Telus 2012 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2012 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 32

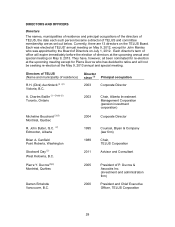

current and former employees of the Nortel Companies on May 31, 2004. The

order was issued due to the Nortel Companies having announced the need to

restate certain of their previously reported financial results and the resulting

delays in filing their financial statements in compliance with Ontario securities

laws. The Autorité des marchés financiers (“AMF”) and the Alberta

Securities Commission (“ASC”) issued similar orders. The order was revoked by

the OSC on June 21, 2005 and the AMF and ASC orders were revoked shortly

thereafter. Mr. Manley was not subject to the AMF or ASC orders. On March 10,

2006, the Nortel Companies announced the need to restate certain of their

previously reported financial results and a resulting delay in the filing of certain

2005 financial statements by the required dates under Ontario securities laws.

The OSC issued a further management cease trade order on April 10, 2006

prohibiting all directors, officers and certain current and former employees,

including Mr. Manley, from trading in securities of the Nortel Companies until the

filings were complete. The British Columbia Securities Commission (“BCSC”)

and the AMF issued similar orders. The OSC lifted its cease trade order June 8,

2006 and the BCSC and AMF orders were revoked shortly thereafter. Mr Manley

was not subject to the BCSC or AMF orders.

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

The description of legal proceedings described in MD&A Section 10.9 Litigation and

legal matters is hereby incorporated by reference. In addition, there have not been any

(a) penalties or sanctions imposed against us by a court relating to securities legislation

or by a securities regulatory authority during the most recently completed financial year,

(b) penalties or sanctions imposed by a court or regulatory body against us that would

likely be considered important to a reasonable investor in making an investment

decision, or (c) settlement agreements entered into by us before a court relating to

securities legislation or with a securities regulatory authority during the most recently

completed financial year.

INTERESTS OF EXPERT

Deloitte LLP, Chartered Accountants, are the auditors of the Company and are

independent within the meaning of the Rules of Professional Conduct of the Institute of

Chartered Accountants of British Columbia.

AUDIT COMMITTEE

The Audit Committee of the Company supports the Board in fulfilling its oversight

responsibilities regarding the integrity of our accounting and financial reporting, internal

controls and disclosure controls, legal and regulatory compliance, ethics policy and

timeliness of filings with regulatory authorities, the independence and performance of the

our external and internal auditors, the management of the our risk, credit worthiness,

treasury plans and financial policy and whistleblower and complaint procedures. A copy

of the Audit Committee’s Terms of Reference is attached as Appendix A to this Annual

Information Form.