Royal Caribbean Cruise Lines 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We expected a 5.1% increase in capacity in 2008, primarily driven

by the addition of Independence of the Seas,which will enter

service in May 2008, a full year of Liberty of the Seas,the addition

of Pacific Star,which will enter service during the first quarter

of 2008 and the addition of Celebrity Solstice,which will enter

service in December 2008.

Depreciation and amortization expenses were expected to be in the

range of $525.0 million to $545.0 million, and interest expense was

expected to be in the range of $340.0 million to $360.0 million.

Based on the expectations contained in this Outlook section, and

assuming that fuel prices remain at the level of the January 30, 2008

“at-the-pump” prices, we expected full year 2008 earnings per

share to be in the range of $3.20 to $3.40.

First Quarter 2008

As announced on January 30, 2008, we expected Net Yields will

increase approximately 7% compared to 2007.

Weexpected Net Cruise Costs per APCD to increase approxi-

mately 1% compared to 2007. Excluding fuel, we expected Net

Cruise Costs per APCD to decrease in the range of 1% to 2%

compared to 2007.

Wedo not forecast fuel prices and our cost outlook for fuel is

based on current “at-the-pump” prices including any hedge

impacts. If fuel prices for the first quarter of 2008 remain at the

level of January 30, 2008, fuel expenses for the first quarter of

2008 would be approximately $145.0 million or $492 per metric

ton. For the first quarter of 2008, our fuel expenseis 52% hedged

and a 10% change in the market price of fuel would result in a

change in fuel costs of approximately $8.0 million for the first

quarter of 2008, after taking intoaccount existing hedges.

Weexpected an 8.8%increase in capacity, primarily driven by the

addition of Liberty of the Seas,which entered service in May 2007.

Depreciation and amortization expenses were expected to be in

the range of $123.0 million to $128.0 million and interest expense

was expected to be in the range of $82.0 million to $87.0 million.

Based on the expectations contained in this Outlook section, and

assuming that fuel prices remain at the level of the January 30, 2008

“at-the-pump” prices, we expected first quarter 2008 earnings per

share to be in the range of $0.30 to $0.35.

Update to Outlook

Since our January 30, 2008 announcement, we have evaluated

major changes in our operating environment including booking

trends, fuel prices, the impact of our fuel supplement and other

factors. Based on our evaluation of these factors, our outlook

for the year remains substantially unchanged and we continue

to expect full year 2008 earnings per share to be in the range

of $3.20 to $3.40. Mainly due to a shift in the timing of certain

expenses, wenowbelievefirst quarter earnings per share will

be in the rangeof $0.25 to $0.30.

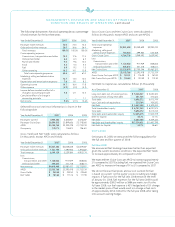

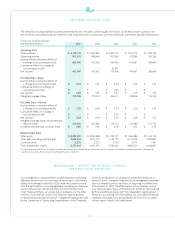

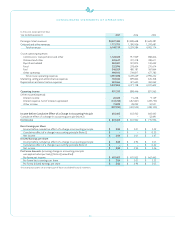

YEAR ENDED DECEMBER 31, 2007 COMPARED

TO YEAR ENDED DECEMBER 31, 2006

Revenues

Net Revenues increased 16.1% in 2007 compared to 2006 due to

a12.3% increase in capacity and a 3.3% increase in Net Yields. The

increase in capacity was primarily attributed to the addition of

Pullmantur Cruises’ fleet, the addition of Liberty of the Seas,

which entered service in May 2007 and a full year of Freedom of

the Seas.This increase was partially offset by the revitalization

of Majesty of the Seas during the first quarter of 2007 which was

out of service for 28 days and an increase in the number of days

ships were in drydock during 2007 as compared to 2006. The

increase in Net Yields was primarily due to the addition of

Pullmantur’s tour business which provides additional revenues

without corresponding capacity and, to a lesser extent, an

increase in ticket prices on a per passenger basis. This increase

was partially offset by a decrease in onboard revenues primarily

due to an expanded cruise season in certain markets and itinerary

changes for certain ships where guests spend less onboard our

ships. Occupancyin 2007 was 105.7% compared to 106.5% in 2006.

Gross Yields increased 4.7% in 2007 compared to 2006, which

was a larger percentage increase than Net Yields primarily due

to increases in commissions, transportation, other expenses and

onboard and other expenses. The increase in commissions, trans-

portation and other expenses was primarily due to Pullmantur

Cruises’ higher commission expenses. This increase was also due

to increases in these direct costs as a result of an expanded cruise

season in certain markets and itinerary changes for certain ships.

The increasein onboard and other expenses was primarily due to

increases in shoreexcursions and land-tour packages sold toour

guests as a result of an expanded cruise season in certain markets

and itinerary changes for certain ships as well as the acquisition

of Pullmantur.

Onboardand other revenues included concession revenues of

$239.3 million and $234.5 million in 2007 and 2006, respectively.

The increase in concession revenues was primarily due to the

increase in capacity mentioned above.

Expenses

Net Cruise Costs increased 19.8% in 2007 compared to 2006

due to a 12.3% increase in capacity mentioned above and a 6.6%

increase in Net Cruise Costs per APCD. The increase in Net Cruise

Costs per APCD was primarily due to increases in other operating

expenses. Other operating expenses increased primarily due to

the addition of Pullmantur’s tour businesswhich adds costs with-

out corresponding capacity.Gross Cruise Costs increased 20.6%

in 2007 compared to 2006, primarily due to the same reasons

discussed above for Net Cruise Costs.

Depreciation and amortization expenses increased 14.6% in 2007

compared to 2006. The increase was primarily due to the addition

of the Pullmantur fleet and the addition of Liberty of the Seas,

which entered service in May 2007. The increase was also due

tothe incremental depreciation as a result of the addition of

Freedom of the Seas,which entered service in June 2006, shore

side additions and ship improvements.

17

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS continued