Red Lobster 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

2014 Annual Report 7

Outlook and Strategy

We expect same-restaurant sales in fiscal 2015 to range from flat to an

increase of 1.0 percent for Olive Garden and an increase of 1.0 percent to

2.0 percent for LongHorn Steakhouse. We expect a blended same-restaurant

sales increase for The Capital Grille, Bahama Breeze, Seasons 52, Eddie V’s

and Yard House of approximately 2.0 percent. Total sales from continuing

operations in fiscal 2015 are expected to increase between 5.0 percent and

7.0 percent, including the impact of the 53rd week in fiscal 2015. We expect

food and beverage expenses to be higher as a percent of sales based on our

expectations of food cost inflation. We also expect restaurant labor expenses

to be higher as a percent of sales based on our expectations that manager

incentive compensation will return to normal levels. Excluding the impact of

costs we expect to incur in connection with the Red Lobster separation in

fiscal 2015, as well as costs related to our lobster aquaculture research and

development project, we expect general and administrative expenses as a

percent of sales to remain consistent with fiscal 2014. This is primarily due

to cost savings generated from actions taken as a result of our restaurant sup-

port platform review. We expect our remaining expense line items, restaurant

expenses and depreciation expense, to be relatively flat as a percent of sales.

We expect diluted net earnings per share from continuing operations for fiscal

2015 to be above fiscal 2014 by between 30.0 percent and 35.0 percent,

including the impact of the 53rd week. In fiscal 2015, we expect to add

approximately 35-40 net new restaurants, and we expect capital expenditures

incurred to build new restaurants and remodel existing restaurants to be

between $325.0 million and $350.0 million.

In June 2014, we announced a quarterly dividend of $0.55 per share,

payable on August 1, 2014. Based on the $0.55 quarterly dividend declaration,

our expected annual dividend is $2.20 per share, which is consistent with

our fiscal 2014 annual dividend. Dividends are subject to the approval of our

Board of Directors and, accordingly, the timing and amount of our dividends

are subject to change.

During fiscal 2015, we are focused on progressing with our value creation

priorities, which include: completion of the Red Lobster sale; continuation of

the Olive Garden “brand renaissance”; continuation of new restaurant growth

at our other brands, primarily driven by LongHorn; implementation of a new

management incentive plan that more directly emphasizes same-restaurant

sales, free cash flow and relative total shareholder return; continuation of the

focus on our restaurant support platform costs; and improvement on capital

allocation discipline.

The total sales growth we envision should increase the cost-effectiveness

of our restaurant support platform. However, we also plan to supplement our

conventional incremental year-to-year cost management efforts with an

ongoing focus on identifying and pursuing transformational multi-year cost

reduction opportunities.

There are significant risks and challenges that could impact our operations

and ability to increase sales and earnings. The full-service restaurant industry

is intensely competitive and sensitive to economic cycles and other business

factors, including changes in consumer tastes and dietary habits. Other risks

and uncertainties are discussed and referenced in the subsection below

entitled “Forward-Looking Statements.”

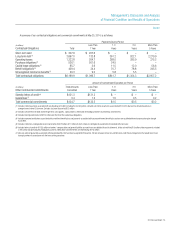

RESULTS OF OPERATIONS FOR FISCAL 2014, 2013 AND 2012

The following table sets forth selected operating data as a percent of sales

from continuing operations for the fiscal years ended May 25, 2014, May 26,

2013 and May 27, 2012. This information is derived from the consolidated

statements of earnings found elsewhere in this report. Additionally, this

information and the following analysis have been presented with the results

of operations, costs incurred in connection with the planned separation and

impairment charges for Red Lobster and the two closed synergy restaurants

classified as discontinued operations for all periods presented.

Fiscal Years

2014 2013 2012

Sales 100.0% 100.0% 100.0%

Costs and expenses:

Cost of sales:

Food and beverage 30.1 29.4 29.2

Restaurant labor 32.1 32.0 31.6

Restaurant expenses 17.2 16.6 15.9

Total cost of sales, excluding

restaurant depreciation and

amortization of 4.5%, 4.3%

and 4.1%, respectively 79.4% 78.0% 76.7%

Selling, general and administrative 10.6 10.6 10.2

Depreciation and amortization 4.8 4.7 4.5

Interest, net 2.1 2.1 1.9

Asset impairment, net 0.3 – –

Total costs and expenses 97.2% 95.4% 93.3%

Earnings before income taxes 2.8 4.6 6.7

Income taxes (0.1) 0.6 1.5

Earnings from continuing operations 2.9 4.0 5.2

Earnings from discontinued operations,

net of taxes 1.7 3.0 3.7

Net earnings 4.6% 7.0% 8.9%

The following table details the number of company-owned restaurants

currently reported in continuing operations and the Red Lobster restaurants

currently reported in discontinued operations that were open at the end of

fiscal 2014, compared with the number open at the end of fiscal 2013 and

the end of fiscal 2012.

May 25, May 26, May 27,

2014 2013 2012

Olive Garden – USA 831 822 786

Olive Garden – Canada 6 6 6

Total 837 828 792

LongHorn Steakhouse 464 430 386

The Capital Grille 54 49 46

Bahama Breeze 37 33 30

Seasons 52 38 31 23

Eddie V’s (1) 15 12 11

Yard House (1) 52 44 –

Other (2) 4 4 1

Total – continuing operations 1,501 1,431 1,289

Red Lobster – USA 679 678 677

Red Lobster – Canada 27 27 27

Other (3) – 2 1

Total – discontinued operations 706 707 705

Total Darden 2,207 2,138 1,994

(1) Includes the 11 Eddie V’s and Wildfish restaurants acquired on November 14, 2011 and the

40 Yard House restaurants acquired on August 29, 2012.

(2) Represents synergy restaurants in operation. We expect to convert all remaining synergy

restaurants into stand-alone Olive Garden restaurants by the end of the first quarter

of fiscal 2015.

(3) Represents synergy restaurants closed as of May 25, 2014 and classified as

discontinued operations.