Salesforce.com 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

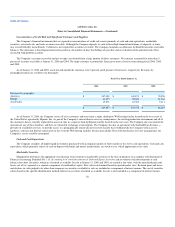

Fair Value of Financial Instruments

The carrying amounts of the Company's financial instruments, which include cash and cash equivalents, short term marketable securities, restricted

cash, accounts receivable, accounts payable, and other accrued expenses, approximate their fair values due to their short maturities. Based on borrowing rates

currently available to the Company for loans with similar terms, the carrying value of capital lease obligations approximates fair value.

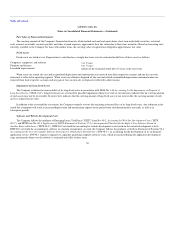

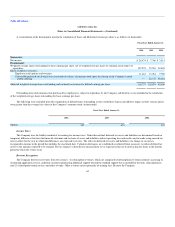

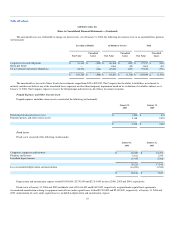

Fixed Assets

Fixed assets are stated at cost. Depreciation is calculated on a straight-line basis over the estimated useful lives of those assets as follows:

Computers, equipment, and software 3 to 5 years

Furniture and fixtures 5 to 7 years

Leasehold improvements Shorter of the estimated useful life of 5 years or the lease term

When assets are retired, the cost and accumulated depreciation and amortization are removed from their respective accounts and any loss on such

retirement is reflected in operating expenses. When assets are otherwise disposed of, the cost and related accumulated depreciation and amortization are

removed from their respective accounts and any gain or loss on such sale or disposal is reflected in other income.

Impairment of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets in accordance with SFAS No. 144, Accounting for the Impairment or Disposal of

Long-Lived Assets ("SFAS 144"). Long-lived assets are reviewed for possible impairment whenever events or circumstances indicate that the carrying amount

of such assets may not be recoverable. If such review indicates that the carrying amount of long-lived assets is not recoverable, the carrying amount of such

assets is reduced to fair value.

In addition to the recoverability assessment, the Company routinely reviews the remaining estimated lives of its long-lived assets. Any reduction in the

useful life assumption will result in increased depreciation and amortization expense in the period when such determinations are made, as well as in

subsequent periods.

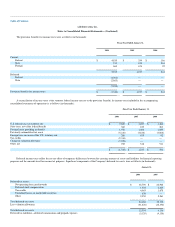

Software and Website Development Costs

The Company follows the guidance of Emerging Issues Task Force ("EITF") Issue No. 00-2, Accounting for Web Site Development Costs ("EITF

00-2"), and EITF Issue No. 00-3, Application of AICPA Statement of Position 97-2 to Arrangements That Include the Right to Use Software Stored on

Another Entity's Hardware ("EITF 00-3"). EITF 00-2 sets forth the accounting for website development costs based on the website development activity.

EITF 00-3 sets forth the accounting for software in a hosting arrangement. As such, the Company follows the guidance set forth in Statement of Position 98-1,

Accounting for the Cost of Computer Software Developed or Obtained for Internal Use ("SOP 98-1"), in accounting for the development of its on-demand

application service. SOP 98-1 requires companies to capitalize qualifying computer software costs, which are incurred during the application development

stage and amortize them over the software's estimated useful life of three years.

59