rights plan

We first adopted a shareholder rights plan in March 2000, which expired on March 20,

2010. The TELUS Board of Directors adopted a substantially similar shareholder rights

plan (Rights Plan) on March 12, 2010 (Effective Date), which was ratified by

shareholders of both share classes at the May 2010 annual and special meeting and re-

confirmed at the May 2013 annual and special meeting. Under the current Rights Plan,

TELUS issued one right (Right) in respect of each Common Share outstanding as at the

Effective Date. The Rights Plan has a term of just over nine years, subject to

shareholder confirmation every three years. Each Right, other than those held by an

Acquiring Person (as defined in the Rights Plan) and certain of its related parties, entitles

the holder in certain circumstances following the acquisition by an Acquiring Person of

20% or more of the Common Shares of TELUS (otherwise than through the “Permitted

Bid” requirements of the Rights Plan) to purchase from TELUS $320 worth of Common

Shares for $160 (i.e. at a 50% discount) respectively.

At the May 2013 annual and special meeting, shareholders approved amendments to

the Rights Plan to reflect the elimination of the Non-Voting Share class from TELUS’

authorized share structure. Additionally, minor amendments were approved to reflect

TELUS’ use of the Direct Registration System Advice program since February 2013.

References to share certificates now also include a reference to securities that have

been issued and registered in uncertificated form that are evidenced by an advice or

other statement and which are maintained electronically with our transfer agent, but for

which no certificate has been issued (commonly referred to as the book entry form).

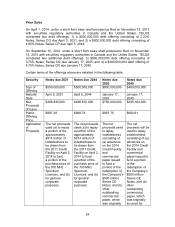

Normal course issuer bid and shelf prospectus

On September 23, 2014, we successfully completed our 2014 normal course issuer bid

(NCIB), purchasing and cancelling approximately 13 million Common Shares and

returning $500 million to shareholders. The average purchase price was $38.45. The

purchased shares represent 2.1% of the Common Shares outstanding prior to

commencement of the NCIB program. Since the commencement of our normal course

issuer bid in 2013 to December 31, 2014, we have purchased and cancelled a total of

approximately 47 million Common Shares for $1.65 billion reflecting an average price of

$34.33. In addition, we received approval from the TSX for a new NCIB program (2015

NCIB) to purchase and cancel up to 16 million Common Shares with a value of up to

$500 million over a 12-month period, commencing October 1, 2014. Such purchases will

be made through the facilities of the TSX, the NYSE and alternative trading platforms or

otherwise as may be permitted by applicable securities laws and regulations. This

represents up to 2.6% of the Common Shares outstanding at the date of the 2015 NCIB

notice to the TSX. The Common Shares will be purchased only when and if we consider

it advisable.

On November 19, 2014, we filed a shelf prospectus, in effect until December 2016,

pursuant to which we may offer up to $3 billion of long-term debt or equity securities.