Royal Caribbean Cruise Lines 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS continued

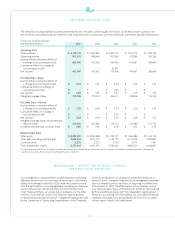

From 2003 through 2007, the cruise industry has been adversely

impacted directly and indirectly by substantial increases in fuel

prices. In 2003, fuel cost per metric ton was $204, whereas in 2007,

our fuel cost per metric ton was $455, an increase of 123%. If our

fuel cost per metric ton in 2007 had remained at 2003’s level,

our fuel expenses would have been approximately $300 million

lower in 2007. In addition, fuel and other factors have caused cost

increases elsewhere including transportation, food products and

other commodities. We have been able to partially mitigate this

increase in these costs with our hedging program and energy

saving initiatives. Also, we implemented a temporary fuel supple-

ment in 2008; however, we believe this fuel supplement will be

partially offset by reductions in ticket prices. We believe higher

and volatile fuel prices are a factor that will continue to impact

our results of operations for the foreseeable future. Despite these

pressures, we continue to focus on cost savings initiatives and

expect to limit increases in our Net Cruise Costs on an APCD basis

(excluding fuel) to 1% to 2% in 2008.

The Company expects to continue the expansion of its interna-

tional passenger sourcing and the development and growth of its

innovative fleet of ships. As of December 31, 2007, we had signed

agreements with two shipyards providing for the construction

of seven additional cruise ships. These new ships are expected

to continue to help us maintain our current position within the

worldwide cruise industry. The year-over-year percentage increase

in our capacity for fiscal 2008, 2009, 2010 and 2011, is currently

planned to be 5.1%, 9.3%, 11.4% and 6.4%, respectively.

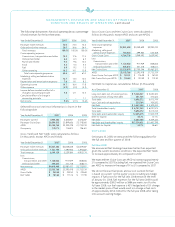

SUMMARYOF HISTORICAL RESULTS

OF OPERATIONS

Total revenues increased 17.6% to $6.1 billion from total revenues

of $5.2 billion in 2006 primarily due to a 12.3%increase in capacity

and a 4.7% increase in Gross Yields. Net Yields increased by approxi-

mately 3.3% compared to the same period in 2006. The increase

in Net Yields was primarily due to the addition of Pullmantur’s tour

business which provides additional revenues without correspond-

ing capacity and, to a lesser extent, a positive pricing environment.

The increase in total revenues was offset by an increase in expenses

primarily due to the increase in capacity and the acquisition of

Pullmantur as well as an increase in interest expense. As a result,

our net income was $603.4 million or $2.82 per share on a fully

diluted basis in 2007compared to $633.9 million or $2.94 per

share on a fully diluted basis in 2006.

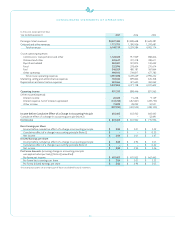

Highlights for 2007included:

• Total revenues increased 17.6% to $6.1 billion from total revenues

of $5.2 billion in 2006 primarily due to a 12.3% increase in capac-

ity and a 4.7% increase in Gross Yields. Net Yields increased by

approximately 3.3% compared to the same period in 2006.

• Net Cruise Costs per APCD increased 6.6% compared to 2006.

• Our Net Debt-to-Capital ratio decreased to 44.7% in 2007 from

46.6% in 2006. Similarly, our Debt-to-Capital ratio decreased

to45.7%in 2007from 47.1% in 2006.

• Weissued €1.0 billion, or approximately $1.3 billion, of 5.625%

senior unsecured notes due 2014 at a price of 99.638% of par.

The net proceeds from the offering were used to retire our

unsecured bridge loan facility obtained to finance our acquisition

of Pullmantur Cruises and to repay a portion of the outstanding

balance on our unsecured revolving credit facility.

• We took delivery of Liberty of the Seas,Royal Caribbean

International’s second Freedom-class ship, which was financed

with a $589.0 million unsecured term loan.

• We placed two additional ship orders, one for Royal Caribbean

International and one for Celebrity Cruises, bringing our total

number of ships on order to seven for an additional capacity

of approximately 25,800 berths.

• We purchased the 1,000-berth Pacific Star and will take posses-

sion of the ship in March 2008 at which time the ship will begin

sailing under the name Ocean Dream.

• We launched a new brand, Azamara Cruises, designed to serve

the emerging deluxe cruise segment of the North American

cruise market. Blue Dream and Blue Moon were redeployed

from Pullmantur Cruises to Azamara Cruises and are sailing under

the names Azamara Journey and Azamara Quest,respectively.

• We redeployed Zenith from Celebrity Cruises to Pullmantur Cruises.

• We amended and restated our unsecured revolving credit facility

to increase the amount available from $1.0 billion to $1.2 billion,

reduce the effective interest rate to LIBOR plus 0.485%, change

the 0.175% commitment fee to a 0.140% facility fee and extend

the maturity datefrom March 27, 2010 to June 29, 2012.

• We launched a second new brand, CDF Croisières de France,

designed to serve the contemporary segment of the French

cruise market with sailings beginning in May 2008. In April 2008,

Holiday Dream will be redeployed from Pullmantur Cruises to CDF

Croisières de France and will sail under the name Bleu de France.

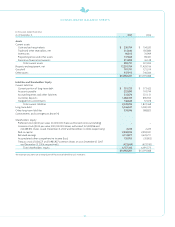

We reported historical total revenues, operating income, income

before cumulative effect of a change in accounting principle,

cumulativeeffect of a change in accounting principle, net income

and earningsper shareas shown in the following table (in thou-

sands, except per share data):

Year Ended December 31, 2007 2006 2005

Total revenues

$6,149,139

$5,229,584 $4,903,174

Operating income

$ 901,335

$ 858,446 $ 871,565

Income before cumulative

effect of a change in

accounting principle

$ 603,405

$ 633,922 $ 663,465

Cumulative effect of a

change in accounting

principle 1

–

– 52,491

Net income

$ 603,405

$ 633,922 $ 715,956

Basic earnings per share:

Income before cumulative

effect of a change in

accounting principle

$ 2.84

$ 3.01 $ 3.22

Cumulativeeffectof a

changein accounting

principle 1

$ –

$ – $ 0.25

Net income

$ 2.84

$ 3.01 $ 3.47

Diluted earnings per share:

Income before cumulative

effect of a change in

accounting principle

$ 2.82

$ 2.94 $ 3.03

Cumulative effect of a

change in accounting

principle 1

$–

$ – $ 0.22

Net income

$ 2.82

$ 2.94 $ 3.26

1In the thirdquarter of 2005, wechanged our method of accounting for drydocking

costs from the accrual in advance to the deferral method (see Note 2. Summary of

Significant Accounting Policies to our consolidated financial statements.)