Royal Caribbean Cruise Lines 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEAR FELLOW SHAREHOLDERS,

During 2013, we began to see the coming together of all our efforts

over the last years. We realized material gains in our key financial

metrics and set the stage for achieving the improved profitability and

higher returns on investment that we need. All of this gives us a great

sense of confidence as we sail into an exciting future.

Material Gains with Key Financial Metrics

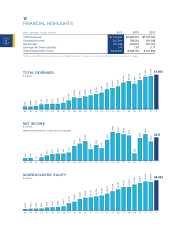

We continue to strengthen our balance sheet as we

progress toward investment grade metrics, and in

2013 we leveraged the improving banking market to

strengthen our liquidity position and to lower our financ-

ing costs with a series of constructive refinancings. We

closed out 2013 with $1.9 billion in liquidity, reduced our

debt by $400 million and doubled our quarterly dividend

to $0.25 per share. We know keeping our capacity

growth moderate is also prudent and that is why we

announced no ship delivery for our consolidated brands

in 2017. The cumulative effect of these actions reflects

our focus on returns for our shareholders with increas-

ing investment returns and profitability.

Cost Discipline in Our Culture

One of our major focus areas has been on controlling

costs and the results have been gratifying. Efforts at

all levels of the organization enabled us to beat our

budgets across the board in 2013. Control of our big-

gest single expense item—fuel—was particularly con-

structive as we maintained our position as having the

lowest energy consumption per berth in the industry.

It is especially gratifying to see that our people are

accomplishing all this while investing in our product and

infrastructure. Guest satisfaction in 2013 reached record

levels which will drive improved pricing in the future.

And, just as importantly, our annual survey of crew

satisfaction and engagement are at its highest level in

our history.

Revenue Yields Remain Key

As critical as controlling our costs are, the biggest

potential improvement in our bottom line will come from

improving revenue performance and we see great

opportunity in this key area. Yields are still too low, but

we are very encouraged by recent trends. Revenue

yields grew by 3.2% which almost precisely equaled our

prediction at the beginning of the year (a prediction that

preceded all the bad press of 2013). Ticket yields were

an important driver with the US market proving partic-

ularly strong and Europe providing some upside. Our

ship upgrading efforts, technology and other enhance-

ments drove transformative onboard revenue results.

While we don’t expect such step changes to occur

every year, 2013 performance demonstrates how

aggressively we manage this element.

We now face 2014 with perhaps the clearest hori-

zon we have seen in some time. The worst of the

economic turbulence appears to be behind and we

are hopeful that the upward trend continues. While still

challenged, the global economy is showing improve-

ment, with moderate growth in North America, slow but

measurable recovery in Europe, and opportunity in

emerging markets like China.

All of our brands are upping their game in the mar-

ketplace. Royal Caribbean International’s market posi-

tioning and newest ship are attracting great attention;

Celebrity’s Modern Luxury positioning and marketing

concentration are driving increased demand; Azamara

Club Cruises’ destination intensification is changing the

OUR MESSAGE

3