Royal Caribbean Cruise Lines 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

SHAREHOLDER INFORMATION

$400

$350

$300

$250

$200

$150

$100

50

0

12/02 12/03 12/04 12/05 12/06 12/07

Royal Caribbean Cruises Ltd.

S&P 500

Dow Jones US Travel & Leisure

$

$

MARKET INFORMATION

Our common stock is listed on the New York Stock Exchange

(“NYSE”) and the Oslo Stock Exchange (“OSE”) under the symbol

“RCL”. The table below sets forth the intra-day high and low prices

of our common stock as reported by the NYSE and the OSE for

the two most recent years by quarter:

NYSE OSE

Common Stock Common Stock 1

High Low High Low

2007

Fourth Quarter

$43.45 $37.52 243.50 205.00

Third Quarter

42.53 36.03 251.00 203.50

Second Quarter

44.62 40.43 268.00 244.00

First Quarter

45.34 38.68 290.00 243.00

2006

Fourth Quarter $43.97 $38.06 282.00 243.00

Third Quarter 39.28 32.47 260.00 203.50

Second Quarter 43.86 35.00 280.00 213.00

First Quarter 46.77 40.59 316.50 271.00

1Denominated in Norwegian kroner.

As of February 12, 2008 there were 1,058 record holders of our

common stock. Since certain of our shares are held indirectly, the

foregoing number is not representative of the number of benefi-

cial owners.

DIVIDENDS

We declared cash dividends on our common stock of $0.15 per

sharein each of the quarters of 2007and 2006.

Holders of our common stock havean equal right tosharein

our profits in the form of dividends when declared by our board

of directors out of funds legally available for the distribution

of dividends. Holders of our common stock have no rights to any

sinking fund.

There are no exchange control restrictions on remittances of

dividends on our common stock. Since (1) we are and intend

tomaintain our status as a nonresident Liberian entity under the

Revenue Code of Liberia (2000) and the regulations thereunder,

and (2) our ship-owning subsidiaries are not now engaged, and

arenot in the futureexpected toengage, in any business in Liberia,

including voyages exclusively within the territorial waters of the

Republic of Liberia, under current Liberian law, no Liberian taxes

or withholding will be imposed on payments to holders of our

securities other than to a holder that is a resident Liberian entity

or a resident individual or an individual or entity subject to taxation

in Liberia as a result of having a permanent establishment within

the meaning of the Revenue Code of Liberia (2000) in Liberia.

The declaration of dividends shall at all times be subject to the

final determination of our board of directors that a dividend is

prudent at that time in consideration of the needs of the business.

The shareholders agreement provides that A. Wilhelmsen AS.

and Cruise Associates will from time to time consider our dividend

policy with due regard for the interests of the shareholders in

maximizing the return on their investment and our ability to pay

such dividends. The shareholders agreement also provides that

payment of dividends will depend, among other factors, upon our

earnings, financial position and capital requirements and the

income and other tax liabilities of A. Wilhelmsen AS., Cruise

Associates and their respective affiliates relating to their owner-

ship of common stock.

ISSUER PURCHASES OF EQUITY SECURITIES

None.

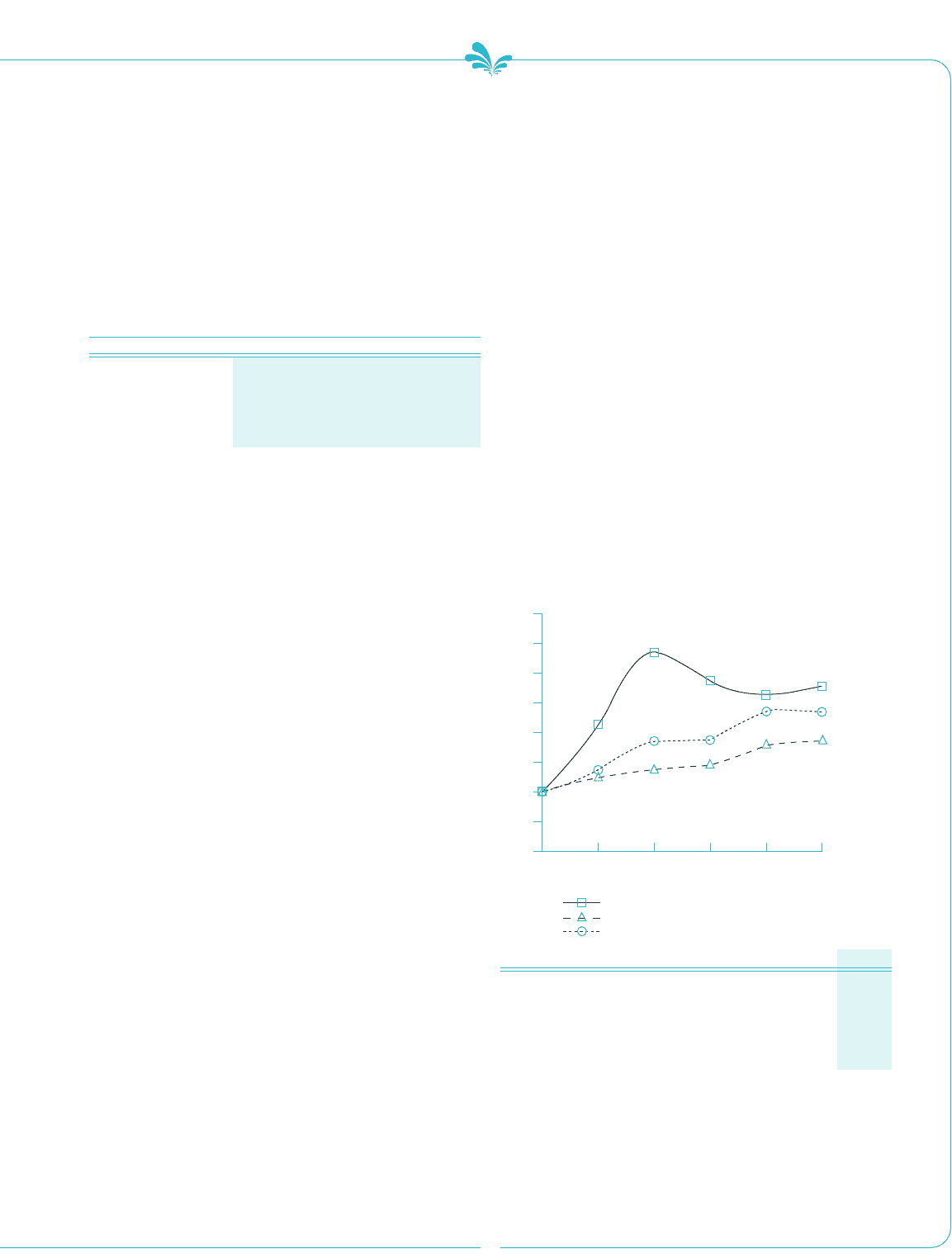

STOCK PERFORMANCE GRAPH

The following graph compares the performance of the Company’s

common stock with the performance of the Standard & Poor’s 500

Composite Stock Index and the Dow Jones U.S. Travel and Leisure

Index for a five year period by measuring the changes in common

stock prices from December 31, 2002 to December 31, 2007.

12/02 12/03 12/04 12/05 12/06 12/07

Royal Caribbean

Cruises Ltd. $100.00 $213.36 $337.80 $283.05 $263.86

$274.59

S&P 500 $100.00 $128.68 $142.69 $149.70 $173.34

$182.87

Dow Jones

US Travel

&Leisure $100.00 $142.61 $183.31 $186.31 $228.12

$224.91

The stock performance graph assumes for comparison that the

value of the Company’s Common Stock and of each index was

$100 on December 31, 2002 and that all dividends were reinvested.

Past performance is not necessarily an indicator of future results.