Telus 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

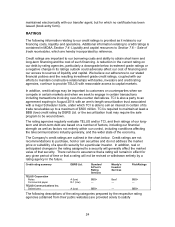

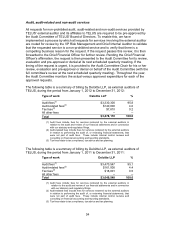

NYSE – Non-Voting Shares

Month High ($U.S.) Low ($U.S.) Volume

January 54.43 51.56 2,157,904

February 57.73 53.22 2,430,302

March 58.78 55.99 3,607,221

April 58.92 55.47 1,923,759

May 58.97 55.10 1,878,835

June 58.75 55.17 1,942,775

July 61.89 58.15 2,271,056

August 64.59 60.41 2,877,199

September 64.06 61.30 2,558,013

October 65.15 61.21 1,895,596

November 65.24 61.62 1,708,155

December 66.54 64.01 1,107,368

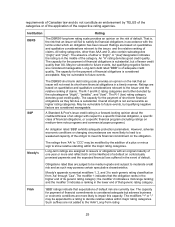

Prior Sales

On December 6, 2012, under a short form base shelf prospectus filed on October 3,

2011, TELUS completed a $500,000,000 debt offering consisting of 3.35% Notes, Series

CJ, due on March 15, 2023. Certain terms of the offering are detailed in the following

table:

Security Notes due 2023

Size of Offering $500,000,000

Maturity Date March 15, 2023

Net Proceeds of Issue $497,415,000

Public Offering Price $998.83

Application of Proceeds Net proceeds used to repay outstanding

commercial paper and pending any such

use, invested in bank deposits and short

term marketable securities. The

commercial paper indebtedness was

originally incurred for general corporate

purposes.

Please refer to TELUS Corporation 2012 year-end audited consolidated financial

statements - Note 20(b) TELUS Corporation Notes for details on our past debt offerings.

In addition, in the ordinary course of business, the Company has the capability to issue

commercial paper with maturities of less than 12 months. As at December 31, 2012, the

Company had $245 million in commercial paper outstanding with maturities up to April

2013.