Suzuki 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

24

(i)Accrued retirement & severance benefits

In order to allow for payment of employees' retirement benefits, based on estimated amount of retirement

benefits liabilities and pension assets at the end of this fiscal year, the allowable amount which occur at the

end of this term is appropriated.

The accrued retirement & severance benefits as of March 31, 2002 represents the estimated present value

of projected benefit obligations in excess of the fair value of the plan assets except that, as permitted under the

current standard, the unrecognized transition amount arising from adopting the current standard of 53,896

million yen at April 1, 2000 (the beginning of previous fiscal year) is amortized on a straight-line basis over

5 years. Prior service cost is being amortized by the straight-line method over periods of mainly 15 years,

which are the estimated average remaining service years of the employees. Actuarial gain and loss are

amortized by the straight-line method over periods of mainly 15 years from the next year of the arising, which

are the estimated average remaining service years of the employees.

In order to allow for payment of directors' retirement benefits, the amount payable accrued at the balance

sheet date based on the internal rule concerning payment of directors' retirement benefits is appropriated.

(j)Revenue recognition

Sales of products are generally recognized in the accounts as delivery is made.

(k)Amounts per share

Primary net income per share is computed based on the weighted average number of shares issued during

the respective years.

Fully diluted net income per share is computed assuming that all convertible bonds at the beginning of the

year were converted into common stock, with an applicable adjustment for related interest expense and net of

tax.

Cash dividends per share are the amounts applicable to the respective periods including dividends to be

paid after the end of the period.

(l)Cash and cash equivalents

All highly liquid investments with original maturities of three months or less when purchased are

considered cash and cash equivalents.

(m)Reclassification

Certain reclassifications of previously reported amounts have been made to conform with current

classifications.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

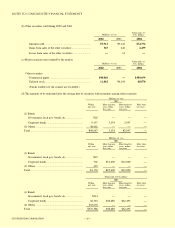

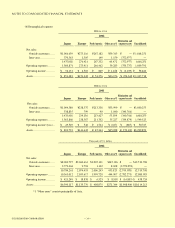

3.Inventories

Inventories as of March 31, 2002 and 2001 were as follows:

Finished products.............................................................. ¥203,707 ¥191,642 $1,528,763

Work in process ................................................................ 14,411 15,773 108,154

Raw materials and others.................................................. 12,594 15,374 94,518

¥230,713 ¥222,791 $1,731,435

Thousands of

U.S. dollars

Millions of yen

2002 2001 2002