Red Lobster 2016 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2016 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DARDEN

DARDEN RESTAURANTS, INC. • 2016 ANNUAL REPORT 43

NOTE 12

ADDITIONAL FINANCIAL INFORMATION

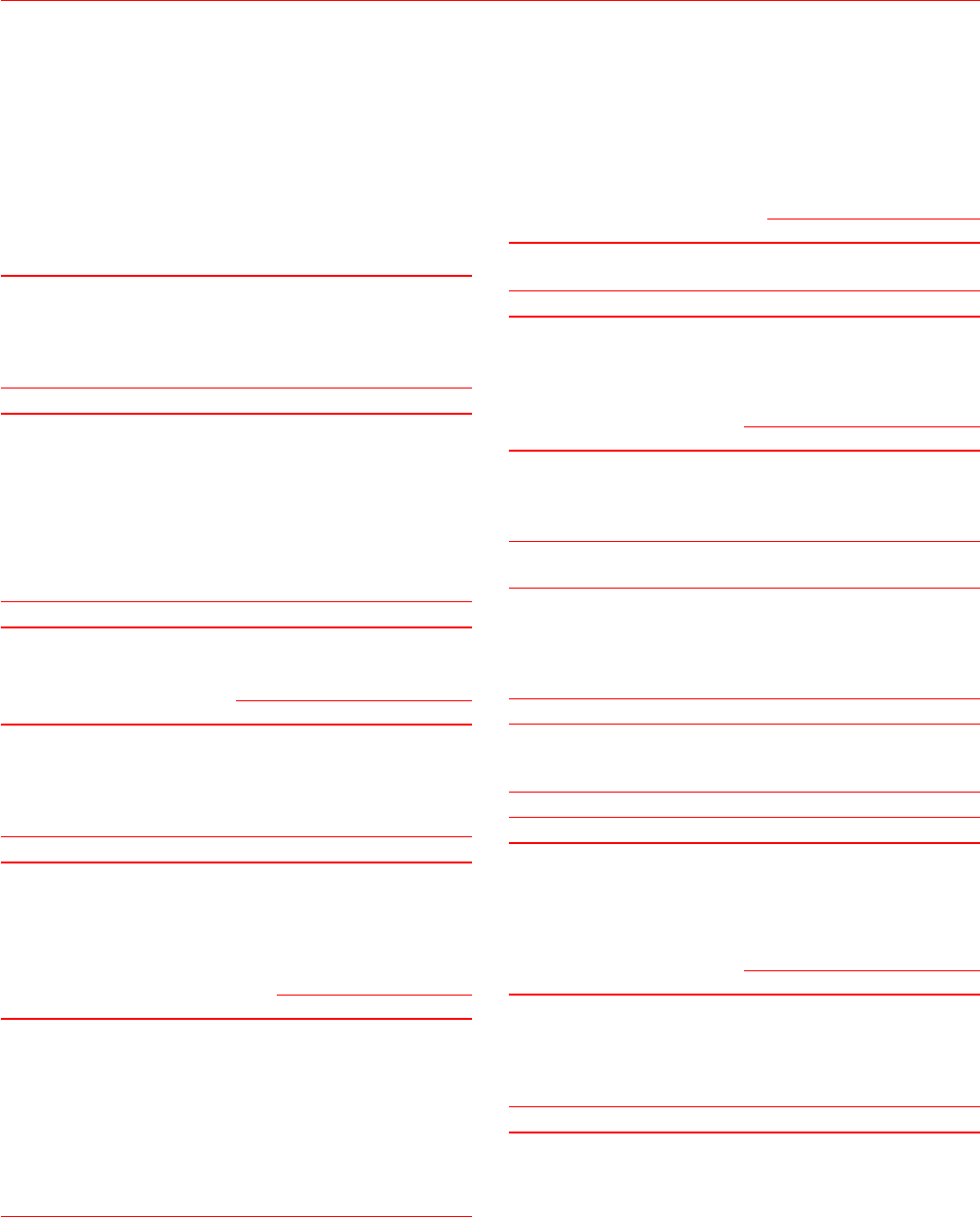

The tables below provide additional financial information related to our

consolidated financial statements:

BALANCE SHEETS

(in millions)

May 29, 2016 May 31, 2015

Receivables, net

Retail outlet gift card sales $ 43.9 $ 47.1

Landlord allowances due 3.7 12.9

Miscellaneous 16.9 18.9

Allowance for doubtful accounts (0.5) (0.9)

$ 64.0 $ 78.0

Other Current Liabilities

Non-qualified deferred compensation plan $194.0 $209.6

Sales and other taxes 58.7 63.9

Insurance-related 36.3 37.4

Employee benefits 35.8 34.3

Contingent proceeds – Red Lobster disposition — 31.5

Accrued interest 5.1 11.4

Miscellaneous 70.7 61.0

$400.6 $449.1

STATEMENTS OF EARNINGS

Fiscal Year

(in millions)

2016 2015 2014

Interest expense (1) $165.4 $186.2 $134.0

Imputed interest on capital

and financing leases 8.9 8.0 3.5

Capitalized interest (0.7) (1.3) (2.6)

Interest income (1.1) (0.6) (0.6)

Interest, net $172.5 $192.3 $134.3

(1) Interest expense in fiscal 2016 and 2015 includes approximately $106.8 million and

$91.3 million, respectively, of expenses associated with the retirement of long-term debt.

See Note 7.

STATEMENTS OF CASH FLOWS

Fiscal Year

(in millions)

2016 2015 2014

Cash paid during the fiscal year for:

Interest, net of amounts capitalized (1) $140.8 $142.8 $117.5

Income taxes, net of refunds (2) $128.0 $290.7 $ 90.0

Non-cash investing and financing activities:

Increase in land, buildings and equipment

through accrued purchases $ 14.9 $ 11.1 $ 24.4

Net book value of assets distributed

in Four Corners separation, net of

deferred tax liabilities $750.4 $ — $ —

(1) Interest paid in fiscal 2016 and 2015 includes approximately $68.7 million and $44.0

million, respectively, of payments associated with the retirement of long-term debt. See

Note 7.

(2) Income taxes paid in fiscal 2015 were higher primarily as a result of the gain recognized

on the sale of Red Lobster.

NOTE 13

INCOME TAXES

Total income tax expense was allocated as follows:

Fiscal Year

(in millions)

2016 2015 2014

Earnings from continuing operations $90.0 $ (21.1) $ (8.6)

Earnings from discontinued operations 3.4 344.8 32.3

Total consolidated income tax expense $93.4 $323.7 $23.7

The components of earnings from continuing operations before income

taxes and the provision for income taxes thereon are as follows:

Fiscal Year

(in millions)

2016 2015 2014

Earnings from continuing operations

before income taxes:

U.S. $450.6 $179.9 $189.0

Foreign (0.9) (4.6) (14.4)

Earnings from continuing operations

before income taxes $449.7 $175.3 $174.6

Income taxes:

Current:

Federal $ 89.1 $ (12.7) $ 39.5

State and local 2.7 (8.0) 5.4

Foreign 1.9 6.9 3.0

Total current $ 93.7 $ (13.8) $ 47.9

Deferred (principally U.S.):

Federal $ (2.4) $ — $ (43.7)

State and local (1.3) (7.3) (12.8)

Total deferred $ (3.7) $ (7.3) $ (56.5)

Total income taxes $ 90.0 $ (21.1) $ (8.6)

The following table is a reconciliation of the U.S. statutory income tax

rate to the effective income tax rate from continuing operations included in

the accompanying consolidated statements of earnings:

Fiscal Year

2016 2015 2014

U.S. statutory rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal tax benefits 1.2 (6.6) (2.7)

Benefit of federal income tax credits (12.5) (34.0) (30.3)

Other, net (3.7) (6.4) (6.9)

Effective income tax rate 20.0% (12.0)% (4.9)%

As of May 29, 2016, we had estimated current prepaid state income

taxes of $17.0 million and current prepaid federal income taxes of

$29.1 million, which are included on our accompanying consolidated

balance sheets as prepaid income taxes.