Salesforce.com 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238

|

|

Table of Contents

PART II

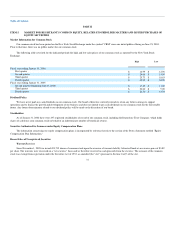

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

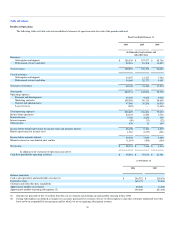

Market Information for Common Stock

Our common stock has been quoted on the New York Stock Exchange under the symbol "CRM" since our initial public offering on June 23, 2004.

Prior to that time, there was no public market for our common stock.

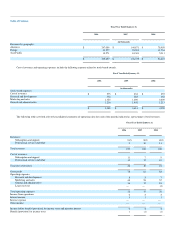

The following table sets forth for the indicated periods the high and low sales prices of our common stock as reported by the New York Stock

Exchange.

High

Low

Fiscal year ending January 31, 2006

First quarter $ 16.99 $ 12.96

Second quarter $ 24.08 $ 14.09

Third quarter $ 25.73 $ 18.63

Fourth quarter $ 42.99 $ 24.70

Fiscal year ending January 31, 2005

Second quarter (beginning June 23, 2004) $ 17.69 $ 11.00

Third quarter $ 20.60 $ 9.00

Fourth quarter $ 22.70 $ 13.35

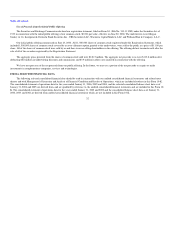

Dividend Policy

We have never paid any cash dividends on our common stock. Our board of directors currently intends to retain any future earnings to support

operations and to finance the growth and development of our business and does not intend to pay cash dividends on our common stock for the foreseeable

future. Any future determination related to our dividend policy will be made at the discretion of our board.

Stockholders

As of January 31, 2006 there were 297 registered stockholders of record of our common stock, including the Depository Trust Company, which holds

shares of salesforce.com common stock on behalf of an indeterminate number of beneficial owners.

Securities Authorized for Issuance under Equity Compensation Plans

The information concerning our equity compensation plans is incorporated by reference herein to the section of the Proxy Statement entitled "Equity

Compensation Plan Information."

Recent Sales of Unregistered Securities

Warrant Exercises

Since November 1, 2005 we issued 493,715 shares of common stock upon the exercise of warrants held by Attractor Funds at an exercise price of $3.89

per share. The warrants were exercised on a "net-exercise" basis and we therefore received no cash proceeds from the exercise. The issuance of the common

stock was exempt from registration under the Securities Act of 1933, as amended (the "Act") pursuant to Section 3(a)(9) of the Act.

31