Royal Caribbean Cruise Lines 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

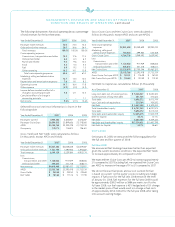

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS continued

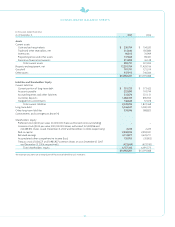

The following table presents historical operating data as a percentage

of total revenues for the last three years:

Year Ended December 31, 2007 2006 2005

Passenger ticket revenues

72.0

73.4 73.6

Onboard and other revenues

28.0

26.6 26.4

Total revenues

100.0%

100.0% 100.0%

Cruise operating expenses

Commissions, transportation and other

18.3

17.6 17.5

Onboard and other

6.6

6.3 6.3

Payroll and related

9.5

9.6 10.4

Food

5.3

5.3 5.5

Fuel

8.9

9.2 7.5

Other operating

16.2

14.1 13.8

Total cruise operating expenses

64.8

62.1 61.0

Marketing, selling and administrative

expenses

12.7

13.4 13.0

Depreciation and amortization expenses

7.8

8.1 8.2

Operating income

14.7

16.4 17.8

Other expense

(4.9)

(4.3) (4.3)

Income before cumulative effect of a

change in accounting principle

9.8

12.1 13.5

Cumulativeeffect of a change in

accounting principle

–

– 1.1

Net income

9.8%

12.1% 14.6%

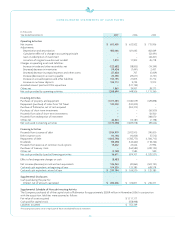

Selected historical statistical information is shown in the

following table:

Year Ended December 31, 2007 2006 2005

Passengers Carried

3,905,384

3,600,807 3,476,287

Passenger Cruise Days

26,594,515

23,849,606 23,178,560

APCD

25,155,768

22,392,478 21,733,724

Occupancy

105.7%

106.5% 106.6%

Gross Yields and Net Yields were calculated as follows

(in thousands, except APCD and Yields):

Year Ended December 31, 2007 2006 2005

Passenger ticket revenues

$4,427,384

$3,838,648 $3,609,487

Onboardand other revenues

1,721,755

1,390,936 1,293,687

Total revenues

6,149,139

5,229,584 4,903,174

Less:

Commissions,

transportation and other

1,124,022

917,929 858,606

Onboardand other

405,637

331,218 308,611

Net revenues

$4,619,480

$3,980,437 $3,735,957

APCD

25,155,768

22,392,478 21,733,724

Gross Yields

$ 244.44

$ 233.54 $ 225.60

Net Yields

$ 183.64

$ 177.76 $ 171.90

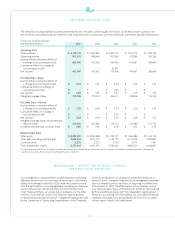

Gross Cruise Costs and Net Cruise Costs were calculated as

follows (in thousands, except APCD and costs per APCD):

Year Ended December 31, 2007 2006 2005

Total cruise operating

expenses

$3,981,698

$3,249,629 $2,994,232

Marketing, selling and

administrative expenses

783,040

699,864 635,308

Gross Cruise Costs

4,764,738

3,949,493 3,629,540

Less:

Commissions,

transportation and other

1,124,022

917,929 858,606

Onboard and other

405,637

331,218 308,611

Net Cruise Costs

$3,235,079

$2,700,346 $2,462,323

APCD

25,155,768

22,392,478 21,733,724

Gross Cruise Costs per APCD

$ 189.41

$ 176.38 $ 167.00

Net Cruise Costs per APCD

$ 128.60

$ 120.59 $ 113.30

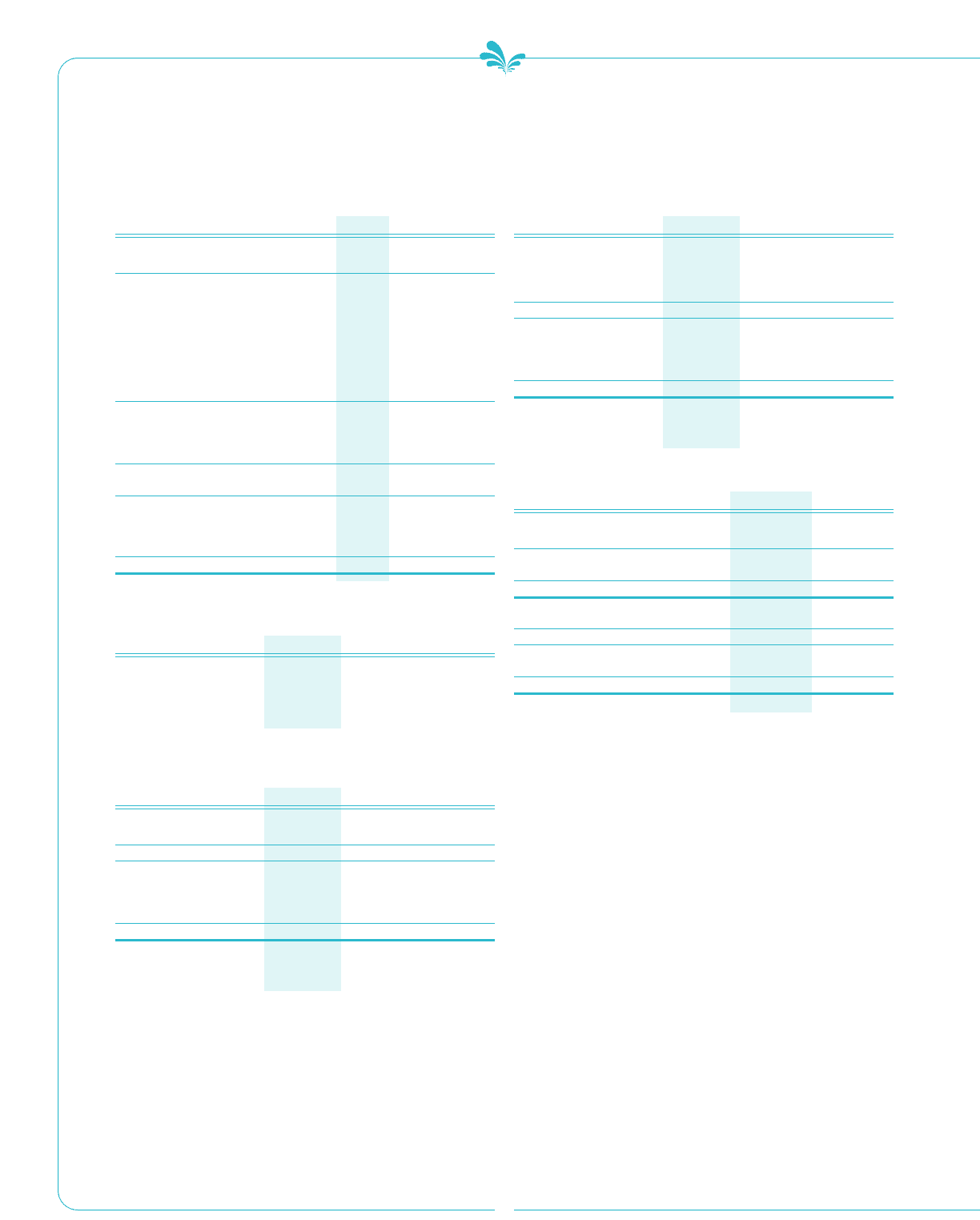

Net Debt-to-Capital was calculated as follows (in thousands):

As of December 31, 2007 2006

Long-term debt, net of current portion

$ 5,346,547

$ 5,040,322

Current portion of long-term debt

351,725

373,422

Total debt

5,698,272

5,413,744

Less: Cash and cash equivalents

230,784

104,520

Net Debt

$ 5,467,488

$ 5,309,224

Total shareholders’ equity

$ 6,757,343

$ 6,091,575

Total debt

5,698,272

5,413,744

Total debt and shareholders’ equity

12,455,615

11,505,319

Debt-to-Capital

45.7%

47.1%

Net Debt

5,467,488

5,309,224

Net Debt and shareholders’equity

$12,224,831

$11,400,799

Net Debt-to-Capital

44.7%

46.6%

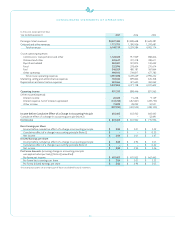

OUTLOOK

On January 30, 2008, weannounced the following guidance for

the full year and first quarter of 2008:

Full Year 2008

We announced that bookings have been better than expected

given the current economic conditions. We expected Net Yields

to increase approximately 4% compared to 2007.

We expected Net Cruise Costs per APCD to increase approximately

2% compared to 2007. Excluding fuel, we expected Net Cruise Costs

per APCD to increase in the range of 1% to 2% compared to 2007.

Wedo not forecast fuel prices and our cost outlook for fuel

is based on current “at-the-pump” prices including any hedge

impacts. If fuel prices for the full year 2008 remain at the level

of January 30, 2008, fuel expenses for the full year 2008 would

be approximately $595.0 million or $484 per metric ton. For the

full year 2008, our fuel expense is 45% hedged and a 10% change

in the market price of fuel would result in a change in fuel costs

of approximately $35.0 million for the full year 2008, after taking

into account existing hedges.