Red Lobster 2016 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2016 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

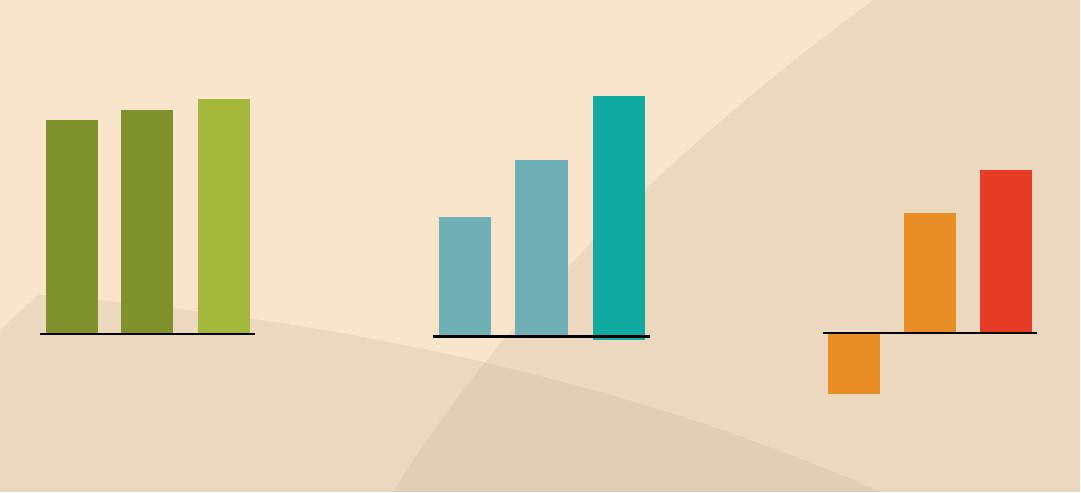

1 Total Sales in fiscal 2015 adjusted to exclude $125 million in sales due to the 53rd week.

2 Adjusted for special items and the 53rd week. A reconciliation of reported to adjusted numbers can be found on page 57.

Total Sales

(in billions)

201420152016

$6.29 $6.64 $6.93

Adjusted Earnings

Per Share

201420152016

$1.71

$2.56

$3.53

Same-Restaurant

Sales Growth

2014

20152016

-1.3%

2.4%

3.3%

1 Industry same-restaurant sales as reported by Knapp-Track (excluding Darden).

2 Fiscal 2015 included an extra week of operations, resulting in a 53-week

fiscal year. Fiscal 2016 growth excludes the impact of the extra operating

week in fiscal 2015 to allow for a 52-week to 52-week comparison.

3 Adjusted for special items and the 53rd week. A reconciliation of reported

to adjusted numbers can be found on page 57.

We bring our mission to life every day through our 150,000

team members in more than 1,500 restaurants across

the country who carry out the four pillars of our Back-to-

Basics operating philosophy – culinary innovation and

execution, attentive service, engaging atmospheres and

integrated marketing. To many, this may all sound simple,

but consistently doing the little things well to create

memorable moments for our guests is extremely dicult.

We continued to leverage our four competitive

advantages that are key to helping our businesses

drive sales growth and expand margins. They are:

• The significant scale of our Company

• The breadth and depth of our data and consumer insights

• Our commitment to rigorous strategic planning

• Our results-oriented, people culture

At a time when our industry faced considerable

headwinds – including increased and more diverse

competition – we are proud of the progress we have

made. Our businesses outperformed the industry1,

creating significant value for our shareholders, our guests,

our team members and the communities we serve.

Delivering Value

to Shareholders

In fiscal 2016, we grew total sales by 4.4 percent2

driven by same-restaurant sales growth of 3.3 percent –

exceeding the industry by more than 400 basis points1

while further simplifying our operations to reduce non-

guest-facing costs by approximately $95 million. Our

sales growth and cost management eorts resulted in

a 37.9 percent increase in adjusted diluted net earnings

per share to $3.53.3 On a reported basis, diluted

net earnings per share from continuing operations

increased 84.1 percent to $2.78 in fiscal 2016.

During the year, we completed a thorough review of our

strategic options to improve shareholder return resulting

in a transaction that was highly successful on many

fronts. We meaningfully improved our capital structure

by completing our comprehensive real estate strategy –

which included a tax-free spino of certain real estate and

restaurant assets into a new public company, Four Corners

Property Trust (FCPT). This strategy enabled us to reduce

our debt by approximately $1 billion while preserving the

Company’s investment-grade credit profile. Given the

2