Snapple 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

r

Letter to Stockholders

We generated $709 million of cash from operations.

Our strong, stable cash ow enabled us to pay down

$395 million of our oating rate term loan in 2008,

pu ing us signi cantly ahead of our repayment

schedule and giving us the exibility to invest in

growth opportunities.

Defi ning and Delivering Against Our

Strategic Priorities

As an independent company, we have established a

strategy that re ects and builds upon our position

as the leading avored beverage business in the U.S.

Accordingly, we set ve key priorities:

Building and enhancing our leading brands•

Pursuing pro table channels, packages and formats•

Leveraging our integrated business model •

Strengthening our route to market•

Improving operating e ciency•

is report highlights the progress we are making in

advancing those strategies.

Building and Enhancing Our Leading Brands

Dr Pepper Snapple has an outstanding portfolio of

well-loved, consumer-preferred brands. In 2008, we

refocused our e orts on the strengths of our top-tier

brands based on consumer insights that informed

successful marketing and product innovation. Once

again, we outperformed the industry in dollar share

growth in CSDs. Dr Pepper volume held steady and

Diet Dr Pepper grew more than 2 percent while

Canada Dry volume increased approximately 3 percent

on the strength of the successful launch of Canada Dry

Green Tea Ginger Ale. Conversely, 7UP declined

7 percent compared with strong results in 2007, which

bene ted from the completed rollout of 7UP with

100% Natural Flavors and the launch of a reformulated

Diet 7UP.

Our juice and juice drink portfolio grew on the

strength of Hawaiian Punch, Mo ’s and Clamato.

However, we were disappointed in the performance

of Snapple as we lapped heavy promotional activity

from the prior year and economic pressures steered

consumers away from premium beverages toward

value-priced o erings. With a complete relaunch of

Snapple premium teas and juices planned in 2009,

as well as the continued rollout of value teas, we are

optimistic about the long-term potential of this

great brand.

We are seeing greater e ciency and e ectiveness

from our product innovation and commercialization

activities a er relocating our R&D Center to our

Plano headquarters. is best-in-class center has

brought R&D functions under the same roof as

our sales and marketing teams. is means greater

alignment, faster decision-making and more nimble

response to emerging consumer trends.

Driving consumer preference for our core brands and

their supporting innovation will be key to our success

in 2009. In addition to major advertising e orts for

Dr Pepper and Diet Dr Pepper, we’re fueling up for

a signi cant push behind all of our biggest brands,

3

Once again, we

outperformed the

industry in dollar

share growth

in CSDs.

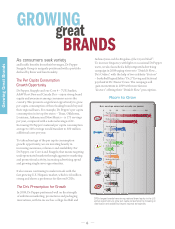

DPS has the leading fl avored CSD portfolio in the U.S. with

six of the top 10 non-cola beverages.