Royal Caribbean Cruise Lines 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

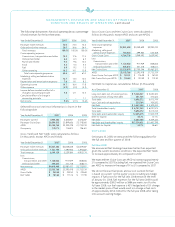

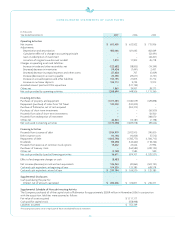

SELECTED FINANCIAL DATA

The selected consolidated financial data presented below for the years 2003 through 2007 and as of the end of each such year, are

derived from our audited financial statements and should be read in conjunction with those financial statements and the related notes.

(in thousands, except per share data)

Year Ended December 31, 2007 2006 2005 2004 2003

Operating Data:

Total revenues

$ 6,149,139

$ 5,229,584 $ 4,903,174 $ 4,555,375 $ 3,784,249

Operating income

901,335

858,446 871,565 753,589 526,185

Income before cumulative effect of

achange in accounting principle

603,405

633,922 663,465 474,691 280,664

Cumulative effect of a change in

accounting principle 1

–

– 52,491 – –

Net income

603,405

633,922 715,956 474,691 280,664

Per Share Data – Basic:

Income before cumulative effect of

achange in accounting principle

$ 2.84

$ 3.01 $ 3.22 $ 2.39 $ 1.45

Cumulative effect of a change in

accounting principle1

$ –

$ – $ 0.25 $ – $ –

Net income

$ 2.84

$ 3.01 $ 3.47 $ 2.39 $ 1.45

Weighted-average shares

212,784

210,703 206,217 198,946 194,074

Per Share Data – Diluted:

Income before cumulative effect of

achangein accounting principle

$ 2.82

$ 2.94 $ 3.03 $ 2.26 $ 1.42

Cumulativeeffect of a change in

accounting principle1

$–

$–$0.22$–$–

Net income

$ 2.82

$ 2.94 $ 3.26 $ 2.26 $ 1.42

Weighted-average shares and potentially

dilutiveshares

214,255

221,485 234,714 234,580 211,175

Dividends declared per common share

$ 0.60

$ 0.60 $ 0.56 $ 0.52 $ 0.52

BalanceSheet Data:

Total assets

$14,982,281

$13,393,088 $11,255,771 $11,964,084 $11,322,742

Total debt, including capital leases

5,698,272

5,413,744 4,154,775 5,731,944 5,835,804

Common stock

2,235

2,225 2,165 2,012 1,961

Total shareholders’ equity

6,757,343

6,091,575 5,554,465 4,804,520 4,262,897

1In the third quarter of 2005, we changed our method of accounting for drydocking costs from the accrual in advance to the deferral method (see Note 2. Summary of

Significant Accounting Policies to our consolidated financial statements.)

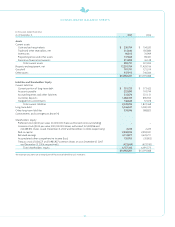

MANAGEMENT’S REPORT ON INTERNAL CONTROL

OVER FINANCIAL REPORTING

Our management is responsible for establishing and maintaining

adequate internal control over financial reporting, as such term is

defined in Exchange Act Rule 13a-15(f). Under the supervision and

with the participation of our management, including our Chairman

and Chief ExecutiveOfficer and ExecutiveVice President and

Chief Financial Officer,we conducted an evaluation of the effec-

tiveness of our internal control over financial reporting based

on the framework in Internal Control – Integrated Framework issued

by the Committee of Sponsoring Organizations of the Treadway

Commission. Based on our evaluation under the framework in

Internal Control – Integrated Framework,our management concluded

that our internal control over financial reporting was effective as

of December 31, 2007. The effectiveness of our internal control

over financial reporting as of December 31, 2007 has been audited

by PricewaterhouseCoopers LLP, the independent registered certi-

fied public accounting firm that audited our consolidated financial

statements included in our Annual Report on Form 10-K, as stated

in their report, which is included herein.