Red Lobster 2016 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2016 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DARDEN

42

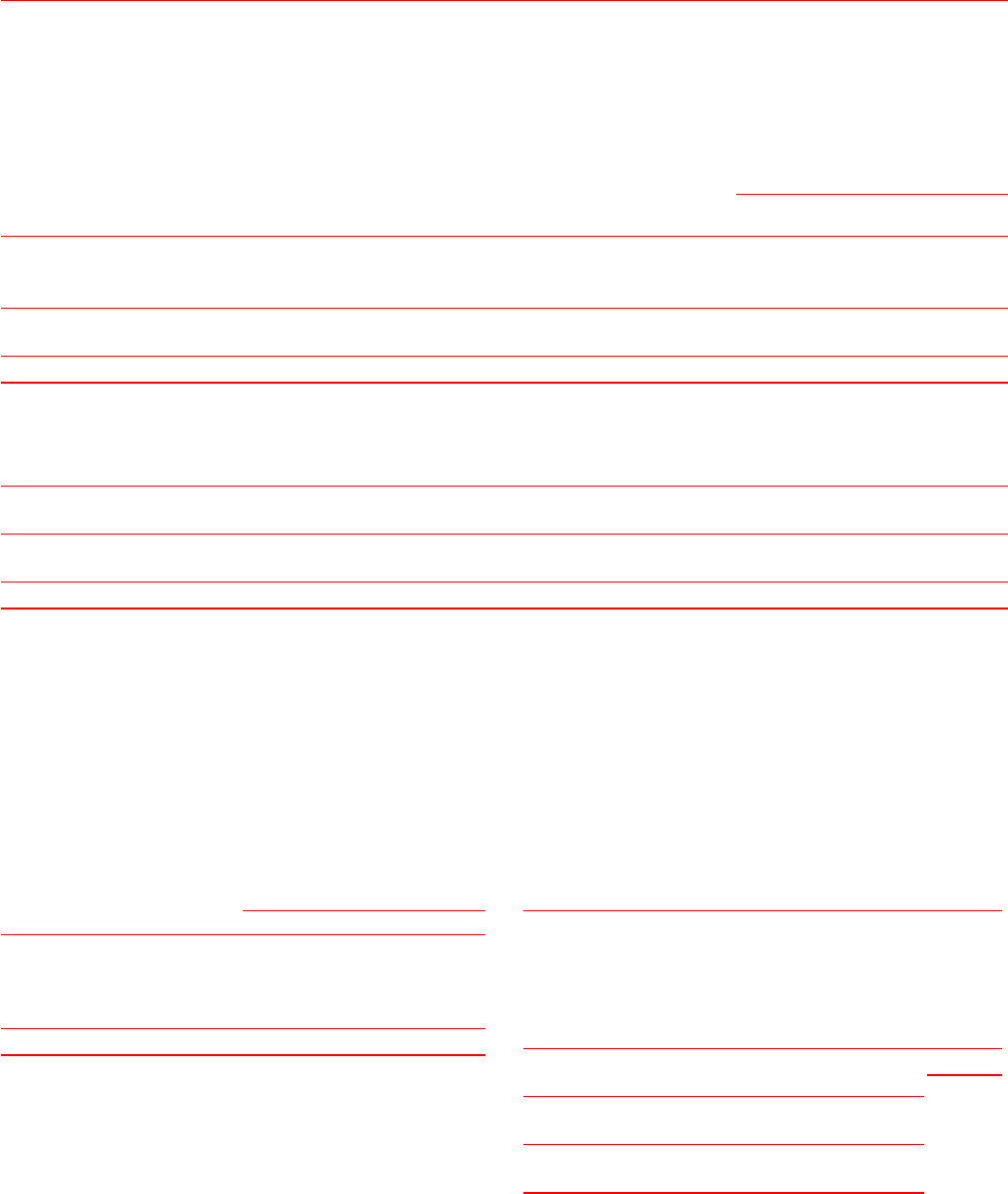

Reclassifications related to foreign currency translation in fiscal 2015 primarily relate to the disposition of Red Lobster and are included in earnings

from discontinued operations, net of tax expense in our consolidated statement of earnings. The following table presents the amounts and line items in our

consolidated statements of earnings where other adjustments reclassified from AOCI into net earnings were recorded:

Fiscal Year

(in millions)

Location of Gain (Loss) May 29, May 31,

AOCI Components Recognized in Earnings 2016 2015

Derivatives

Equity contracts (1) $ 2.1 $ (1.0)

Interest rate contracts (2) (37.4) (45.7)

Total before tax $(35.3) $(46.7)

Tax benefit 14.3 17.5

Net of tax $(21.0) $(29.2)

Benefit plan funding position

Pension/postretirement plans

Actuarial losses (3) $ (2.8) $ (2.6)

Settlement loss (3) — (6.1)

Total – pension/postretirement plans $ (2.8) $ (8.7)

Recognized net actuarial gain – other plans (4) 3.4 1.8

Total before tax $ 0.6 $ (6.9)

Tax benefit (0.2) 2.8

Net of tax $ 0.4 $ (4.1)

(1) Primarily included in restaurant labor costs and general and administrative expenses. See Note 8 for additional details.

(2) Included in interest, net, on our consolidated statements of earnings. Reclassifications primarily related to the acceleration of hedge loss amortization resulting from the pay down of the

associated long-term debt.

(3) Included in the computation of net periodic benefit costs – pension and postretirement plans, which is a component of restaurant labor expenses and general and administrative expenses.

See Note 14 for additional details.

(4) Included in the computation of net periodic benefit costs – other plans, which is a component of general and administrative expenses.

NOTE 11

LEASES

An analysis of rent expense incurred related to continuing operations

is as follows:

Fiscal Year

(in millions)

2016 2015 2014

Restaurant minimum rent (1) $233.6 $167.0 $146.4

Restaurant rent averaging expense 15.9 16.7 26.9

Restaurant percentage rent 8.0 7.7 6.6

Other 8.1 3.5 5.5

Total rent expense $265.6 $194.9 $185.4

(1) The increase for fiscal 2016 is primarily related to the REIT transaction and individual

sale-leaseback transactions. See Note 2 for further information.

Total rent expense included in discontinued operations was $0.0 million,

$6.2 million and $36.2 million for fiscal 2016, 2015 and 2014, respectively.

These amounts include restaurant minimum rent of $0.0 million, $5.8 million

and $33.0 million for fiscal 2016, 2015 and 2014, respectively.

The annual future lease commitments under capital lease obligations

and noncancelable operating and financing leases, including those related to

restaurants reported as discontinued operations, for each of the five fiscal

years subsequent to May 29, 2016 and thereafter is as follows:

(in millions)

Fiscal Year Capital Financing Operating

2017 $ 5.9 $ 7.1 $ 297.6

2018 6.0 7.2 287.6

2019 6.0 7.4 271.5

2020 6.1 7.5 255.2

2021 6.0 7.6 232.8

Thereafter 49.0 115.8 1,484.6

Total future lease commitments $ 79.0 $152.6 $2,829.3

Less imputed interest (at 6.5%), (various) (27.0) (76.6)

Present value of future lease commitments $ 52.0 $ 76.0

Less current maturities (2.7) (1.3)

Obligations under capital and financing

leases, net of current maturities $ 49.3 $ 74.7