Salesforce.com 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

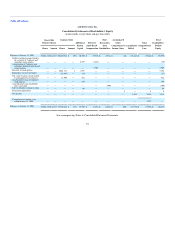

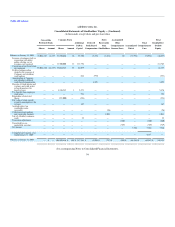

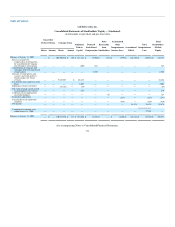

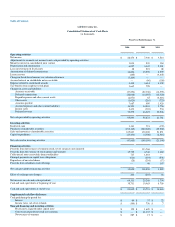

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

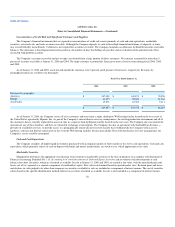

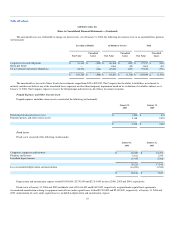

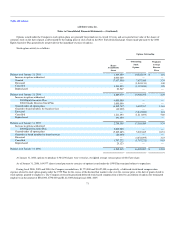

A reconciliation of the denominator used in the calculation of basic and diluted net income per share is as follows (in thousands):

Fiscal Year Ended January 31,

2006

2005

2004

Numerator:

Net income $ 28,474 $ 7,346 $ 3,514

Denominator:

Weighted-average shares outstanding for basic earnings per share, net of weighted-average shares of common stock subject to

repurchase 107,274 75,503 29,605

Effect of dilutive securities:

Employee stock options and warrants 11,463 13,054 7,780

Convertible preferred stock which was converted into shares of common stock upon the closing of the Company's initial

public offering — 22,317 58,024

Adjusted weighted-average shares outstanding and assumed conversions for diluted earnings per share 118,737 110,874 95,409

Outstanding unvested common stock purchased by employees is subject to repurchase by the Company and therefore is not included in the calculation

of the weighted-average shares outstanding for basic earnings per share.

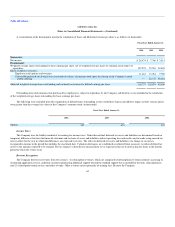

The following were excluded from the computation of diluted shares outstanding as they would have had an anti-dilutive impact as their exercise prices

were greater than the average fair values of the Company's common stock (in thousands):

Fiscal Year Ended January 31,

2006

2005

2004

Options 387 674 901

Income Taxes

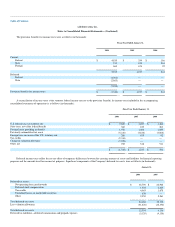

The Company uses the liability method of accounting for income taxes. Under this method, deferred tax assets and liabilities are determined based on

temporary differences between the financial statement and tax basis of assets and liabilities and net operating loss and credit carryforwards using enacted tax

rates in effect for the year in which the differences are expected to reverse. The effect on deferred tax assets and liabilities of a change in tax rates is

recognized in income in the period that includes the enactment date. Valuation allowances are established or adjusted when necessary to reduce deferred tax

assets to the amounts expected to be realized. The tax expense or benefits for unusual items or tax exposure items are treated as discrete items in the interim

period in which the events occur.

Revenue Recognition

The Company derives its revenues from two sources: (1) subscription revenues, which are comprised of subscription fees from customers accessing its

on-demand application service, and from customers purchasing additional support beyond the standard support that is included in the basic subscription fee;

and (2) related professional services and other revenue. Other revenues consist primarily of training fees. Because the Company

62