Ryanair 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

CHAIRMAN’S REPORT

Dear Shareholders,

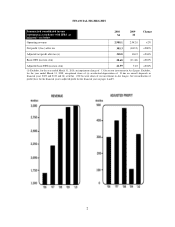

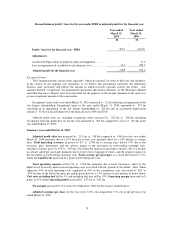

I am very pleased to report an adjusted net profit of 1318.8m which was a 204% increase on last year’s

result despite the headwinds we suffered from the economic downturn. These headwinds led most of our

competitors to announce losses while more carriers have gone bankrupt including Blue Wings (Germany),

Globe Span (UK), My Air (Italy), Segal Air and Sky Europe (Slovakia).

Last year we achieved a number of significant milestones:

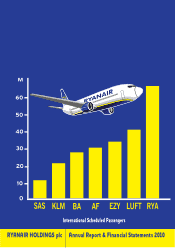

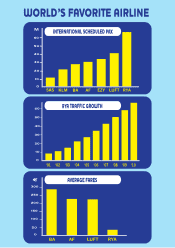

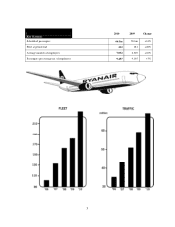

• Our traffic grew by 14% to 66.5m passengers.

• We reduced our average fares by 13% to just 135.

• We took delivery of 51 net new aircraft as our fleet rose to 232 Boeing 737-800s.

• We opened eight new bases at Bari, Brindisi, Faro, Leeds, Oslo Rygge, Pescara, Porto and

Trapani making 41 in total.

• We opened 284 new routes which brings our total routes operated to 940.

• We improved our industry leading passenger service with better punctuality, fewer lost bags and

less cancellations.

• We proposed a 1500m dividend (subject to AGM approval), increasing the total funds returned to

shareholders over the past 3 years to 1846m.

We continue to grow our business at large and small airports across Europe. The new routes and bases

launched this year have delivered lower charges, which have resulted in airport and handling unit costs falling

by 9%, despite the excessive (up to 40%) increase in charges at Dublin airport.

Increased profitability has seen our cash in hand rise by 1535m to 12.8bn, and we have one of the

strongest balance sheets in the industry. During the year we terminated negotiations on a 200 aircraft order

with Boeing, and we do not anticipate any new orders in the foreseeable future. As a result, capital expenditure

will fall substantially over the next 3 years. Subject to profitability, this will generate up to 11bn in surplus

cash by the end of FY13. The Board proposes to return 1500m of this cash by way of a dividend in October

2010, subject to AGM approval on September 22, 2010. We anticipate that there may be a further 1500m

available for return to shareholders, either via a share buy back, or perhaps another dividend by the end of

FY13. Any such distributions will be subject to the continuing profitability of the business, and no new aircraft

orders or other significant capital expenditure in the interim.

The recent Icelandic volcanic ash disruptions led to the repeated and unnecessary closure of large parts of

European airspace in late April and early May. Over an 18 day period Ryanair was forced to cancel 9,484

flights with the loss of 1.5m passengers. The Company estimates that the exceptional costs of these disruptions

and cancellations will be approximately 150m although it will be some time before we can determine the final

outcome of these claims under the current regulations which strangely appear to treat the ash related airspace

closures as the responsibility of the airline. The fact that no other transport providers (or travel insurers) are

obliged to reimburse expenses of disrupted passengers in force majeure cases, proves that these regulations are

dis-proportionate and discriminatory.