Suzuki 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

22

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Basis of presenting consolidated financial statements

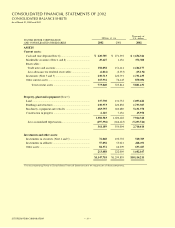

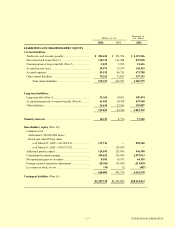

The accompanying consolidated financial statements of SUZUKI MOTOR CORPORATION (the

Company) have been prepared on the basis of generally accepted accounting principles and practices in

Japan, and from the consolidated financial statements filed with the Ministry of Finance as required by the

Securities and Exchange Law of Japan.

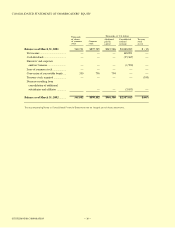

Certain reclassifications and modifications have been made to the original consolidated financial

statements for the convenience of readers outside Japan. In addition, the consolidated statements of

shareholders' equity have been prepared as additional information, although such statements are not required

in Japan, and the notes include information which is not required under generally accepted accounting

principles and practices in Japan.

As permitted, amount of less than one million yen have been omitted. For the convenience of readers, the

consolidated financial statements including the opening balance of shareholders' equity have been presented

in U.S. dollars by translating all Japanese yen amounts on the basis of ¥133.25 to U.S.$1, the rate of exchange

prevailing as of March 29, 2002. Consequently, the totals shown in the consolidated financial statements

(both in yen and in U.S. dollars) do not necessarily agree with the sum of the individual amounts.

2. Summary of significant accounting policies

(a)Principles of consolidation

The consolidated financial statements for the years ended March 31, 2002 and 2001, include the accounts

of the Company and its significant subsidiaries and the number of consolidated subsidiaries are 128 and 126

respectively. All significant inter-company accounts and transactions are eliminated in consolidation.

Investments in affiliated companies are accounted for by the equity method.

As for the evaluation of assets and liabilities of consolidated subsidiaries, the complete market value

accounting method is adopted. The difference at the time of acquisition between the cost and underlying net

equity of investments in consolidated subsidiaries and in affiliated companies accounted for under the equity

method is, as a rule, amortized over a period of five years after appropriate adjustments.

(b)Marketable securities, investment in securities

Securities have to be classified into four categories; Trading securities, Held-to-maturity debt securities,

Investments of the Company in equity securities issued by unconsolidated subsidiaries and affiliates and

Other securities.

According to this classification, securities held by the Company and its subsidiaries are Other securities.

Other securities for which market quotations are available are stated at fair value by closing date's market

value method. Unrealized gains or losses are included in a component of shareholders' equity at a net-of-tax

amount, and gains or losses from sales of securities are recognized on cost determined by the moving average

method.

Other securities for which market quotations are unavailable are stated at cost by a moving average

method. At the beginning of each fiscal year, the holding purpose of existing securities is reviewed and

securities within one year due is classified as current assets, and the others as investment in securities.

(c)Hedge accounting

Gains or losses arising from changes in fair value of the derivatives designated as “hedging instruments”

are deferred as an asset or liability and included in net profit or loss in the same period during which the gains

and losses on the hedged items or transactions are recognized.

The derivatives designated as hedging instruments by the Company are principally interest swaps and

forward exchange contracts. The related hedged items are trade accounts receivable and investments in

securities.