Snapple 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Snapple annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

Table of contents

-

Page 1

-

Page 2

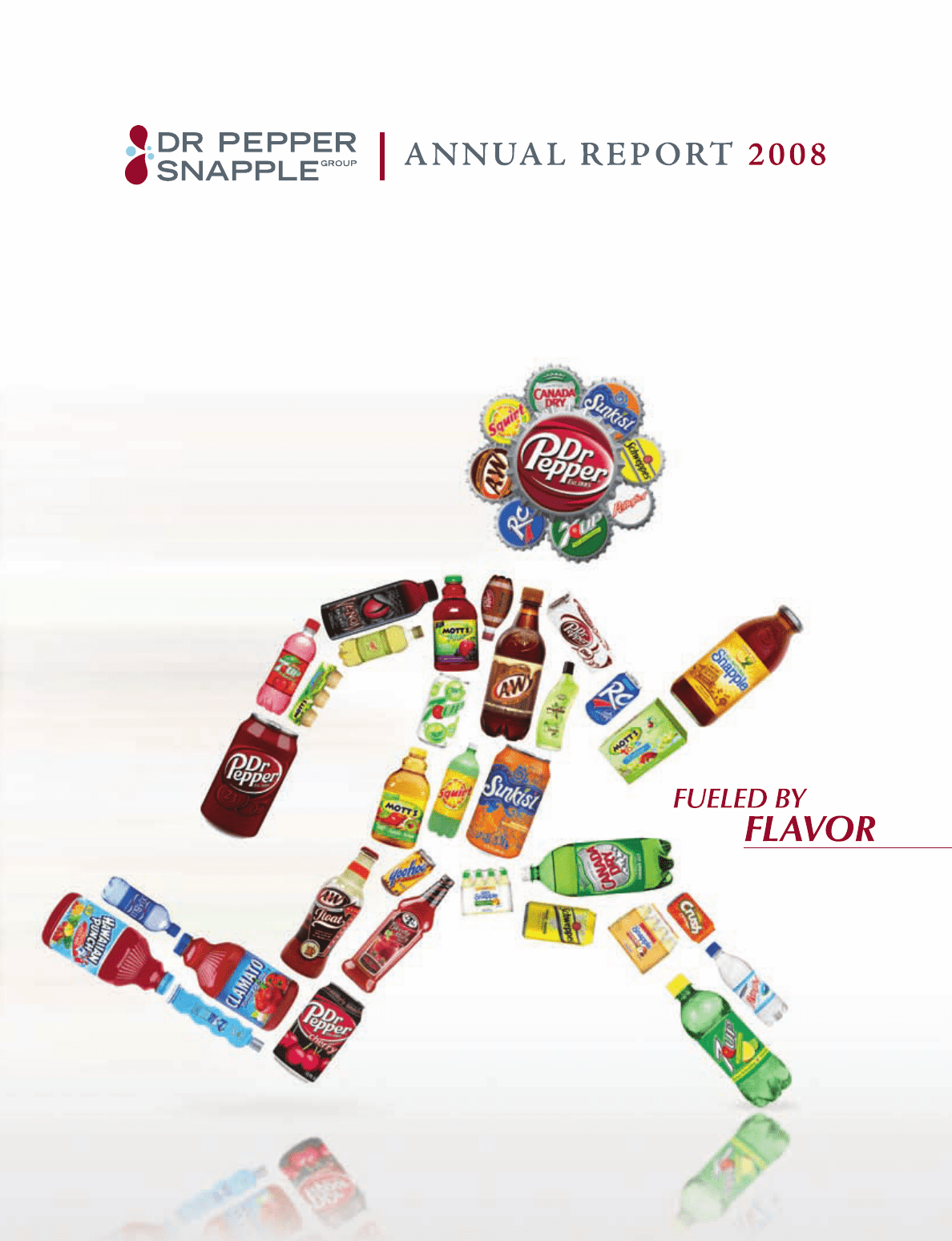

...Our brands have been synonymous with refreshment, revitalization, fun and flavor for generations. In 2008, those 50-plus brands became Dr Pepper Snapple Group, the oldest new company traded on the New York Stock Exchange. We may be a new player in the equity markets, but the equity of our brands is...

-

Page 3

...

Dr Pepper Snapple Group is an integrated refreshment beverage business serving consumers across the U.S., Canada, Mexico and the Caribbean. Our business is led by an experienced management team that is focused on building capabilities to support growth and create shareholder value. With 200 years...

-

Page 4

...Cadbury Schweppes acquires Duffy-Mott Co., Canada Dry and the Sunkist soda license

Cadbury Schweppes acquires Dr Pepper/Seven Up Companies, Inc. Snapple Beverage Corp. acquired

Dr Pepper/Seven Up, Inc., Mott's LLP, Snapple Beverage Corp. and Bebidas Mexico form Cadbury Schweppes Americas Beverages...

-

Page 5

At Dr Pepper Snapple Group,

everything we do is fueled by flavor. It's what sets us apart, energizes our business and drives our success. Our portfolio reads like a who's who of flavor, with such iconic brands as Dr Pepper, Snapple, 7UP, Mott's, A&W, Sunkist soda and Canada Dry. Flavor not only ...

-

Page 6

..., Dr Pepper Snapple Group began a new life as an independent beverage company in 2008. Our spinoff from Cadbury and May 7 listing on the New York Stock Exchange was the culmination of a series of moves to create a company with the leading portfolio of flavors and a broad and flexible route to market...

-

Page 7

... our top-tier brands based on consumer insights that informed successful marketing and product innovation. Once again, we outperformed the industry in dollar share growth in CSDs. Dr Pepper volume held steady and Diet Dr Pepper grew more than 2 percent while Canada Dry volume increased approximately...

-

Page 8

... several bottling businesses over the last few years has helped us secure our route to market, protect our brands and better serve our customers. In the past year, we made further strides through a realignment of our sales functions. Dr Pepper Snapple is focused on crushing costs. With our company...

-

Page 9

... to corporate social responsibility that also addresses consumer health and well-being, the workplace and our communities. In 2009, we will establish related goals for our stand-alone business, with an eye toward reporting on our progress in 2010. We truly believe that Dr Pepper Snapple Group stands...

-

Page 10

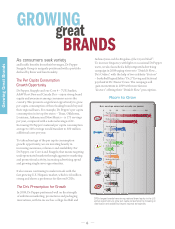

...and health benefits from their beverages, Dr Pepper Snapple Group is uniquely positioned with a portfolio defined by flavor and functionality.

The Per Capita Consumption Growth Opportunity

Dr Pepper, Snapple and our Core 4 - 7UP, Sunkist, A&W Root Beer and Canada Dry - enjoy strong brand equity and...

-

Page 11

... of a Diet Canada Dry Green Tea Ginger Ale and a restaged Cherry 7UP Antioxidant. A&W will be made with aged vanilla, and Sunkist will complete the introduction of updated graphics that communicate the brand's vibrant citrus tastes.

Strengthening Our Core Flavors through Marketing and Innovation...

-

Page 12

..."Best Stuff on Earth" even better, with an all-natural positioning emphasizing a blend of healthy green tea, tasty black tea and sugar. e restage will be supported by Snapple's largest, most aggressive advertising campaign this decade.

Leading the Juice Category with Functionality and Value

In 2008...

-

Page 13

...Red soda and All Sport isotonic beverages. Hydrive is a new low-calorie, non-carbonated energy drink, and Big Red and All Sport have been distributed in our system for years. We expect these brands to benefit from better alignment on innovation, marketing and sales strategies.

Energizing Our Flavor...

-

Page 14

...pieces of our company-owned route to market, we have brought our expanded production and distribution capabilities into full alignment, creating a world-class supply chain that is helping us execute our plans better than ever. We also have broken ground on a new 850,000 square-foot manufacturing and...

-

Page 15

... like Dr Pepper, involvement and visibility in retail displays and close alignment on promotions. Likewise, our bottlers see the opportunity for our flavor brands to fuel their continued growth and success. In 2008, we reached agreements with a number of bottlers, including Pepsi Bottling Group and...

-

Page 16

... Winning in Single Serve takes off with plans to place 35,000 new coolers and vending machines More celebrity "doctors" urging Dr Pepper fans to "Drink It Slow" Snapple, Mott's, 7UP, A&W and Canada Dry all back on the airwaves in new advertising campaigns

Company Highlights

Grocer's Best in

Class...

-

Page 17

DR PEPPER SNAPPLE GROUP, INC. RECONCILIATION OF GAAP AND NON-GAAP INFORMATION For the Years Ended December 31, 2008 and 2007 (Dollars in millions, except per share data) We report our financial results in accordance with U.S. GAAP. However, management believes that certain non-GAAP measures that ...

-

Page 18

(Intentionally Left Blank)

14

-

Page 19

...of June 30, 2008, the last business day of the registrant's most recently completed second fiscal quarter, was $5,322,326,678 (based on closing sale price of registrant's Common Stock on that date as reported on the New York Stock Exchange). As of March 20, 2009, there were 253,827,507 shares of the...

-

Page 20

(Intentionally Left Blank)

-

Page 21

DR PEPPER SNAPPLE GROUP, INC. FORM 10-K For the Year Ended December 31, 2008

Page

Item Item Item Item Item Item

1. 1A. 1B. 2. 3. 4.

PART I. Business ...Risk Factors ...Unresolved Staff Comments ...Properties ...Legal Proceedings ...Submission of Matters to a Vote of Security Holders ...

1 12 18 ...

-

Page 22

(Intentionally Left Blank)

ii

-

Page 23

... global financial events; • litigation claims or legal proceedings against us; • increases in the cost of employee benefits; • increases in cost of materials or supplies used in our business; • shortages of materials used in our business; • substantial disruption at our manufacturing or...

-

Page 24

... to retain or recruit qualified personnel; • disruptions to our information systems and third-party service providers; • weather and climate changes; and • other factors discussed in Item 1A under "Risks Related to Our Business Factors" and elsewhere in this Annual Report on Form 10-K.

iv

-

Page 25

... 1. BUSINESS

Our Company Dr Pepper Snapple Group, Inc. is a leading integrated brand owner, bottler and distributor of non-alcoholic beverages in the United States, Canada and Mexico with a diverse portfolio of flavored (non-cola) carbonated soft drinks ("CSD") and non-carbonated beverages ("NCB...

-

Page 26

...waters Founded in Brooklyn, New York in 1972

• #2 lemon-lime CSD in the United States • Flavors include regular, diet and cherry antioxidant • The original "Un-Cola," created in 1929

#1 apple juice and #1 apple sauce brand in the United States Juice products include apple and other fruit...

-

Page 27

.... Our key brands are Dr Pepper, 7UP, Sunkist, A&W and Canada Dry, and we also sell regional and smaller niche brands. In the CSD market segment we are primarily a manufacturer of beverage concentrates and fountain syrups. Beverage concentrates are highly concentrated proprietary flavors used to make...

-

Page 28

...major beverage concentrate manufacturer with year-over-year market share growth in the CSD market segment in each of the last five years. Our largest brand, Dr Pepper, is the #2 flavored CSD in the United States, according to The Nielsen Company, and our Snapple brand is a leading ready-to-drink tea...

-

Page 29

... increase demand for high margin products like single-serve packages for many of our key brands through increased promotional activity. Leverage our integrated business model. We believe our integrated brand ownership, bottling and distribution business model provides us opportunities for net sales...

-

Page 30

...glass bottles and aluminum cans, and sell it as a finished beverage to retailers. Concentrate prices historically have been reviewed and adjusted at least on an annual basis. Syrup is shipped to fountain customers, such as fast food restaurants, who mix the syrup with water and carbonation to create...

-

Page 31

...of branded products come from our own brands, such as Dr Pepper, 7UP, Snapple, Sunkist, A&W and Canada Dry, with the remaining from the distribution of third party brands such as FIJI mineral water and Arizona tea. In addition, a small portion of our Bottling Group sales come from bottling beverages...

-

Page 32

...and bottled water segments in the overall liquid refreshment beverage market and as a result, although we have increased our market share in the overall United States CSD market, we have lost share in the overall United States liquid refreshment beverage market over the past several years. In Canada...

-

Page 33

... solutions to address the opportunities. Solutions include new and reformulated products, improved packaging design, pricing and enhanced availability. We use advertising, media, merchandising, public relations and promotion to provide maximum impact for our brands and messages. Manufacturing As of...

-

Page 34

... businesses. Under many of our supply arrangements for these raw materials, the price we pay fluctuates along with certain changes in underlying commodities costs, such as aluminum in the case of cans, natural gas in the case of glass bottles, resin in the case of PET bottles and caps, corn...

-

Page 35

... as market share, retail pricing, promotional activity and distribution across various channels, retailers and geographies. Measured categories provided to us by The Nielsen Company Scantrack include flavored (non-cola) carbonated soft drinks ("CSDs"), energy drinks, single-serve bottled water, non...

-

Page 36

... Digest Fact Book. We use Beverage Digest primarily to track market share information and broad beverage and channel trends. This annual publication provides a compilation of data supplied by beverage companies. Beverage Digest covers the following categories: CSDs, energy drinks, bottled water and...

-

Page 37

... our business and financial performance. We depend on a small number of large retailers for a significant portion of our sales. Food and beverage retailers in the United States have been consolidating, resulting in large, sophisticated retailers with increased buying power. They are in a better...

-

Page 38

... reduction in stock market valuations. These events could have a number of different effects on our business, including: • a reduction in consumer spending, which could result in a reduction in our sales volume; • a negative impact on the ability of our customers to timely pay their obligations...

-

Page 39

... materials we use in our business are aluminum cans and ends, glass bottles, PET bottles and caps, paperboard packaging, sweeteners, juice, fruit, water and other ingredients. Additionally, conversion of raw materials into our products for sale also uses electricity and natural gas. The cost of the...

-

Page 40

... our business and financial performance. For example, in letters dated October 10, 2008, and December 11, 2008, we received formal notification from Hansen Natural Corporation, terminating our agreements to distribute Monster Energy as well as other Hansen's beverage brands in certain markets in...

-

Page 41

...or capital expenditures. For example, changes in recycling and bottle deposit laws or special taxes on soft drinks or ingredients could increase our costs. Regulatory focus on the health, safety and marketing of food products is increasing. Certain state warning and labeling laws, such as California...

-

Page 42

... in California and parts of the desert Southwest. When open in 2010, the facility will produce a wide range of soft drinks, juices, juice drinks, bottled water, ready-to-drink teas, energy drinks and other premium beverages at the Victorville plant. The plant will consist of an 850,000-square-foot...

-

Page 43

...is listed and traded on the New York Stock Exchange under the symbol "DPS". The following table sets forth, for the quarterly periods indicated, the high and low sales prices per share for our common stock, as reported on the New York Stock Exchange composite tape, and dividend per share information...

-

Page 44

... & Poor's 500 and a peer group index. The graph assumes that $100 was invested on May 7, 2008, the day we became a publicly traded company on the New York Stock Exchange, with dividends reinvested. Comparison of Total Returns Assumes Initial Investment of $100 December 2008

$120

$100

$80

$60...

-

Page 45

... was traded prior to May 7, 2008 and no DPS equity awards were outstanding for the prior periods. Subsequent to May 7, 2008, the number of basic shares includes approximately 500,000 shares related to former Cadbury Schweppes benefit plans converted to DPS shares on a daily volume weighted average...

-

Page 46

... and distributor of non-alcoholic beverages in the United States, Canada and Mexico with a diverse portfolio of flavored CSDs and NCBs, including ready-to-drink teas, juices, juice drinks and mixers. Our brand portfolio includes popular CSD brands such as Dr Pepper, 7UP, Sunkist, A&W, Canada Dry...

-

Page 47

... our 2008 Bottling Group net sales of branded products come from our own brands, with the remaining from the distribution of third party brands such as Monster energy drink, FIJI mineral water and Arizona tea. In addition, a small portion of our Bottling Group sales come from bottling beverages and...

-

Page 48

... segments, such as the Hispanic community in the United States, will drive further market growth. • Product and packaging innovation. We believe brand owners and bottling companies will continue to create new products and packages such as beverages with new ingredients and new premium flavors...

-

Page 49

... case sales and concentrates and finished beverage sales volumes are not equal during any given period due to changes in bottler concentrates inventory levels, which can be affected by seasonality, bottler inventory and manufacturing practices, and the timing of price increases and new product...

-

Page 50

... publicly-traded company listed on the New York Stock Exchange under the symbol "DPS". We entered into a Separation and Distribution Agreement, Transition Services Agreement, Tax Sharing and Indemnification Agreement ("Tax Indemnity Agreement") and Employee Matters Agreement with Cadbury, each dated...

-

Page 51

... 7UP, Sunkist, A&W and Canada Dry, declined 2%, primarily related to a 7% decline in 7UP as the brand cycled the final stages of launch support for 7UP with 100% Natural Flavors and the re-launch of Diet 7UP, partially offset by a 3% increase in Canada Dry due to the launch of Canada Dry Green Tea...

-

Page 52

... 2007 intended to create a more efficient organization that resulted in the reduction of employees in the Company's corporate, sales and supply chain functions and the continued integration of our Bottling Group into existing businesses. Restructuring costs for 2007 were higher due to higher costs...

-

Page 53

... sales as reported ...$5,710

(1) Intersegment sales are eliminated in the Consolidated Statement of Operations. Total segment net sales include Beverage Concentrates and Finished Goods sales to the Bottling Group segment and Bottling Group segment sales to Beverage Concentrates and Finished Goods...

-

Page 54

...Soda Fountain Classics" line. The "Core 4" brands, which include 7UP, Sunkist, A&W and Canada Dry, decreased 2%, driven primarily by 7UP as the brand cycled the final stages of launch support for 7UP with 100% Natural Flavors and the re-launch of Diet 7UP, partially offset by a 3% increase in Canada...

-

Page 55

... sales volumes decreased by 10% as we chose not to repeat aggressive promotional activity used in 2007 and from the impact of a weakened retail environment on our premium products. The increase in prices was primarily driven by our Mott's brand. UOP increased $24 million for 2008 compared with 2007...

-

Page 56

... quarter of 2008. An increase in distribution costs and wages resulted from additional distribution routes added during the year. In a letter dated December 11, 2008, we received formal notification from Hansen Natural Corporation terminating our agreements to distribute Monster Energy in Mexico...

-

Page 57

... of these unrecognized tax benefits that are subsequently realized. Refer to Note 13 of the Notes to our Audited Consolidated Financial Statements for further information regarding the tax impact of the separation. Items Impacting Equity In connection with our separation from Cadbury, the following...

-

Page 58

.... In CSDs, Dr Pepper declined 2%, driven by declines in the "Soda Fountain Classics" line extensions which were introduced nationally in 2005. Our "Core 4" brands, which include 7UP, Sunkist, A&W and Canada Dry, increased 1%, consistent with the consumer shift from colas to flavored CSDs. Sales of...

-

Page 59

... October 2007 intended to create a more efficient organization that resulted in the reduction of employees in the Company's corporate, sales and supply chain functions and the continued integration of our Bottling Group into existing businesses. The restructuring costs in 2006 were primarily related...

-

Page 60

... in our audited consolidated statements of operations. Total segment net sales include Beverage Concentrates and Finished Goods sales to the Bottling Group segment and Bottling Group sales to the Beverage Concentrates and Finished Goods segments as detailed below. The increase in these eliminations...

-

Page 61

...net sales and lower marketing expenses, particularly advertising costs, partially offset by increased sweetener and flavor costs and increased selling, general and administrative expenses. The lower marketing expenses were primarily a result of a reduction in costs to support new product initiatives...

-

Page 62

... strong volumes in 2006 driven by the third quarter launch of 7UP "with natural flavors" and heavy promotional support for 7UP and other brands. The Diet Rite decline was due to the shift of marketing investment from Diet Rite to other diet brands, such as Diet Sunkist, Diet A&W and Diet Canada Dry...

-

Page 63

... by an increase in post-acquisition employee benefit costs, wage inflation costs, higher sweetener costs, the elimination of co-packing fees in 2007 which were previously earned on manufacturing for the Finished Goods segment, and an increase in investments in new markets. Mexico and the Caribbean...

-

Page 64

...for the year ended December 31, 2008. We are required to pay annual amortization in equal quarterly installments on the aggregate principal amount of the term loan A equal to: (i) 10% , or $220 million, per year for installments due in the first and second years following the initial date of funding...

-

Page 65

...'s net investment in us, purchase certain assets from Cadbury related to our business and pay fees and expenses related to our credit facilities. Debt Ratings As of December 31, 2008, our debt ratings were Baa3 with a stable outlook from Moody's Investor Service and BBB- with a negative outlook from...

-

Page 66

... from Cadbury. For the 2007, cash used in net issuances of related party notes receivable totaled $929 million compared with cash provided by net repayments of related party notes receivable of $1,375 million for 2008. We increased capital expenditures by $74 million in the current year, primarily...

-

Page 67

...Cadbury and payments of third party long-term debt. This increase was partially offset by the issuances of third party long-term debt. The following table summarizes the issuances and payments of third party and related party debt for 2008 and 2007 (in millions):

For the Year Ended December 31, 2008...

-

Page 68

... our consolidated financial statements in conformity with U.S. GAAP requires the use of estimates and judgments that affect the reported amounts of assets, liabilities, revenue, and expenses. Critical accounting estimates are both fundamental to the portrayal of a company's financial condition and...

-

Page 69

... year of trade spend costs from our Bottling Group while 2006 includes the effect of our Bottling Group's trade spend only from the date of the acquisition of the remaining 55% of DPSUBG. The amounts of trade spend are larger in our Bottling Group than those related to other parts of our business...

-

Page 70

... the rights to manufacture, distribute and sell products of the licensor within specified territories. For our annual impairment analysis performed as of December 31, 2008, methodologies used to determine the fair values of the assets included a combination of the income based approach and market...

-

Page 71

...of the Bottling Group goodwill, Snapple brand and the Bottling Group's distribution rights recorded in the fourth quarter. Indicative of the economic and market conditions, our average stock price declined 19% in the fourth quarter as compared to the average stock price from May 7, 2008, the date of...

-

Page 72

... and expenses included in our Consolidated Financial Statements are determined from actuarial analyses based on plan assumptions, employee demographic data, years of service, compensation, benefits and claims paid and employer contributions. The expense related to the postretirement plans has been...

-

Page 73

...net changes represent the deferred tax expense or benefit for the year. The total of taxes currently payable per the tax return and the deferred tax expense or benefit represents the income tax expense or benefit for the year for financial reporting purposes. We periodically assess the likelihood of...

-

Page 74

... our ability to recover increased costs through higher pricing may be limited by the competitive environment in which we operate. Our principal commodities risks relate to our purchases of aluminum, corn (for high fructose corn syrup), natural gas (for use in processing and packaging), PET and fuel...

-

Page 75

... DATA

Page

Audited Financial Statements: Report of Independent Registered Public Accounting Firm ...Consolidated Statements of Operations for the years ended December 31, 2008, 2007 and 2006 ...Consolidated Balance Sheets as of December 31, 2008 and 2007 ...Consolidated Statements of Cash Flows...

-

Page 76

...balance sheets of Dr Pepper Snapple Group, Inc. and subsidiaries (the "Company") as of December 31, 2008 and 2007, and the related consolidated statements of operations, stockholders' equity, and cash flows for each of the three years in the period ended December 31, 2008. These financial statements...

-

Page 77

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED STATEMENTS OF OPERATIONS For the Years Ended December 31, 2008, 2007 and 2006

For the Year Ended December 31, 2008 2007 2006 (In millions, except per share data)

Net sales ...$5,710 Cost of sales ...2,590 Gross profit ...Selling, general and administrative...

-

Page 78

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED BALANCE SHEETS As of December 31, 2008 and 2007

December 31, December 31, 2008 2007 (In millions except share and per share data)

ASSETS Current assets: Cash and cash equivalents ...Accounts receivable: Trade (net of allowances of $13 and $20, respectively...

-

Page 79

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS For the Years Ended December 31, 2008, 2007 and 2006

For the Year Ended December 31, 2008 2007 2006 (In millions) Operating activities: Net (loss) income ...Adjustments to reconcile net income to net cash provided by operations: ...

-

Page 80

DR PEPPER SNAPPLE GROUP, INC. CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY For the Years Ended December 31, 2008, 2007 and 2006

Accumulated Common Stock Additional Other Issued Paid-In Accumulated Cadbury's Net Comprehensive Comprehensive Capital Deficit Investment Shares Amount Income...

-

Page 81

... 2008, DPS became an independent publicly-traded company listed on the New York Stock Exchange under the symbol "DPS". Dr Pepper Snapple Group, Inc. was formed on October 24, 2007, and did not have any operations prior to ownership of Cadbury's beverage business in the United States, Canada, Mexico...

-

Page 82

...other related parties within the Cadbury group, including allocated expenses, were also included in Cadbury's net investment. Restatement of Net Sales and Cost of Sales related to Intercompany Eliminations Subsequent to the issuance of the Company's 2007 Combined Annual Financial Statements included...

-

Page 83

... Accounts Trade accounts receivable are recorded at the invoiced amount and do not bear interest. The Company determines the required allowance for doubtful collections using information such as its customer credit history and financial condition, industry and market segment information, economic...

-

Page 84

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) For financial reporting purposes, depreciation is computed on the straight-line method over the estimated useful asset lives as follows:

Asset Useful Life

Buildings and improvements ...Machinery and ...

-

Page 85

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Other Assets The Company provides support to certain customers to cover various programs and initiatives to increase net sales, including contributions to customers or vendors for cold drink equipment used to market and sell the Company's products...

-

Page 86

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) SFAS No. 158. In accordance with SFAS 106, the Company accrues the cost of these benefits during the years that employees render service. Refer to Note 15 for additional information. Risk Management ...

-

Page 87

... million in 2008, 2007 and 2006, respectively. Trade spend for 2008 and 2007 reflect a full year of trade spend costs from the Company's Bottling Group while 2006 includes the effect of the Bottling Group's trade spend only from the date of the acquisition of the remaining 55% of Dr Pepper/Seven Up...

-

Page 88

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The stock-based compensation plans in which the Company's employees participate are described further in Note 16. Restructuring Costs The Company periodically records facility closing and reorganization ...

-

Page 89

... period of expected cash flows used to measure the fair value of the asset under SFAS No. 141 (revised 2007), Business Combinations ("SFAS 141(R)") and other GAAP. FSP 142-3 is effective for financial statements issued for fiscal years beginning after December 15, 2008. The measurement provisions of...

-

Page 90

...is provided below (in millions):

For the Year Ended December 31, 2008 Impairment Income Tax Impact on Net Charge Benefit Income

Snapple brand(1) ...Distribution rights(2) ...Bottling Group goodwill ...Total ...(1) The Snapple brand related to the Finished Goods segment.

$ 278 581 180 $1,039

$(112...

-

Page 91

...Bottling Group goodwill, Snapple brand and the Bottling Group's distribution rights recorded in the fourth quarter. Indicative of the economic and market conditions, the Company's average stock price declined 19% in the fourth quarter as compared to the average stock price from May 7, 2008, the date...

-

Page 92

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Settlement of Related Party Balances Upon the Company's separation from Cadbury, the Company settled debt and other balances with Cadbury, eliminated Cadbury's net investment in the Company and purchased ...

-

Page 93

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) unrecognized tax benefits that are subsequently realized. See Note 13 for further information regarding the tax impact of the separation. Items Impacting Equity In connection with the Company's separation ...

-

Page 94

...the equity method of accounting. The carrying value of the investment was $12 million and $13 million as of December 31, 2008 and 2007, respectively. The Company's proportionate share of the net income resulting from its investment in the joint venture is reported under line item captioned equity in...

-

Page 95

..., 2007. The Company completed its fair value assessment of the assets acquired and liabilities assumed of this acquisition during the first quarter 2008, resulting in a $1 million increase in the Bottling Group's goodwill. During the second quarter of 2008, the Company made a tax election related to...

-

Page 96

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The net carrying amounts of intangible assets other than goodwill as of December 31, 2008, and December 31, 2007, are as follows (in millions):

Gross Amount December 31, 2008 Accumulated Net Amortization ...

-

Page 97

...of December 31, 2008, and December 31, 2007 (in millions):

December 31, 2008 December 31, 2007

Trade accounts payable ...Customer rebates ...Accrued compensation ...Insurance reserves ...Third party interest accrual and interest rate swap liability...Other current liabilities...Accounts payable and...

-

Page 98

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) specific terms and provisions of the senior unsecured credit agreement and the indenture governing the senior unsecured notes, respectively, copies of which are included as exhibits to this Annual Report ...

-

Page 99

... and escrow accounts. The Company used the funds to settle with Cadbury related party debt and other balances, eliminate Cadbury's net investment in the Company, purchase certain assets from Cadbury related to DPS' business and pay fees and expenses related to the Company's credit facilities. Bridge...

-

Page 100

...from Cadbury, the Company had a variety of debt agreements with other wholly-owned subsidiaries of Cadbury that were unrelated to DPS' business. As of December 31, 2007, outstanding debt totaled $3,019 million with $126 million recorded in current portion of long-term debt payable to related parties...

-

Page 101

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) 13. Income Taxes (Loss) income before provision for income taxes and equity in earnings of unconsolidated subsidiaries was as follows (in millions):

For the Year Ended December 31, 2008 2007 2006

U.S...$(...

-

Page 102

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following is a reconciliation of income taxes computed at the U.S. federal statutory tax rate to the income taxes reported in the consolidated statement of operations (in millions):

For the Year Ended ...

-

Page 103

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) of goodwill and intangible assets resulted in a reduction of $343 million to the Company's net deferred tax liability. Furthermore, in association with the Company's separation from Cadbury, the carrying ...

-

Page 104

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following is reconciliation of the changes in the gross balance of unrecognized tax benefits amounts during 2008 (in millions): Balance as of January 1, 2007 ...Tax position taken in current period: ...

-

Page 105

... by operating segment (in millions). The Company does not expect to incur significant additional charges related to the organizational restructuring.

Costs for the Year Ended December 31, 2008 2007

Cumulative Costs to Date

Beverage Concentrates ...Finished Goods ...Bottling Group ...Mexico and the...

-

Page 106

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) charges for the years ended December 31, 2008, 2007 and 2006 and the cumulative costs to date by operating segment (in millions). The Company does not expect to incur significant additional charges related...

-

Page 107

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Prior to the separation from Cadbury, certain employees of the Company participated in five defined benefit plans and one postretirement health care plan sponsored by Cadbury. Effective January 1, 2008, ...

-

Page 108

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following tables set forth amounts recognized in the Company's financial statements and the plans' funded status for the years ended December 31, 2008 and 2007 (in millions):

Pension Plans 2008 2007 ...

-

Page 109

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) (2) In accordance with SFAS 158, the Company elected the transition method under which DPS re-measured the plan obligations and plan assets as of January 1, 2008, the first day of the 2008 fiscal year, for...

-

Page 110

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes amounts included in AOCI for the plans as of December 31, 2008 and 2007 (in millions):

Pension Plans 2008 2007 Postretirement Benefit Plans 2008 2007

Prior service cost (...

-

Page 111

...PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes the weighted-average assumptions used to determine benefit obligations at the plan measurement dates for foreign plans:

Pension Plans 2008 2007 Postretirement Benefit Plans 2008...

-

Page 112

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The expected long-term rate of return on U.S. pension fund assets held by the Company's pension trusts was determined based on several factors, including input from pension investment consultants and ...

-

Page 113

... in the Consolidated Statements of Operations related to the fair value of employee share-based awards and recognition of compensation cost over the service period, net of estimated forfeitures. The components of stock-based compensation expense for the years ended December 31, 2008, 2007 and 2006...

-

Page 114

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) A summary of DPS' stock option activity for the year ended December 31, 2008, is as follows:

Stock Options Weighted Average Exercise Price

Number outstanding at January 1, 2008 ...Granted ...Exercised ......

-

Page 115

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The following table summarizes information about restricted stock units outstanding as of December 31, 2008 (in millions except per share and share data):

Number Outstanding Weighted Average Remaining ...

-

Page 116

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Company's consolidated financial statements will not be impacted by the Cadbury sponsored plans in future periods. The Company recognized the cost of all unvested employee stock-based compensation plans ...

-

Page 117

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Awards Made Prior to 2004 Awards Made for 2004 Forward

Face value of conditional share award made Performance conditions

50% to 80% of base salary

Award is based on Total Stockholder Return ("TSR") ...

-

Page 118

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Awards Made Prior to 2004 Awards Made for 2004 Forward

Comparator Group

A weighting of 75% is applied to the UKT companies in the Comparator Group, and 25% to the non-UK based companies.

The Comparator ...

-

Page 119

...was available to a group of senior executives of the Company. The maximum number of shares issued to employees under this plan was three million in each of 2007 and 2006. The fair value of the shares under the plan was based on the market price of the Cadbury Schweppes ordinary shares on the date of...

-

Page 120

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) (iii) The Cadbury Schweppes (New Issue) Share Option Plan 2004 was established by the Directors, under the authority given by stockholders in May 2004. Eligible executives are granted options to subscribe ...

-

Page 121

... dividend yield of Cadbury. A summary of the status of the Company's non-vested shares, in relation to the BSRP, LTIP and ISAP as of December 31, 2007, and changes during the year ended December 31, 2007, is presented below:

Number of Non-vested Shares ('000) Weighted Average Grant Date Fair Value...

-

Page 122

.... Subsequent to May 7, 2008, the number of basic shares includes approximately 500,000 shares related to former Cadbury benefit plans converted to DPS shares on a daily volume weighted average. See Note 16 for information regarding the Company's stock-based compensation plans. (2) Anti-dilutive...

-

Page 123

... in the Consolidated Balance Sheet. For more information on the valuation of these derivative instruments, see Note 19. 19. Fair Value of Financial Instruments Effective January 1, 2008, the Company adopted SFAS 157, which defines fair value as the price that would be received to sell an asset or...

-

Page 124

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The difference between the fair value and the carrying value represents the theoretical net premium or discount that would be paid or received to retire all debt at such date. The carrying amounts of long-...

-

Page 125

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

(1) The following detail represents the initial non-cash financing and investing activities in connection with the Company's separation from Cadbury for the year ended December 31, 2008 (in millions): Tax...

-

Page 126

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Snapple Distributor Litigation In 2004, one of the Company's subsidiaries, Snapple Beverage Corp., and several affiliated entities of Snapple Beverage Corp., including Snapple Distributors Inc., were sued ...

-

Page 127

...'s entities within the Bottling Group. The Company has accrued an estimated liability based on current facts and circumstances. However, there is no assurance of the outcome of the audits.

23. Segments Due to the integrated nature of DPS' business model, the Company manages its business to maximize...

-

Page 128

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) As of December 31, 2008, the Company's operating structure consisted of the following four operating segments: • The Beverage Concentrates segment reflects sales from the manufacture of concentrates and ...

-

Page 129

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) sales to Beverage Concentrates and Finished Goods as detailed below. The impact of foreign currency totaled $(2) million, $9 million and $(2) million for the years ended December 31, 2008, 2007 and 2006, ...

-

Page 130

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

For the Year Ended December 31, 2008 2007 2006

Depreciation Beverage Concentrates ...Finished Goods ...Bottling Group ...Mexico and the Caribbean ...Segment total ...Corporate and other ...Adjustments and...

-

Page 131

... of net sales for the year ended December 31, 2008 and 2007, respectively. These sales were reported primarily in the Finished Goods and Bottling Group segments. No customers contributed 10% or more of total net sales in 2006. 24. Related Party Transactions Separation from Cadbury Upon the Company...

-

Page 132

... PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) The Company had other related party receivables of $66 million as of December 31, 2007, which primarily related to taxes, accrued interest receivable from the notes with wholly owned subsidiaries of Cadbury...

-

Page 133

... 31, 2008 and 2007. The consolidating schedules are provided in accordance with the reporting requirements for guarantor subsidiaries. On May 7, 2008, Cadbury plc transferred its Americas Beverages business to Dr Pepper Snapple Group, Inc., which became an independent publicly-traded company. Prior...

-

Page 134

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidating Statement of Operations For the Year Ended December 31, 2008 Parent Guarantor Non-Guarantor Eliminations Total (In millions)

Net sales ...$ - Cost of sales...- Gross profit ...- ...

-

Page 135

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidating Statement of Operations For the Year Ended December 31, 2006 Guarantor Non-Guarantor Eliminations (In millions)

Parent

Total

Net sales ...Cost of sales ...Gross profit ...Selling...

-

Page 136

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidating Balance Sheet As of December 31, 2008 Guarantor Non-Guarantor Eliminations (In millions)

Parent

Total

Current assets: Cash and cash equivalents ...Accounts receivable: Trade (net...

-

Page 137

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidating Balance Sheet As of December 31, 2007 Guarantor Non-Guarantor Eliminations (In millions)

Parent

Total

Current assets: Cash and cash equivalents ...Accounts receivable: Trade (net...

-

Page 138

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidated Statement of Cash Flows for the Year Ended December 31, 2008 Guarantor Non-Guarantor Eliminations (In millions)

Parent

Total

Operating activities: Net cash provided by operating ...

-

Page 139

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidated Statement of Cash Flows For the Year Ended December 31, 2007 Guarantor Non-Guarantor Eliminations (In millions)

Parent

Total

Operating activities: Net cash provided by operating ...

-

Page 140

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Condensed Consolidated Statement of Cash Flows For the Year... ...Excess tax benefit on stock-based compensation ...Change in Cadbury's net investment ...Net cash provided by (used in) financing activities...

-

Page 141

...share by quarter for the years ended December 31, 2008 and 2007. This data was derived from the Company's unaudited consolidated financial statements. For periods prior to May 7, 2008, DPS' financial data has been prepared on a "carve-out" basis from Cadbury's consolidated financial statements using...

-

Page 142

DR PEPPER SNAPPLE GROUP, INC. NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS - (Continued) presentation in the previously reported net sales and cost of sales captions on the Statement of Operations. The Company did not eliminate certain intercompany net sales and cost of sales. The Company will...

-

Page 143

... in this annual report. Prior to separation, we relied on certain financial information, administrative and other resources of Cadbury to operate our business, including portions of corporate communications, regulatory, human resources and benefit management, treasury, investor relations, corporate...

-

Page 144

... Services Agreement between Cadbury Schweppes plc and Dr Pepper Snapple Group, Inc., dated as of May 1, 2008 (filed as Exhibit 10.1 to the Company's Current Report on Form 8-K (filed on May 5, 2008) and incorporated herein by reference). Tax Sharing and Indemnification Agreement between Cadbury...

-

Page 145

...the Company's Registration Statement on Form 10 (filed on February 12, 2008) and incorporated herein by reference). Third Amendment to the Agreement between Cadbury Schweppes Bottling Group, Inc. (now known as The American Bottling Company) and CROWN Cork & Seal USA, Inc., dated April 4, 2007 (filed...

-

Page 146

... Exhibit 10.4 to the Company's Quarterly Report on Form 10-Q (filed on November 13, 2008) and incorporated herein by reference). List of Subsidiaries (as of December 31, 2008). Consent of Deloitte & Touche LLP Certification of Chief Executive Officer of Dr Pepper Snapple Group, Inc. pursuant to Rule...

-

Page 147

..., the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. Dr Pepper Snapple Group, Inc.

By:

/s/ John O. Stewart Name: John O. Stewart Title: Executive Vice President, Chief Financial Officer and Director

Date: March 26, 2009 Pursuant to...

-

Page 148

(Intentionally Left Blank)

124

-

Page 149

...company information are available at www.drpeppersnapple.com. Investors wanting further information about DPS should contact the Investors Relations department at corporate headquarters at 972-673-7000 or http://investor.drpeppersnapple.com/contactus.cfm.

Form 10-K

Copies of Dr Pepper Snapple Group...

-

Page 150