Red Lobster 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

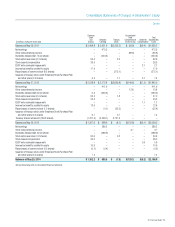

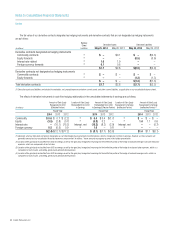

Notes to Consolidated Financial Statements

Darden

2014 Annual Report 35

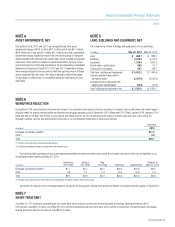

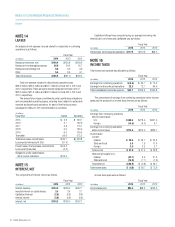

NOTE 4

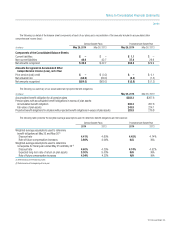

ASSET IMPAIRMENTS, NET

During fiscal 2014, 2013 and 2012, we recognized long-lived asset

impairment charges of $18.3 million ($11.3 million net of tax), $0.7 million

($0.4 million net of tax) and $0.2 million ($0.1 million net of tax), respectively.

Impairment charges resulted primarily from the carrying value of restaurant

assets exceeding the estimated fair market value, which is based on projected

cash flows. These costs are included in asset impairments, net as a compo-

nent of earnings from continuing operations in the accompanying consolidated

statements of earnings for fiscal 2014, 2013 and 2012. Impairment charges

were measured based on the amount by which the carrying amount of these

assets exceeded their fair value. Fair value is generally determined based

on appraisals or sales prices of comparable assets and estimates of future

cash flows.

NOTE 5

LAND, BUILDINGS AND EQUIPMENT, NET

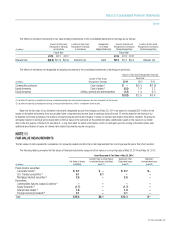

The components of land, buildings and equipment, net, are as follows:

(in millions)

May 25, 2014 May 26, 2013

Land $ 659.7 $ 888.1

Buildings 3,234.5 4,474.5

Equipment 1,378.4 1,860.9

Assets under capital leases 69.5 67.7

Construction in progress 89.1 149.7

Total land, buildings and equipment $ 5,431.2 $ 7,440.9

Less accumulated depreciation

and amortization (2,027.0) (3,030.2)

Less amortization associated with

assets under capital leases (23.2) (19.6)

Land, buildings and equipment, net $ 3,381.0 $ 4,391.1

NOTE 6

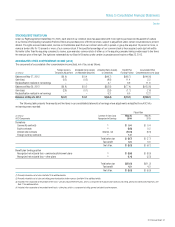

WORKFORCE REDUCTION

During fiscal 2014, we performed comprehensive reviews of our operations and support structure resulting in changes in our growth plans and related support

structure needs. As a result, we had workforce reductions and program spending cuts in September 2013 (September 2013 Plan), January 2014 (January 2014

Plan) and May 2014 (May 2014 Plan). In accordance with these actions, we incurred employee termination benefits costs and other costs which are

included in selling, general and administrative expenses in our consolidated statements of earnings as follows:

Fiscal Year

(in millions)

2014

Employee termination benefits (1) $17.2

Other (2) 0.9

Total $18.1

(1) Includes salary and stock-based compensation expense.

(2) Includes postemployment medical, outplacement and relocation costs.

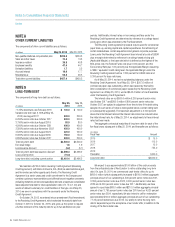

The following table summarizes the accrued employee termination benefits and other costs which are primarily included in other current liabilities on our

consolidated balance sheet as of May 25, 2014:

September January May Balance at

(in millions)

2013 Plan 2014 Plan 2014 Plan Payments Adjustments May 25, 2014

Employee termination benefits (1) $7.7 $0.7 $5.0 $(4.9) $(0.3) $8.2

Other 0.8 0.1 0.2 (0.5) (0.2) 0.4

Total $8.5 $0.8 $5.2 $(5.4) $(0.5) $8.6

(1) Excludes costs associated with stock options and restricted stock that will be settled in shares upon vesting.

We expect the majority of the remaining liability to be paid by the first quarter of fiscal 2015 and the remainder to be paid by the first quarter of fiscal 2016.

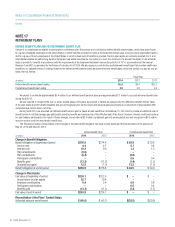

NOTE 7

SHORT-TERM DEBT

As of May 25, 2014, amounts outstanding as short-term debt, which consist of unsecured commercial paper borrowings, bearing an interest rate of

0.80 percent, were $207.6 million. As of May 26, 2013, amounts outstanding as short-term debt, which consist of unsecured commercial paper borrowings,

bearing an interest rate of 0.20 percent, were $164.5 million.