Snapple 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. •WegrewDrPepperdollarshareforthefifthconsecutiveyear,up0.2points.

•BasedonpositiveconsumerresponsetoDrPepperTEN

40percentofdollarsaleswereincrementaltotheCSDcategory.Backedbythesepromisingresults,wetook

•WegrewSnapplevolume3percent,ensuringthatSnappleisenjoyedbymoreconsumersacrossthecountry.

•WelaunchedSnappleDietHalf‘nHalfLemonadeIcedTea,whichgaineddistributionquicklyandhasalready

•DrivenbylocalactivationeventssuchassponsorshipsofsportingeventsandTheLatinGRAMMY

•CanadaDryvolumeincreased6percentontopofdouble-digitgainsin2011.

•RetailsalesonprioritybrandsinCanadawereup1percent,outpacingtheliquidrefreshmentbeverages

(LRB)categoryby0.2percentagepoints.

•OurLatinAmericaBeveragessegmentgrewvolume2percent,drivenbyincreasesinPeñafiel,Crush,Clamato

andSquirt.InMexico,wegrewdollarshareoftotalLRBby0.2points.

•Weincreasedtrialandsamplingopportunitiesatthefountain,addingmorethan45,000valvesandgrowing

•Withafocusonqualityplacements

cold-drinkequipment.

•Weincreaseddisplaytie-inratesby

•Sincebeginningourrapidcontinuous

Growing Our Business

In 2012, we continued to execute disciplined pricing in the marketplace, invest behind our well-loved brands and drive

productivity improvements with RCI.

For the year, net sales increased 2 percent as price increases and favorable mix offset flat CSD volumes and

a 5 percent decline in non-carbonated beverages. Segment operating profit was up 2 percent, reflecting contributions

from net sales growth and ongoing productivity improvements partially offset by higher packaging and ingredient

costs, inflation in labor and benefits costs and increased marketing investments. We reported core earnings of $2.92

per diluted share, an increase of 2 percent compared to 2011.

Going forward, opportunities remain to build our business by increasing distribution and availability across

high-growth and high-margin packages, categories and channels. With a focus on excellence in execution,

we will optimize shelf and display space and expand our immediate consumption presence through fountain

and cold-drink placements.

Leading With Flavor

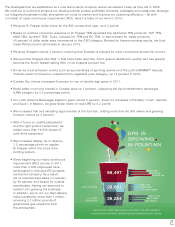

Having gained steadily on colas over the past two decades, flavored CSD sales now represent nearly 51 percent

of total retail sales of CSDs. This growth has largely been driven by demographics such as the growing Hispanic

population, who strongly prefer flavors to colas, and millennial consumers, who seek variety. As the flavor leader,

DPSisuniquelypositionedtocontinuetocapitalizeonthesetrends.Infact,we’readdingincrementalsalestothe

CSD category through flavorful innovations such as our new TEN products, which provide options for consumers

who want fewer calories but prefer the full flavor of a regular CSD. TEN represents a strategic platform for DPS,

and we believe it has tremendous potential not only for our business, but for the CSD category as a whole. Far from

beingalineextension,TENisacriticalpartofalong-termstrategydesignedtoincreaseconsumptionfrequencyand

capture lapsed users.

We’re creating value for retailers and consumers by providing more package sizes, such as SnapTea gallons under

the Snapple trademark and six-pack half-liter bottles for CSDs. We’re adding more product options, such as Hawaiian

Punch Aloha Morning, to provide convenience for moms and increase opportunities for consumers to enjoy our brands

more times throughout the day.

Building Our Brands

Ouriconicflavorsandtheirdevotedfollowersaredriving growth for our brands. Still, we have opportunities to

introduce more consumers to our flavor portfolio. To that end, we’re developing innovative media and marketing

programs that deliver fun as well as flavor. Promotions such as our Facebook® Credits Program, the teaming up of

Snapple with America’s Got Talent®, and our wildly popular Dr Pepper Tuition Giveaway have strengthened our

brand awareness with consumers while bringing new flavor fans into our fold.

Driving Executional Excellence

We’re putting the shopper in the center of our plans to inform our marketing programs. This approach, combined

with a commitment to excellence in retail execution, is delivering strong results for DPS in the dollar channel, where

flavorshavegrown21percentoverthelastthreeyears.InCalifornia,there’sanewsalesteamintown–ourLatino

Street Force – and they’re dedicated to connecting with Hispanic consumers at local retail and community events.

These efforts are helping to drive growth in key Hispanic accounts by gaining incremental display space for brands

such as Clamato.

Creating Shareholder Value

At DPS, we’re focused on driving profitable volume and sales growth to create strong shareholder value over time.

Through RCI, we are freeing up critical resources – people, time and money – that we can redirect toward building our

brands, growing our business and providing strong total shareholder returns in the years ahead. In 2012, we used RCI

to develop an inventory replenishment strategy. As a result, DPS is now world class among large consumer packaged

goods (CPG) companies in the food and beverage industry for maintaining the lowest days sales in inventory.

value,onethingremainsthesame:Whenitcomestoliquidrefreshment,tasteisking.In2013,ourunrivaledbrand

aroundgoaldeployment,ensuringalignmentacrossfunctionsandcultivatingaLeanmindsetinourseniorleadersand

ourleadersandtheirteamsthroughourMobilizingforACTIONinitiative.Thetalentandcommitmentofouremployees

3