Snapple 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150

|

|

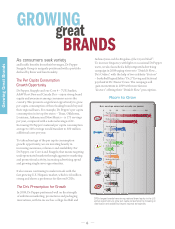

Growing Great Brands

8

And in 2009, a comprehensive restage of Snapple’s premium teas and juices

will make the “Best Stu on Earth” even be er, with an all-natural positioning

emphasizing a blend of healthy green tea, tasty black tea and sugar. e restage

will be supported by Snapple’s largest, most aggressive advertising campaign

this decade.

Leading the Juice Category with Functionality and Value

In 2008, we became the leading player on the juice aisle with an approximately

10 percent share of the market in measured channels, driven primarily by

Hawaiian Punch, Mo ’s and Clamato. ese beverages represent a promising

growth platform as consumers become more health-focused and avor and

ingredient technology enables greater innovation.

Following up on the successful 2006 launch of Mo ’s for Tots, we rolled out

new multi-serve packaging, providing even more options for moms. is

rst-of-its-kind o ering gives younger consumers a diluted, lower-sugar juice

without sacri cing the nutrient content of a full- avored product.

We will restage Mo ’s base juice product in 2009 with a “back to the core”

theme and more vitamin C per serving and continue to drive trial in Mo ’s

for Tots with national account sampling programs.

Driven by a strong portfolio of fl avors, Dr Pepper Snapple’s U.S. dollar share of the CSD market

has grown a percentage point to 19.7 percent since 2005, while colas have lost three share

points over the same period.