Royal Caribbean Cruise Lines 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

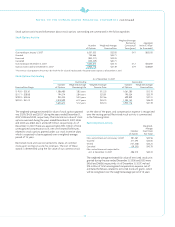

At December 31, 2007, we have future commitments to pay for

our usage of certain port facilities, marine consumables, services

and maintenance contracts as follows (in thousands):

Year

2008 $123,722

2009 74,511

2010 65,089

2011 66,728

2012 70,141

Thereafter 230,249

$630,440

NOTE 15. RELATED PARTIES

A. Wilhelmsen AS. and Cruise Associates collectively own approxi-

mately 35.7% of our common stock and are parties to a shareholders’

agreement which provides that our board of directors will consist

of four nominees of A. Wilhelmsen AS., four nominees of Cruise

Associates and our Chief Executive Officer. They have the power

to determine, among other things, our policies and the policies

of our subsidiaries and actions requiring shareholder approval.

NOTE 16. SUBSEQUENT EVENTS

In February 2008, we entered into a $530.0 million unsecured

term loan due through 2015. We have elected to have the entire

loan amount bear interest at LIBOR plus the then applicable

margin. We intend to use the proceeds of the loan towards the

purchase of Independence of the Seas.

40

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS continued

NOTE 17. QUARTERLY SELECTED FINANCIAL DATA (UNAUDITED)

First Quarter Second Quarter Third Quarter Fourth Quarter

(in thousands, except per share data) 2007 2006 2007 2006

2007

2006

2007

2006

Total revenues1

$1,223,126

$1,146,536

$1,481,325

$1,292,984

$1,953,592

$1,636,851

$1,491,095

$1,153,215

Operating income

$ 79,643

$ 141,051

$ 200,883

$ 184,244

$ 482,834

$ 419,609

$ 137,974

$ 113,542

Net income (loss)

$ 8,825

$ 119,499

$ 128,745

$ 122,427

$ 395,000

$ 345,372

$ 70,834

$ 46,624

Earnings (loss) per share:

Basic

$ 0.04

$ 0.57

$ 0.61

$ 0.58

$ 1.85

$ 1.66

$ 0.33

$ 0.22

Diluted

$ 0.04

$ 0.55

$ 0.60

$ 0.57

$ 1.84

$ 1.63

$ 0.33

$ 0.22

Dividends declared per share

$ 0.15

$ 0.15

$ 0.15

$ 0.15

$ 0.15

$ 0.15

$ 0.15

$ 0.15

1Our revenues are seasonal based on the demand for cruises. Demand is strongest for cruises during the North American summer months and holidays.