Telus 2012 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2012 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

requirements of Canadian law and do not constitute an endorsement by TELUS of the

categories or of the application of the respective rating agencies.

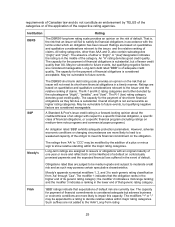

Institution Rating

DBRS The DBRS® long-term rating scale provides an opinion on the risk of default. That is,

the risk that an issuer will fail to satisfy its financial obligations in accordance with the

terms under which an obligation has been issued. Ratings are based on quantitative

and qualitative considerations relevant to the issuer, and the relative ranking of

claims. All rating categories, other than AAA and D, also contain subcategories

“(high)” and “(low)”. The absence of either a “(high)” or “(low)”designation indicates

the rating is in the middle of the category. An “A” rating denotes good credit quality.

The capacity for the payment of financial obligations is substantial, but of lesser credit

quality than AA. May be vulnerable to future events, but qualifying negative factors

are considered manageable. Long-term debt rated “BBB” is of adequate credit

quality. The capacity for the payment of financial obligations is considered

acceptable. May be vulnerable to future events.

The DBRS® short-term debt rating scale provides an opinion on the risk that an

issuer will not meet its short-term financial obligations in a timely manner. Ratings are

based on quantitative and qualitative considerations relevant to the issuer and the

relative ranking of claims. The R-1 and R-2 rating categories are further denoted by

the subcategories “(high)”, “(middle)”, and “(low)”. The R-1 (low) rating category

denotes good credit quality. The capacity for the payment of short-term financial

obligations as they fall due is substantial. Overall strength is not as favourable as

higher rating categories. May be vulnerable to future events, but qualifying negative

factors are considered manageable.

S&P A Standard & Poor's issue credit rating is a forward-looking opinion about the

creditworthiness of an obligor with respect to a specific financial obligation, a specific

class of financial obligations, or a specific financial program (including ratings on

medium-term note programs and commercial paper programs).

An obligation rated ‘BBB’ exhibits adequate protection parameters. However, adverse

economic conditions or changing circumstances are more likely to lead to a

weakened capacity of the obligor to meet its financial commitment on the obligation.

The ratings from ‘AA’ to ‘CCC’ may be modified by the addition of a plus or minus

sign to show relative standing within the major rating categories.

Moody’s Long-term ratings are assigned to issuers or obligations with an original maturity of

one year or more and reflect both on the likelihood of a default on contractually

promised payments and the expected financial loss suffered in the event of default.

Obligations rated Baa are judged to be medium-grade and subject to moderate credit

risk and as such may possess certain speculative characteristics.

Moody's appends numerical modifiers 1, 2, and 3 to each generic rating classification

from ‘Aa’ through ‘Caa’. The modifier 1 indicates that the obligation ranks in the

higher end of its generic rating category; the modifier 2 indicates a mid-range ranking;

and the modifier 3 indicates a ranking in the lower end of that generic rating category.

Fitch 'BBB' ratings indicate that expectations of default risk are currently low. The capacity

for payment of financial commitments is considered adequate but adverse business

or economic conditions are more likely to impair this capacity. The modifiers "+" or "-"

may be appended to a rating to denote relative status within major rating categories.

Such suffixes are not added to the 'AAA' Long-Term rating