Snapple 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

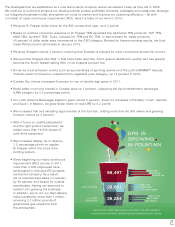

Growing in the Dollar Channel

The dollar channel is one of the fastest-growing

channels for LRBs, with flavored CSDs representing

the single largest opportunity for DPS in this area.

In 2012, we increased the availability of the Dr Pepper

product line across a key retail customer in the dollar

channel, driving a volume increase of nearly 16 percent

in this account. In addition, we gained distribution for

flavors such as 7UP, Canada Dry, Sunkist® soda and

Crush product lines in other dollar stores, adding more

than 1 million incremental cases. In 2013, we’ll focus

on driving distribution of additional flavors and package

sizes, securing warm shelf space and adding additional

single-serve coolers, which are growing in importance

to consumers who are making more frequent stops in

the dollar channel.

Hispanic Market Growth

We’re connecting with Hispanic consumers through sponsorships of local sporting events as well as national

holidays. In California, the 2012 Clamato sponsorship of the Chivas USA™ soccer team included meet-and-greets

with players, product sampling during games and impactful merchandising at key retailers. In Florida, Clamato

merchandising tie-ins to national holidays such as Father’s Day drove activation in key Hispanic accounts, with

prizes allocated to retail customers to promote sales in their stores. These efforts helped contribute to a 15 percent

volume increase for the Clamato product line in 2012.

OUR FLAVORED CSDs

ARE GROWING IN THE

DOLLAR CHANNEL

(Dollar Increase 2010-2012)

DPS brands are outperforming flavored CSD growth

in the dollar channel by nearly 3 percentage points.

‘10 ‘11 ‘12

+21%

11

TASTE AND NUTRITION ARE

IMPORTANT TO MOMS, WHICH

MAKES OUR MOT T'S SNACK

& GO APPLESAUCE POUCHES

THE PERFECT SOLUTION FOR

JUST-PICKED TASTE WITH

NO ADDED SUGAR.