Red Lobster 2016 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2016 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

DARDEN

12

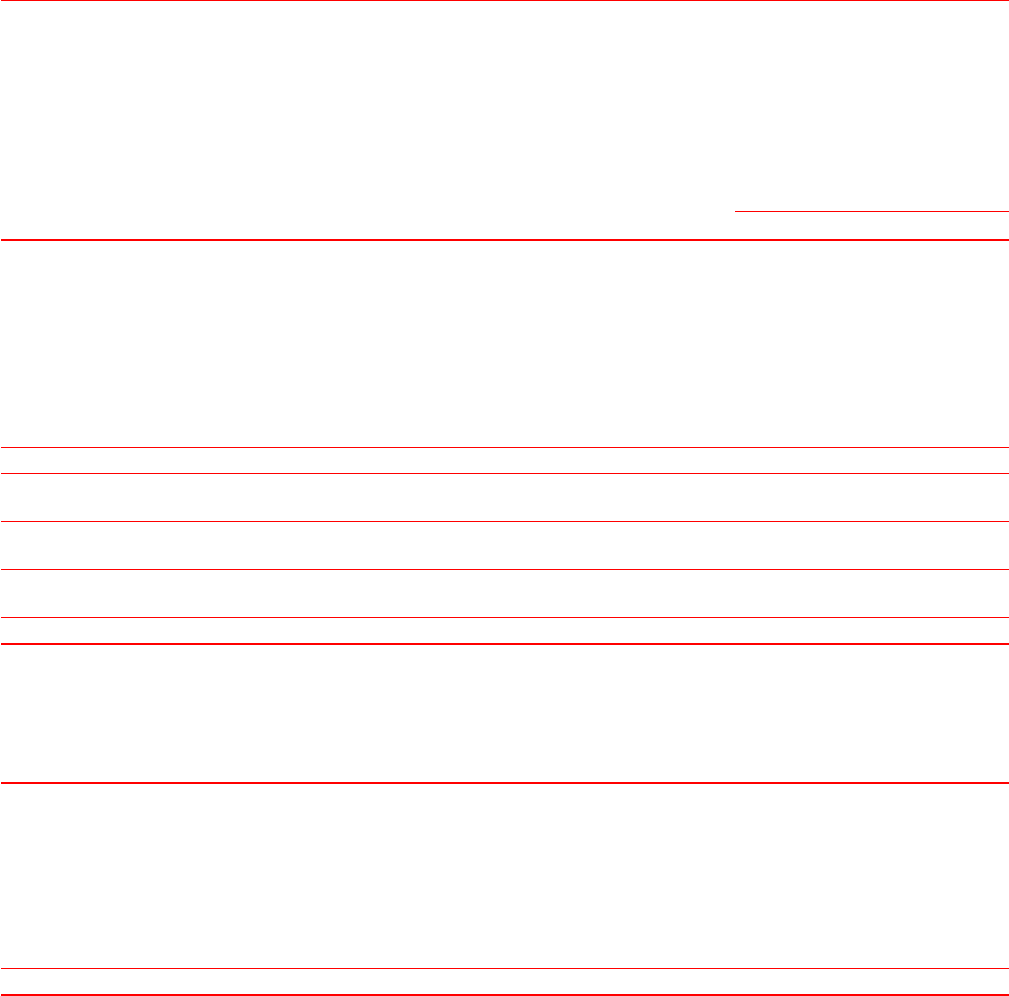

RESULTS OF OPERATIONS FOR FISCAL 2016, 2015 AND 2014

To facilitate review of our results of operations, the following table sets forth our financial results for the periods indicated. All information is derived from the

consolidated statements of earnings for the fiscal years ended May 29, 2016, May 31, 2015 and May 25, 2014. This information and the following analysis

have been presented with the results of operations, costs incurred in connection with the sale and related gain on the sale of Red Lobster and results for the

two closed company-owned synergy restaurants classified as discontinued operations for all periods presented.

Percent Change

(in millions) May 29, 2016 May 31, 2015 May 25, 2014 2016 vs 2015 2015 vs 2014

Sales $6,933.5 $6,764.0 $6,285.6 2.5% 7.6%

Costs and expenses:

Food and beverage 2,039.7 2,085.1 1,892.2 (2.2)% 10.2%

Restaurant labor 2,189.2 2,135.6 2,017.6 2.5% 5.8%

Restaurant expenses 1,163.5 1,120.8 1,080.7 3.8% 3.7%

Marketing expenses 238.0 243.3 252.3 (2.2)% (3.6)%

General and administrative expenses 384.9 430.2 413.1 (10.5)% 4.1%

Depreciation and amortization 290.2 319.3 304.4 (9.1)% 4.9%

Impairments and disposal of assets, net 5.8 62.1 16.4 (90.7)% 278.7%

Total operating costs and expenses $6,311.3 $6,396.4 $5,976.7 (1.3)% 7.0%

Operating income 622.2 367.6 308.9 69.3% 19.0%

Interest, net 172.5 192.3 134.3 (10.3)% 43.2%

Earnings before income taxes 449.7 175.3 174.6 156.5% 0.4%

Income tax expense (benefit) (1) 90.0 (21.1) (8.6) (526.5)% 145.3%

Earnings from continuing operations $ 359.7 $ 196.4 $ 183.2 83.1% 7.2%

Earnings from discontinued operations, net of tax 15.3 513.1 103.0 (97.0)% 398.2%

Net earnings $ 375.0 $ 709.5 $ 286.2 (47.1)% 147.9%

(1) Effective tax rate 20.0% (12.0)% (4.9)%

The following table details the number of company-owned restaurants currently reported in continuing operations, compared with the number open at the

end of fiscal 2015 and the end of fiscal 2014.

May 29, 2016 May 31, 2015 May 25, 2014

Olive Garden (1) 843 846 837

LongHorn Steakhouse 481 480 464

Yard House 65 59 52

The Capital Grille 54 54 54

Bahama Breeze 37 36 37

Seasons 52 40 43 38

Eddie V’s 16 16 15

Other (2) — — 4

Total 1,536 1,534 1,501

(1) Includes six locations in Canada for all periods presented.

(2) Represents company-owned synergy restaurants in operation. We completed the conversion of all remaining synergy restaurants into stand-alone Olive Garden restaurants during the

first quarter of fiscal 2015.