Royal Caribbean Cruise Lines 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

we used the intrinsic value method to account for stock-based

awards to our employees under APB Opinion No. 25, “Accounting

for Stock Issued to Employees,” and disclosed pro forma informa-

tion as if we had applied the fair value recognition provisions of

SFAS No. 123, “Accounting for Stock-Based Compensation.” We

have adopted SFAS 123R using the modified prospective transition

method in which we are recognizing compensation expense on

the unvested portion of the awards over the remaining vesting

period. Under this transition method, prior period results have

not been restated. In addition, SFAS 123R requires us to estimate

the amount of expected forfeitures in calculating compensation

costs for all outstanding awards. Previously, we had accounted for

forfeitures as they occurred. As of January 1, 2006, the cumulative

effect of adopting the expected forfeiture method and the

impact on cash flows was not significant.

The impact of adopting SFAS 123R was a reduction of our net income

by approximately $10.3 million and $11.3 million, or $0.05 on a basic

and diluted earnings per share basis, for each of the years ended

December 31, 2007 and December 31, 2006, respectively.

Segment Reporting

We operate four cruise brands, Royal Caribbean International,

Celebrity Cruises, Pullmantur Cruises, and Azamara Cruises, and

launched a new brand, CDF Croisières de France, which will commence

operations in May 2008. The brands have been aggregated as a single

reportable segment based on the similarity of their economic char-

acteristics as well as products and services provided.

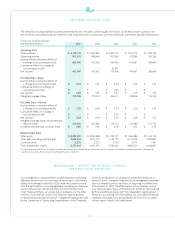

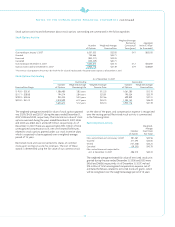

Information bygeographic area is shown in the table below.

Passenger ticket revenues areattributed to geographic areas

based on where the reservation originates.

2007 2006 2005

Passenger ticket revenues:

North America

70%

82% 85%

All other countries

30%

18% 15%

North America includes the United States which represents 63.4%,

75.8%and 78.9% of total consolidated passenger ticket revenue

for 2007, 2006 and 2005, respectively.

Recent Accounting Pronouncements

In June 2006, the Financial Accounting Standards Board (“FASB”)

issued Interpretation No. 48, “Accounting for Uncertainty in

Income Taxes, an interpretation of FASB Statement No. 109”

(“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income

taxes recognized in an enterprise’s financial statements. FIN 48

prescribes a recognition threshold and measurement attribute

for the financial statement recognition and measurement of

atax position taken or expected tobe taken in the tax return.

Weadopted FIN 48 on January 1, 2007. The adoption did not have

amaterial impact on our 2007 consolidated financial statements.

In September 2006, the FASB issued Statement of Financial

Accounting Standard (“SFAS”) No. 157, “Fair Value Measurements”

(“SFAS 157”). SFAS 157 defines fair value, establishes a formal

framework for measuring fair value and expands disclosures about

fair value measurements. SFAS 157 is effective the first fiscal year

beginning after November 15, 2007, and interim periods within

that fiscal year, and is applied prospectively with the exception

of certain financial instruments. In February 2008, the FASB issued

aFASB Staff Position (“FSP”) that amends SFAS 157 to delay the

effective date of SFAS 157 for all non-financial assets and non-

financial liabilities, except those that are recognized or disclosed

atfair value in the financial statements on a recurring basis to

fiscal years beginning after November 15, 2008, and interim periods

within those fiscal years. In February 2008, the FASB also issued

an FSP that would exclude leasing transactions accounted for under

SFAS No. 13, “Accounting for Leases,” and its related interpretive

accounting pronouncements. We do not expect the adoption

of SFAS 157 and related guidance to have a material impact on

our 2008 consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option

for Financial Assets and Financial Liabilities” (“SFAS 159”). Under

SFAS 159, entities will have the option to measure certain financial

instruments and other items at fair value that are not currently

measured at fair value. At the effective date, a company may elect

the fair value option for eligible items that exist at that date. The

effectof this election is reported as a cumulative effect adjustment

tothe opening balance of retained earnings in the year of adoption.

SFAS 159 is effective the first fiscal year beginning after November 15,

2007. The adoption of SFAS 159 will not have a material impact on

our 2008 consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007),

“Business Combinations,” (“SFAS 141R”). SFAS 141R requires the

acquiring entity in a business combination to recognize the full fair

value of assets acquired and liabilities assumed in the transaction

whether full or partial acquisition, establishes the acquisition-date

fair value as the measurement objective for all assets acquired

and liabilities assumed, requires expensing of most transaction

and restructuring costs, and requires the acquirer to disclose all

information needed to evaluate and understand the nature and

financial effectof the business combination. SFAS 141R applies to

all transactions or other events in which an entity obtains control

of one or more businesses, including combinations achieved

without transfer of consideration, for example, by contract alone

or through the lapse of minority veto rights. SFAS 141R applies

prospectively to business combinations for which the acquisition

date is on or after the beginning of the first fiscal year beginning

after December 15, 2008. We are currently evaluating the impact

SFAS 141R mayhave on our consolidated financial statements.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling

Interests in Consolidated Financial Statements – An Amendment

of ARB No.51,” (“SFAS 160”). SFAS 160 requires reporting entities

to present noncontrolling (minority) interests as equity as opposed

to as a liability or mezzanine equity and provides guidance on the

accounting for transactions between an entity and noncontrolling

interests. SFAS 160 is effective the first fiscal year beginning after

December 15, 2008, and interim periods within that fiscal year.

SFAS 160 applies prospectively as of the beginning of the fiscal

year SFAS 160 is initially applied, except for the presentation and

disclosure requirements which are applied retrospectively for

all periods presented subsequent to adoption. We are currently

evaluating the impact SFAS 160 may have on our consolidated

financial statements.