Snapple 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strengthened by a business foundation built on rapid continuous improvement (RCI), we’re committed to driving

profitable volume and sales growth to create strong shareholder value over time.

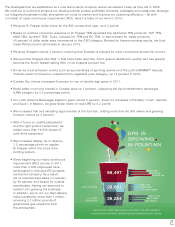

Returning Cash to Shareholders

Since 2010, we’ve been consistent in returning excess free cash to our shareholders and expect to continue to do so

over time. We’ve repurchased more than $2 billion of our stock and expect to buy back an additional $375 million to

$400 million in 2013, subject to market conditions. In 2013, we also announced the fifth increase to our dividend, and

our annual payout is now $1.52 per share.

Since we became a public company in 2008, our annualized total shareholder return has been 15 percent, outpacing

both the 1 percent return of the S&P 500 Index and the 6 percent return of our peer group index.

Rapid Continuous Improvement

In 2011, DPS launched RCI in an effort to improve across five key areas – safety, quality, delivery, productivity and

growth. RCI is a proven business model that will, over time, create a sustainable business mindset of continuous

improvement. By focusing on the fundamentals of Lean principles, we provide value to our customers and consumers

while eliminating unnecessary activities, thereby improving productivity.

During the last two years, we’ve made significant progress on the road toward embedding RCI at DPS. More than

3,000 employees have participated in 200-plus RCI events held across the business, leading to higher quality and

a safer, more productive workplace, while identifying $116 million in annualized cash productivity toward our three-

year goal of $150 million.

Creating Shareholder Value

STRONG CASH FLOW + PROFITABLE GROWTH

12