Snapple 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At Dr Pepper Snapple Group, fun, flavor and

innovation combine to create our formula for growth.

Wayne R. Sanders

Chairman of the Board

Larry D. Young

President &

Chief Executive Officer

To Our Stockholders

STOCKHOLDER LETTER

At Dr Pepper Snapple Group, we are known for our flavors. The 50-plus brands in our unmatched portfolio set us

apart from our peers, providing the variety our customers and consumers want and the great taste and refreshment

they enjoy. It’s our winning flavors, along with fun and innovation, that combine to create our one-of-a-kind formula

for growth.

This formula proved successful in 2012 as we outperformed the carbonated soft drink (CSD) category, growing

dollar share for CSDs despite a backdrop of an uncertain economic environment and cautious consumer spending.

To ensure our brands were close at hand and top of mind for our consumers, we closed distribution gaps and

increased all-commodity volume (ACV), placing more of our products into stores and gaining incremental shelf space.

We grew ACV on our core brands and packages across CSDs, teas and juices in grocery, with CSDs up 0.5

percentage points, Mott’s up 1.8 percentage points and tea up 4.3 percentage points. And with carefully crafted

promotions designed to drive on-the-go shoppers into stores, we increased ACV in the convenience channel by

0.2 percentage points for CSDs and 6.7 points for Snapple 16-oz. glass.

We’re proud that 13 of our 14 leading brands hold the No. 1 or No. 2 position in their flavor category. Even so, many

of our brands have considerable runway for growth outside their heartland areas, so we’ve continued our efforts to

expand consumption of key brands with new and existing consumers in targeted markets. Per-capita consumption

of Snapple, long a stronghold on the coasts, grew in targeted markets by 0.7 servings per person. In our targeted

markets for Canada Dry, we grew volume share of ginger ale by 2.2 percentage points.

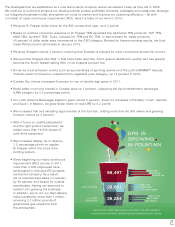

As we approach our fifth anniversary as a public company, our cash flow remains strong and consistent. We returned

approximately $684 million to shareholders in 2012, with $400 million in share repurchases and $284 million in

dividends. More recently, we announced a 12 percent increase to our dividend, our fifth increase since going public

and a further demonstration of our commitment to return excess free cash to our shareholders over time.

•WegrewDrPepperdollarshareforthefifthconsecutiveyear,up0.2points.

•BasedonpositiveconsumerresponsetoDrPepperTEN

40percentofdollarsaleswereincrementaltotheCSDcategory.Backedbythesepromisingresults,wetook

•WegrewSnapplevolume3percent,ensuringthatSnappleisenjoyedbymoreconsumersacrossthecountry.

•WelaunchedSnappleDietHalf‘nHalfLemonadeIcedTea,whichgaineddistributionquicklyandhasalready

•DrivenbylocalactivationeventssuchassponsorshipsofsportingeventsandTheLatinGRAMMY

•CanadaDryvolumeincreased6percentontopofdouble-digitgainsin2011.

•RetailsalesonprioritybrandsinCanadawereup1percent,outpacingtheliquidrefreshmentbeverages

(LRB)categoryby0.2percentagepoints.

•OurLatinAmericaBeveragessegmentgrewvolume2percent,drivenbyincreasesinPeñafiel,Crush,Clamato

andSquirt.InMexico,wegrewdollarshareoftotalLRBby0.2points.

•Weincreasedtrialandsamplingopportunitiesatthefountain,addingmorethan45,000valvesandgrowing

•Withafocusonqualityplacements

cold-drinkequipment.

•Weincreaseddisplaytie-inratesby

•Sincebeginningourrapidcontinuous

DPSisuniquelypositionedtocontinuetocapitalizeonthesetrends.Infact,we’readdingincrementalsalestothe

beingalineextension,TENisacriticalpartofalong-termstrategydesignedtoincreaseconsumptionfrequencyand

Ouriconicflavorsandtheirdevotedfollowersare

flavorshavegrown21percentoverthelastthreeyears.InCalifornia,there’sanewsalesteamintown–ourLatino

value,onethingremainsthesame:Whenitcomestoliquidrefreshment,tasteisking.In2013,ourunrivaledbrand

aroundgoaldeployment,ensuringalignmentacrossfunctionsandcultivatingaLeanmindsetinourseniorleadersand

ourleadersandtheirteamsthroughourMobilizingforACTIONinitiative.Thetalentandcommitmentofouremployees

1