Telus 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 7

income trust. On October 31, 2006, the federal Minister of Finance announced a new

tax plan that would increase the taxation of income trusts. The Company re-evaluated

its proposal in light of the Minister’s announcement and, on November 24, 2006, the

Company announced that it would not proceed with the proposal as TELUS

management and the Board of Directors believed it was no longer in the best interests of

the Company and its shareholders to do so.

In April 2007, Canada’s largest telecommunications service provider, BCE Inc., entered

into a strategic review process. On June 21, 2007, TELUS announced that it had

entered into a mutual non-disclosure and standstill agreement and was pursuing non-

exclusive discussions to acquire BCE. On June 26, TELUS announced that

inadequacies in BCE's bid process did not make it possible for TELUS to submit an offer

to acquire BCE. On June 30, BCE announced that it had entered into a definitive

agreement to be acquired by a consortium led by Teachers Private Capital, the private

investment arm of the Ontario Teachers' Pension Plan, and the U.S.-based Providence

Equity Partners and Madison Dearborn Partners, LLC. In early August, TELUS

concluded its assessment of whether it should potentially make a competing offer for

BCE, and announced that it did not intend to submit a competing offer.

On November 29, 2007, TELUS and Emergis Inc. (“Emergis”) announced that they had

entered into a support agreement pursuant to which TELUS agreed to make an all-cash

offer to acquire by way of a take over bid all the outstanding common shares of Emergis

at $8.25 per share. The take over bid was supported by the board of Emergis and, as

part of the transaction, Emergis’ directors, officers, and certain shareholders entered into

lock-up agreements with TELUS pursuant to which they agreed to, among other things,

tender all of their Emergis shares, representing approximately 22 per cent of the

outstanding Emergis shares on a fully-diluted basis.

On January 17, 2008, 6886116 Canada Ltd., a wholly-owned subsidiary of TCI, had

purchased approximately 94 per cent of the issued and outstanding common shares of

Emergis on a fully diluted basis at a price of $8.25 cash per share. 6886116 Canada

Ltd. exercised its statutory rights under the Canada Business Corporations Act and

purchased the remaining common shares of Emergis by compulsory acquisition. The

approximate total purchase price of the Emergis common shares was $743 million. A

corporate reorganization of Emergis was completed immediately prior to the purchase.

The common shares of Emergis have been de-listed from the Toronto Stock Exchange

and Emergis is no longer a reporting issuer.

Emergis develops and manages solutions that automate transactions and the secure

exchange of information. Emergis has expertise in electronic health-related claims

processing, health records systems, pharmacy management solutions, point-of-sale

transaction processing, cash management and loan document processing and

registration. In Canada, Emergis delivers solutions to major insurance companies, top

financial institutions, government agencies, hospitals, large corporations, real estate

lawyers and notaries, and approximately 3,000 pharmacies.

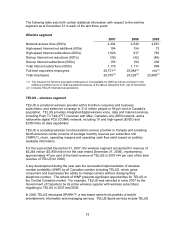

DESCRIPTION OF THE BUSINESS AND GENERAL DEVELOPMENTS

TELUS is the largest incumbent telecommunications company in Western Canada and one

of the largest telecommunications companies in Canada. TELUS has two reportable

segments: wireline and wireless.