Red Lobster 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

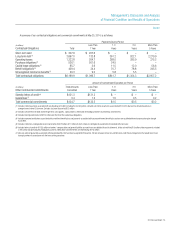

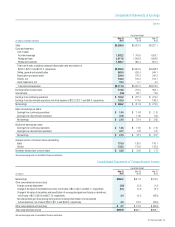

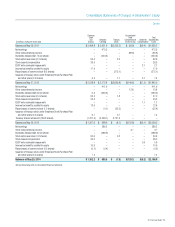

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

2014 Annual Report 17

Our defined benefit and other postretirement benefit costs and liabilities

are determined using various actuarial assumptions and methodologies

prescribed under FASB ASC Topic 715, Compensation – Retirement Benefits

and Topic 712, Compensation – Nonretirement Postemployment Benefits.

We use certain assumptions including, but not limited to, the selection of a

discount rate, expected long-term rate of return on plan assets and expected

health care cost trend rates. We set the discount rate assumption annually

for each plan at its valuation date to reflect the yield of high-quality fixed-

income debt instruments, with lives that approximate the maturity of the plan

benefits. At May 25, 2014, our discount rate was 4.4 percent and 4.5 percent,

respectively, for our defined benefit and postretirement benefit plans. The

expected long-term rate of return on plan assets and health care cost trend

rates are based upon several factors, including our historical assumptions

compared with actual results, an analysis of current market conditions, asset

allocations and the views of leading financial advisers and economists.

Our expected long-term rate of return on plan assets for our defined benefit

plan was 8.0 percent for fiscal year 2014 and 9.0 percent for fiscal years

2013 and 2012. At May 25, 2014, the expected health care cost trend rate

assumed for our postretirement benefit plan for fiscal 2015 was 6.8 percent.

The rate gradually decreases to 5.0 percent through fiscal 2021 and

remains at that level thereafter. We made plan contributions of approximately

$0.4 million, $2.4 million and $22.2 million in fiscal years 2014, 2013 and

2012, respectively.

In the current year, we reduced our expected rate of return for investment

of pension plan assets from 9.0 percent to 8.0 percent in connection with

our current expectations for long-term returns and target asset fund allocation.

The expected long-term rate of return on plan assets component of our net

periodic benefit cost is calculated based on the market-related value of plan

assets. Currently, our target asset fund allocation is 37.0 percent U.S.

equities, 40.0 percent high-quality, long-duration fixed-income securities,

18.5 percent international equities and 4.5 percent real estate securities.

Prior to fiscal 2014, our target asset fund allocation was 40.0 percent U.S.

equities, 35.0 percent high-quality, long-duration fixed-income securities,

20.0 percent international equities and 5.0 percent real estate securities.

We monitor our actual asset fund allocation to ensure that it approximates

our target allocation and believe that our long-term asset fund allocation will

continue to approximate our target allocation. In developing our expected

rate of return assumption, we have evaluated the actual historical performance

and long-term return projections of the plan assets, which give consideration

to the asset mix and the anticipated timing of the pension plan outflows. We

employ a total return investment approach whereby a mix of equity and fixed

income investments are used to maximize the long-term return of plan assets

for what we consider a prudent level of risk. Our historical 10-year, 15-year

and 20-year rates of return on plan assets, calculated using the geometric

method average of returns, are approximately 9.3 percent, 8.4 percent and

9.9 percent, respectively, as of May 25, 2014.

We have recognized net actuarial losses, net of tax, as a component

of accumulated other comprehensive income (loss) for the defined benefit

plans and postretirement benefit plan as of May 25, 2014 of $64.0 million

and $5.8 million, respectively. These net actuarial losses represent changes

in the amount of the projected benefit obligation and plan assets resulting

from differences in the assumptions used and actual experience. The amor-

tization of the net actuarial loss component of our fiscal 2015 net periodic

benefit cost for the defined benefit plans and postretirement benefit plan is

expected to be approximately $2.6 million and $0.5 million, respectively.

We believe our defined benefit and postretirement benefit plan

assumptions are appropriate based upon the factors discussed above.

However, other assumptions could also be reasonably applied that could

differ from the assumptions used. A quarter-percentage point change in

the defined benefit plans’ discount rate and the expected long-term rate of

return on plan assets would increase or decrease earnings before income

taxes by $0.6 million and $0.5 million, respectively. A quarter-percentage

point change in our postretirement benefit plan discount rate would increase

or decrease earnings before income taxes by $0.1 million. A one-percentage

point increase in the health care cost trend rates would increase the accu-

mulated postretirement benefit obligation (APBO) by $7.4 million at May 25,

2014 and the aggregate of the service cost and interest cost components

of net periodic postretirement benefit cost by $0.5 million for fiscal 2014.

A one-percentage point decrease in the health care cost trend rates would

decrease the APBO by $5.9 million at May 25, 2014 and the aggregate of

the service cost and interest cost components of net periodic postretirement

benefit cost by $0.4 million for fiscal 2014. These changes in assumptions

would not significantly impact our funding requirements. We expect to

contribute approximately $0.4 million to our defined benefit pension plans

and approximately $1.1 million to our postretirement benefit plan during

fiscal 2015.

Other than the pending sale of Red Lobster and related retirement of

debt, which we expect will enhance our capital structure, we are not aware

of any trends or events that would materially affect our capital requirements

or liquidity. We believe that our internal cash-generating capabilities, the

potential issuance of unsecured debt securities under our shelf registration

statement and short-term commercial paper should be sufficient to finance

our capital expenditures, debt maturities, stock repurchase program and

other operating activities through fiscal 2015.

OFF-BALANCE SHEET ARRANGEMENTS

We are not a party to any off-balance sheet arrangements that have, or are

reasonably likely to have, a current or future material effect on our financial

condition, changes in financial condition, sales or expenses, results of

operations, liquidity, capital expenditures or capital resources.

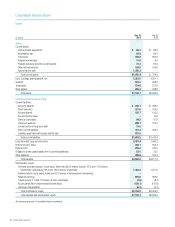

FINANCIAL CONDITION

Our total current assets were $1.98 billion at May 25, 2014, compared

with $764.9 million at May 26, 2013. The increase was primarily due

to the increase in assets held for sale as a result of the pending sale of

Red Lobster.

Our total current liabilities were $1.62 billion at May 25, 2014,

compared with $1.42 billion at May 26, 2013. The increase was primarily

due to the increase in liabilities associated with assets held for sale as a

result of the pending sale of Red Lobster, an increase in short-term debt and

an increase in unearned revenues associated with gift card sales in excess

of current-period redemptions.