Royal Caribbean Cruise Lines 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

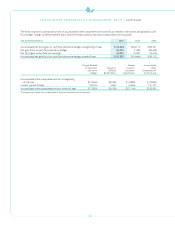

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

At December 31, 2007, $59.8 million of estimated unrealized net

gains associated with our cash flow hedges are expected to be

reclassified as earnings from other accumulated comprehensive

income within the next twelve months. Reclassification is expected

tooccur primarily as the result of fuel consumption associated

with our hedged forecasted fuel purchases. At December 31, 2007,

wehave hedged the variability in future cash flows for certain

forecasted transactions occurring through the second half of 2011.

Hedge of Net Investment in a Foreign Operation

In 2006, in conjunction with our acquisition of Pullmantur

Cruises, we obtained a bridge loan with a notional amount of

€750.0 million, or approximately $960.5 million, of which we

drew €701.0 million, or approximately $925.1 million, to finance

the acquisition. We designated a portion of this bridge loan,

approximately €478.8 million, or approximately $631.8 million,

as a nonderivative hedge of our net investment in Pullmantur

Cruises and, accordingly, included approximately $18.7 million

of foreign-currency transaction losses in the foreign currency

translation adjustment component of accumulated other

comprehensivelossat December 31, 2006.

In 2007, prior to repaying the bridge loan, we included approxi-

mately $12.7 million of foreign-currency transaction gains in the

foreign currency translation adjustment component of accumu-

lated other comprehensive loss.

Subsequent to repayment of the bridge loan, we issued €1.0 bil-

lion unsecured senior notes to refinance the acquisition of

Pullmantur Cruises and to repay amounts under our $1.2 billion

revolving credit facility.During 2007, wedesignated a portion of

the €1.0 billion unsecured senior notes as a nonderivative hedge

of our net investment in Pullmantur Cruises. The designated

portion was approximately €466.0 million, or approximately

$679.9 million at December 31, 2007. Accordingly, we included

approximately $76.7million of foreign-currency transaction losses

related to the €1.0 billion unsecured senior notes in the foreign

currency translation adjustment component of accumulated

other comprehensive loss. The total net foreign currency trans-

action loss recorded in the foreign currency translation adjust-

ment component of accumulated other comprehensive loss

was approximately $64.0 million as of December 31, 2007.

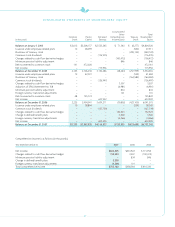

NOTE 13. FAIR VALUE OF

FINANCIAL INSTRUMENTS

The estimated fair values of certain of our financial instruments

areas follows (in thousands):

2007 2006

Long-term debt (including current portion

of long-term debt)

$5,558,984

$5,474,988

Foreign currency forward contracts

in a net gain position

413,652

104,159

Interest rate swap agreements

in a net receivable position

23,437

5,856

Fuel swap agreements in a

net receivable (payable) position

68,595

(20,456)

Cross currency swap agreements

in a net receivable position

53,952

–

The reported fair values are based on a variety of factors and

assumptions. Accordingly, the fair values may not represent actual

values of the financial instruments that could have been realized

as of December 31, 2007 or 2006, or that will be realized in the

future and do not include expenses that could be incurred in an

actual sale or settlement. Our financial instruments are not held

for trading or speculative purposes.

Our exposure under foreign currency contracts, interest rate and

fuel swap agreements is limited to the cost of replacing the contracts

in the event of non-performance by the counterparties to the

contracts, all of which are currently our lending banks. To mini-

mize this risk, we select counterparties with credit risks accept-

able to us and we limit our exposure to an individual counterparty.

Furthermore, all foreign currency forward contracts are denomi-

nated in relatively stable currencies.

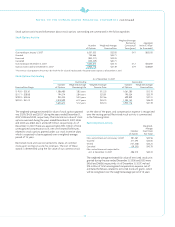

Long-Term Debt

The fair values of our senior notes and senior debentures were

estimated by obtaining quoted market prices. The fair values of all

other debt wereestimated using the present value of expected

futurecash flows.

Foreign Currency Contracts

The fair values of our foreign currency forward contracts were

estimated using the present value of expected future cash flows.

Our exposure to market risk for fluctuations in foreign currency

exchange rates relates to seven ship construction contracts and

forecasted transactions. We use foreign currency forward contracts

to mitigate the impact of fluctuations in foreign currency exchange

rates. As of December 31, 2007, wehad foreign currency forward

contracts in a notional amount of €3.9 billion maturing through

2011. As of December 31, 2007, the fair value of our foreign currency

forward contracts was a net unrealized gain of approximately

$413.7 million. At December 31, 2006, the fair value of our foreign

currency forward contracts was a net unrealized gain of approxi-

mately $104.2 million. At December 31, 2007, approximately 7.7%

of the aggregate cost of the ships was exposed to fluctuations in

the euro exchange rate.

Interest Rate Swap Agreements

The fair values of our interest rate swap agreements were esti-

mated based on the present value of expected future cash flows.

Weenter into interest rate swap agreements to modify our expo-

sure to interest rate movements and to manage our interest

expense related to our long-term debt obligations.

Market risk associated with our long-term fixed rate debt is the

potential increase in fair value resulting from a decrease in inter-

est rates. As of December 31, 2007, we had interest rate swap

agreements, designated as fair value hedges, which exchanged

fixed U.S. dollar interest rates for floating U.S. dollar interest

rates in a notional amount of $350.0 million, maturing in 2016,

and exchanged fixed Euro interest rates for floating Euro interest

rates in a notional amount of €1.0 billion, maturing in 2014.

Market risk associated with our long-term floating rate debt is the

potential increase in interest expense from an increase in interest

rates. As of December 31, 2007, we had an interest rate swap

agreement, designated as a cash flow hedge, which exchanges

floating rate term debt for a fixed interest rate of 4.40% in a

notional amount of $25.0 million, maturing in January 2008.