Telus 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

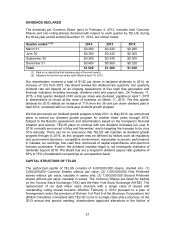

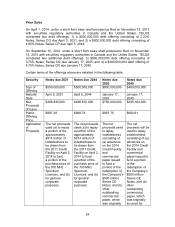

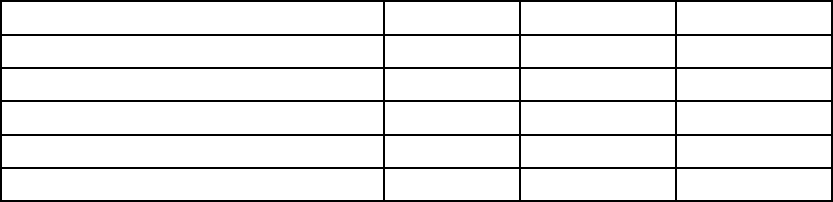

DIVIDENDS DECLARED

The dividends per Common Share (prior to February 4, 2013, includes both Common

Shares and non-voting shares) declared with respect to each quarter by TELUS, during

the three-year period ended December 31, 2014, are shown below:

Quarter ended (1)(2) 2014 2013 2012

March 31 $0.360 $0.320 $0.290

June 30 $0.380 $0.340 $0.305

September 30 $0.380 $0.340 $0.305

December 31 $0.400 $0.360 $0.320

Total $1.520 $1.360 $1.220

(1) Paid on or about the first business day of the next month.

(2) Adjusted for two-for-one share split effective April 16, 2013.

Our shareholders received a total of $1.52 per share in declared dividends in 2014, an

increase of 12% from 2013. Our Board reviews the dividend rate quarterly. Our quarterly

dividend rate will depend on an ongoing assessment of free cash flow generation and

financial indicators including leverage, dividend yield and payout ratio. On February 11,

2015, a first quarter dividend of 40 cents per share was declared, payable on April 1, 2015

to shareholders of record at the close of business on March 11, 2015. The first quarter

dividend for 2015 reflects an increase of 11% from the 36 cent per share dividend paid in

April 2014, consistent with our multi-year dividend growth program.

We first announced our dividend growth program in May 2011. In May 2013, we announced

plans to extend our dividend growth program for another three years through 2016.

Subject to the Board’s assessment and determination based on the Company’s financial

situation and outlook, TELUS plans to continue with two dividend increases per year to

2016, normally announced in May and November, and is targeting the increase to be circa

10% annually. There can be no assurance that TELUS will maintain its dividend growth

program through to 2016, as this program may be affected by factors such as regulatory

and government decisions; competitive environment; reasonable economic performance

in Canada; our earnings, free cash flow, and levels of capital expenditures; and spectrum

licenses purchases. Further, the dividend increase target is not necessarily indicative of

dividends beyond 2016. The Board has set a long-term dividend payout ratio guideline of

65% to 75% of sustainable net earnings on a prospective basis.

CAPITAL STRUCTURE OF TELUS

The authorized capital of TELUS consists of 4,000,000,000 shares, divided into: (1)

2,000,000,000 Common Shares without par value; (2) 1,000,000,000 First Preferred

shares without par value, issuable in series and; (3) 1,000,000,000 Second Preferred

shares without par value, issuable in series. The Common Shares are listed for trading

on the Toronto Stock Exchange (TSX) and the New York Stock Exchange (NYSE). The

replacement of our dual share class structure with a single class of issued and

outstanding voting shares became effective February 4, 2013 pursuant to a plan of

Arrangement under the provision of Division 5 of Part 9 of the Business Corporations Act

(British Columbia). Consistent with TELUS’ move to a single class share structure, at the

2013 annual and special meeting, shareholders approved alterations to the Notice of