Snapple 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As consumers seek variety

and health bene ts from their beverages, Dr Pepper

Snapple Group is uniquely positioned with a portfolio

de ned by avor and functionality.

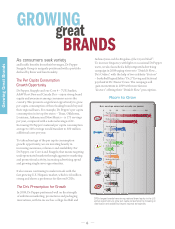

The Per Capita Consumption

Growth Opportunity

Dr Pepper, Snapple and our Core 4 – 7UP, Sunkist,

A&W Root Beer and Canada Dry – enjoy strong brand

equity and awareness among consumers across the

country. is presents a signi cant opportunity to grow

per capita consumption of these leading brands beyond

their regional bases. For example, Dr Pepper’s per capita

consumption in its top ve states – Texas, Oklahoma,

Louisiana, Arkansas and New Mexico – is 173 servings

per year, compared with a national average of 62.

Increasing Dr Pepper’s national per capita consumption

average to 100 servings would translate to 300 million

additional cases per year.

To take advantage of the per capita consumption

growth opportunity, we are investing heavily in

increasing awareness, relevance and availability. For

Dr Pepper, our Core 4 and Snapple, that means targeting

underpenetrated markets through aggressive marketing

and promotional activity, increasing advertising spend

and growing single serve opportunities.

It also means continuing to make inroads with the

fast-growing U.S. Hispanic market, which is 45 million

strong and shows a preference for avored CSDs.

The Dr’s Prescription for Growth

In 2008, Dr Pepper performed well on the strength

of ambitious marketing, promotions and packaging

innovations, with tie-ins such as college football and

Indiana Jones and the Kingdom of the Crystal Skull™.

To increase frequency with light or occasional Dr Pepper

users, we also launched a fully integrated advertising

campaign in 2008 urging viewers to “Drink It Slow…

Dr’s Orders,” with the help of two celebrity “doctors”

– basketball legend Julius “Dr. J” Erving and ctional

psychiatrist Dr. Frasier Crane. e campaign will

gain momentum in 2009 with more famous

“doctors” o ering their “Drink It Slow” prescription.

GROWING

great

BRANDS

6

Growing Great Brands

DPS’s largest brands have strong national brand equity in the U.S.

and an opportunity to grow per capita consumption by focusing on

distribution and availability beyond regional strongholds.